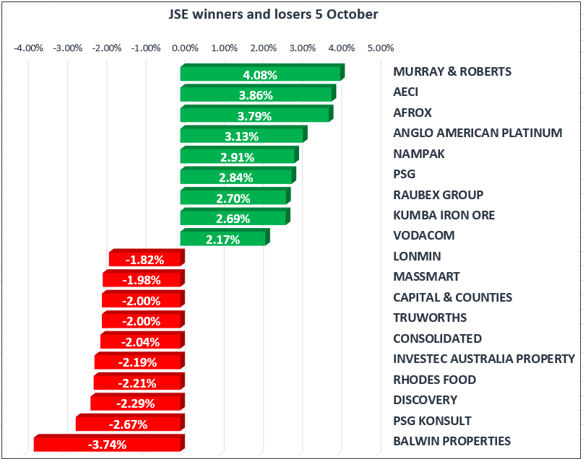

JSE stretched further into record territory on Thursday, marginally higher than the highs of Wednesday.

Vodacom [JSE:VOD] emerged as market winner on the Top 40 after falling to R143.11 on Wednesday. The sharp drop on Wednesday followed an announcement that the mobile phone operator faces an investigation by the Competition Commission into a R5 billion contract with National Treasury. The commission said it had initiated the investigation for “abuse of dominance”.

The share climbed to R154.65 on Thursday following an announcement by Vodacom’s chief executive Shameel Joosub who said that the group had followed due process in bidding for the government contract.

The rand continued to slide against dollar strength, and traded at R13.63 at the close of the market.

The Al-Share index closed 0.44% higher, while the Top 40 gained 0.48%. The market was led by industrials gaining 0.51% on the back of the weakening rand. Gold miners slipped 0.66% as the price of gold continues to edge lower.

Gold fell to $1273/Oz as positive US jobs and services data suggests that the US market can accommodate the Fed raising interest rates again this year. A stronger dollar makes dollar-priced gold more expensive for non-U.S. investors.

European bourses are providing mixed data following posting back-to-back losses for the first time in a month, with the Stoxx Europe 600 Index up 0.16%. Germany's DAX has edged 0.02% lower after a record close, while Spain's IBEX 35 is rebounding from a large drop on Wednesday with a 2.51% gain.

In the States, speculation is ramping up over the potential impact of former Fed governor Kevin Warsh being appointed as the next chairman of the central bank. Warsh favours reduced regulation on banks and could de-emphasise the Fed's reliance on utilising an inflation target as a guide for interest rate hikes.

Crude oil prices are 2.38% higher to $57.12/bbl after a stretch of declines tied to oversupply concerns and some booking of profits. Traders have their eyes on a tropical depression that could develop into a hurricane that threatens the U.S. Gulf Coast on Sunday.