The JSE managed to close firmer despite a muted start and relatively flat trading session.

The was a lot of volatility towards the close as news came out that Donald Trump was favouring Jerome Powell, who is a member of the US Fed Governors to replace US Fed Chair, Janet Yellen, when her current term expires. This led to a minor sell off in the US dollar which benefited the Rand as it bounced from today’s lows.

The Rand strengthened to R14.09/$ after having traded above R14.25/$ for the better part of today’s session. This strengthening Rand further supported Rand sensitive stocks such as Mr Price [JSE:MRP] and Barclays Africa [JSE:BGA] which were trading firmer despite a weak Rand. The stocks closed the day up 2.42% and 1.96% respectively.

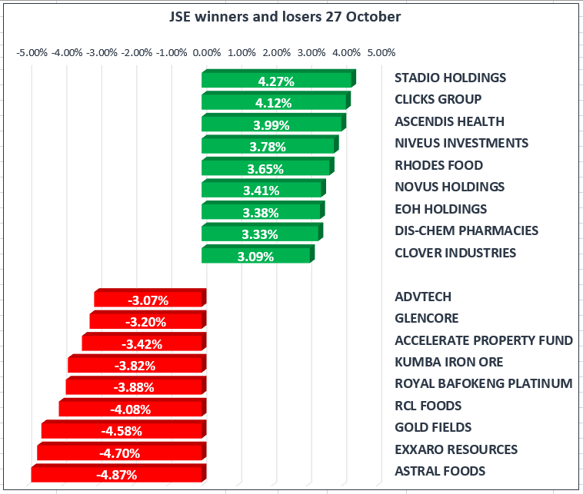

Rhodes Food Group [JSE:RFG] was one of the biggest gainers of the day as it closed up 3.65%. Pharmacists Dis-Chem [JSE:DCP] and Clicks [JSE:CLS] inched up 3.33% and 4.12% respectively. Balwin Properties [JSE:BWN] closed 3.02% whilst Stadio Holdings [JSE:SDO] bounced to close the day up 4.27% at R6.10 per share.

Miners came under pressure today following the strong rally recorded yesterday. African Rainbow Minerals [JSE:ARM], Gold Fields [JSE:GFI] and Glencore [JSE:GLN] all traded weaker to close the day down 4.93%, 4.58% and 3.20% respectively. Sasol [JSE:SOL] shed 2.21% whilst Sappi [JSE:SAP] lost 1.60%.

The JSE All-Share Index rebounded to close the day 0.24% firmer whilst the JSE Top-40 Index firmed by 0.25%. The Industrials Index firmed by 0.80% whilst the Financials Index also gained 0.80%. The Resources Index traded under pressure as it lost 1.70%.

The USA released GDP annualised quarter-on-quarter numbers which beat analyst estimates. GDP for the period was recorded at 3.0% which was better than the forecasted 2.6%, but it was lower than the prior recording of 3.1%. Immediate impact was felt in the US dollar as it strengthened after the release, however the news about Donald Trump’s candidate preference for the position of US Fed chairman resulted in it sliding briefly.

Gold found some reprieve after the US dollar slid towards the close of the JSE. Gold had reached a low of $1263.15/Oz intra-day, before it rebounded trade at $1270.64/Oz just after the JSE closed. Unfortunately this did not feed into the JSE listed Gold miners as the Gold Mining Index closed 2.19% weaker.

Brent Crude had another positive day as it broke $59 per barrel overnight and managed to reach an intra-day high of $60.13 per barrel. Sentiment remains largely bullish in the commodity as OPEC is expected to agree to the extension of production cuts until the end of 2018.

xoxo