The rand weakened on Friday afternoon to R14.20 against the greenback after US nonfarm payroll numbers came in lower than expected.

The US economy added 261,000 jobs in October as employment rebounded from a relatively small gain in the prior month due to hurricanes Harvey and Irma. The market expected 331,000 new jobs.

The US unemployment rate slipped to 4.1% from 4.2%, the lowest level since December 2000. Wages fell one US cent to an average of $26.53 an hour

The rand was also under pressure amid reports that an S&P Global Ratings delegation had visited SA and was preparing to downgrade SA’s sovereign credit rating on November 24

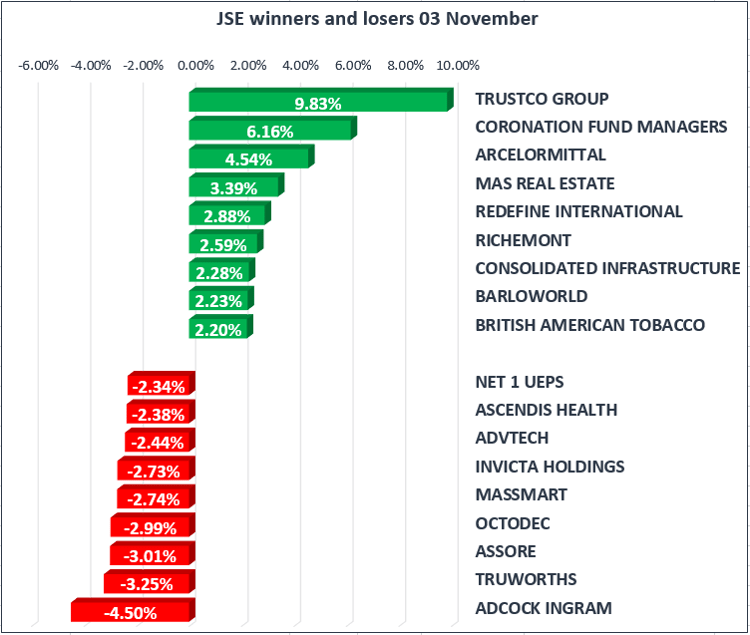

The JSE All-Share Index closed the day 0.52% firmer, matched by the blue-chip JSE Top-40 Index which gained 0.67%. The Industrials Index edged 0.86% higher on the weaker rand, whilst financials dropped 0.10%

Lonmin [JSE:LON] took a bath, crashing 28.32% to close at R14.00 a share. The platinum miner saw more than a fifth wiped off its market capitalisation on Friday after the announcing that it would not be able to publish annual results on time. Lonmin blamed the delay on further talks with its lenders over the impact that asset sales and investment decisions could have on a tangible net worth covenant of $1.1bn required by its credit facilities.

Gold miners drifted lower, with the index slipping 0.79%, Goldfields -1.57% to R56.65, AngloGold -1.06% to R128.84 and Harmony -0.69% to R24.58

President Trump has nominated Jerome Powell to run the Federal Reserve once Janet Yellen's term expires in February, in a move unlikely to disturb the booming stock market. The decision came as Republican leaders unveiled their tax reform plan, which hit shares of private equity groups and homebuilders amid proposals to cap the tax deductibility of interest and mortgage payments.

Apple shares rose over 3% this afternoon, with the company's market cap topping $900B, after the tech giant reported better-than-expected earnings and offered a rosy forecast for the holiday shopping season. Quarterly shipments of the iPhone rose 2.6% from a year earlier to 46.7M units, and China sales rose for the first time since early 2016. Apple's (NASDAQ:AAPL) mound of cash also continued to build, coming in at $268.9B for the quarter.

Want market news and free trade research direct to your email?