The local bourse edged higher on Wednesday on the back of modest gains across all the major indices.

There was positive news in terms of local economic data as Statistics SA released South Africa’s inflation data for the month of November. CPI YoY slowed down to 3.6% from a prior recording of 3.7%, which was also in line with initial forecasts. CPI MoM was recorded at 0.1%, up from a prior recording of 0%. There was disappointment in terms of retail sales YoY for the month of October which slowed down to 0.3% from a prior recording 0.4%, while retail sales MoM was recorded at -0.2% from a prior recording of 0.6%.

The rand was trading mildly firmer against the US dollar as it peaked at a session high of R14.72/$. At 17.00 CAT, the rand was trading 0.14% firmer at R14.76/$.

Focus on the global markets is on the US Fed interest rate decision which is slated for 21.00 CAT on Wednesday, in which the central bank is widely forecasted to keep rates unchanged at 1.75%. However, more attention will be on the following press conference in which the Fed chairman will give his remarks.

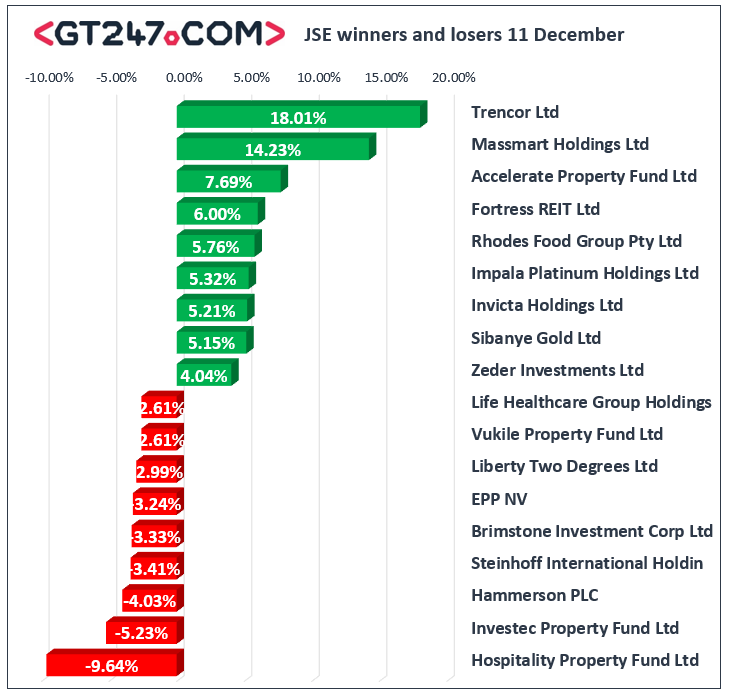

Trencor Ltd [JSE:TRE] which unbundled one of its business units surged 18.01% to close at R8.26 based on its remaining issued share capital after the undbundling. Massmart [JSE:MSM] surged 14.23% to close at R51.53 after having peaked as high as R52.34. Fellow retailer, Pick n Pay [JSE:PIK] climbed 2.44% to close at R66.65. Miners remained buoyant as gains were recorded for Impala Platinum [JSE:IMP] which climbed 5.32% to close at R138.38, Sibanye Gold [JSE:SGL] which added 5.15% to close at R33.69, and Exxaro Resources [JSE:EXX] which surged 2.74% to close at R138.09. Listed property stock Fortress REIT [JSE:FFB] gained 6% to close at R7.60, while Accelerate Property Fund [JSE:APF] closed at R1.68 after surging 7.69%.

Investec Property Fund [JSE:IPF] found itself amongst the day’s biggest losers after it fell 5.23% to close at R14.50, while UK focused Hammerson PLC [JSE:HMN] lost 4.03% to close at R56.86. Life Healthcare Group [JSE:LHC] struggled as it fell 2.61% to close at R23.13, while Dis-Chem Pharmacies [JSE:DCP] dropped 1.05% to close at R25.53. Listed property stocks recorded the bulk of the day’s biggest losses as declines were also recorded Echo Polska Properties [JSE:EPP] which retreated 3.24% to close at R17.31, Vukile Property Fund [JSE:VKE] which dropped 2.61% to close at R20.16, and Lighthouse Capital [JSE:LTC] which closed at R8.51 after losing 2.18%.

The JSE Top-40 index closed 0.63% firmer while the broader JSE All-Share index also closed 0.63% higher. The Resources index closed 1.12% firmer, while the Industrials and Financials indices gained 0.42% and 0.4% respectively.

Brent crude continued to trade relatively softer as it was recorded trading 0.28% softer at $64.16/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.22% firmer at $1467.20/Oz, Palladium had risen 0.76% to $1911.00/Oz, and Platinum was up 0.81% at $930.05/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.