The JSE maintained its positive momentum, gained on the back of positive international market news from last week.

The weaker rand boosted JSE miners and industrials, as the currency fell to R13.61 against the dollar. The softer currency does however spell doom for local fuel prices.

The All-share index closed 0.36% higher, while the Top 40 index traded 0.47% stronger at 49 609 points. The Industrial index gained 0.20%, the Resources index gained 1.23%%, while the financial index fell 0.12%

The dollar has been strengthening with expectations that the US federal Reserve will raise rates for the third time this year. The rand has weakened aggressively relative to other emerging market currencies, with indications that possible third quarter rebalancing ahead of December’s credit ratings could be influencing macro investors.

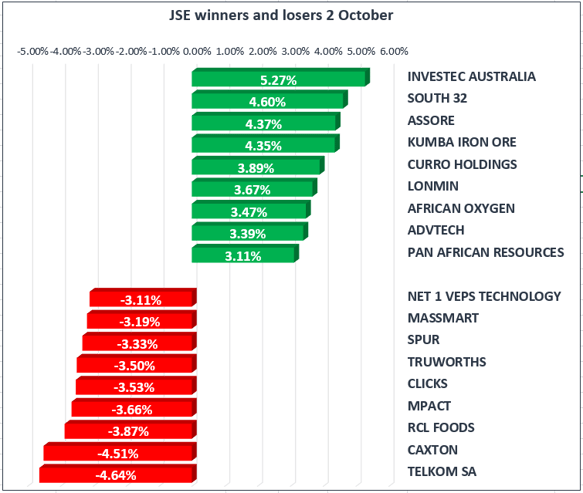

The biggest movers of the day, saw Mondi PLC [JSE:MNP] gain 2.62% to R372.64, while Netcare fell 3.07% to R23.07.

The euro got knocked overnight, falling 0.7% to $1.1738, as more than 90% of Catalan voters chose independence from Spain amid clashes with riot police. Markets also took a hit following the referendum dubbed illegal by Spain, with the benchmark Spanish Ibex 35 Index down 1.2% and government debt suffering as well. Spain has a large debt burden that would require negotiations to split the value with Catalonia should there be a successful claim for independence.

Crude oil prices have softened to $55.83/bbl as US refineries have gradually come online again following recent hurricanes. The rise in U.S. oil drilling and higher OPEC output put the brakes on a rally that helped prices to register their biggest third-quarter gain in 13 years.