Stocks on the JSE struggled for direction on Wednesday as they lacked a catalyst both locally and from international markets.

Stocks in Asia also traded mostly flat aiding to the local index’s lack of direction. This trend also persisted on major European counters as well as the Dow Jones and S&P 500 indices in the USA which opened relatively flat. The exception was the Nasdaq which recorded decent gains as tech stocks surged after Micron Technologies Inc beat profit estimates in its latest earnings release.

Caution remains the default state for investors as they await the next tweet from Donald Trump which could potentially cause a swing in the markets. With US GDP numbers expected on Thursday, investors will eagerly be looking to get a clearer understanding of the impact of the ongoing US-China trade war on economic growth.

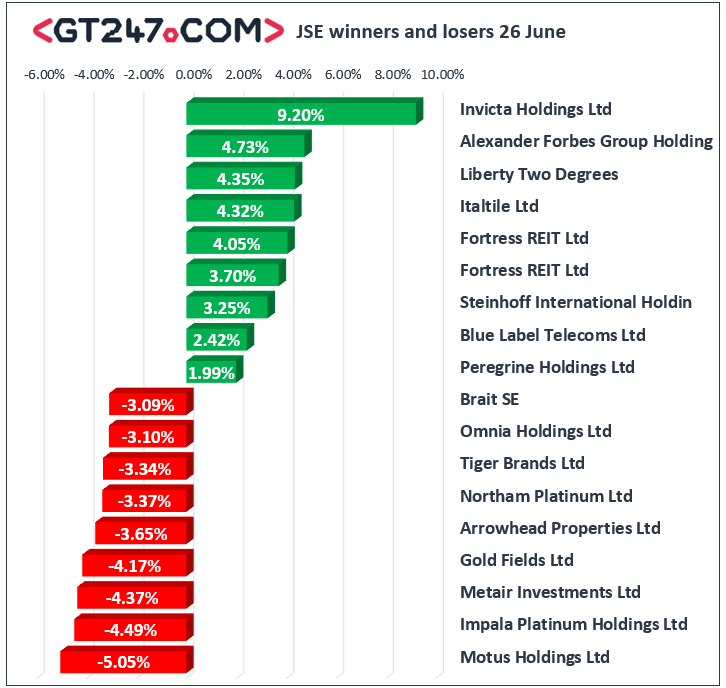

On the JSE, index giant Naspers [JSE:NPN] found some momentum as it advanced 1.5% to end the day at R3420.55 despite a softer close in Tencent Holdings on the Hang Seng. Gains amongst blue-chip counters were limited on the day. ABSA Group [JSE:ABG] managed to post gains of 1.07% as it closed at R178.99, while FirstRand [JSE:FSR] inched up 0.98% to close at R69.74. Diversified miner BHP Group [JSE:BHP] rose 0.56% as it close at R363.11, while investment holding company Remgro [JSE:REM] added 0.76% to close at R189.00. Aspen Pharmacare [JSE:APN] firmed by 0.76% to close at R102.67, while retailer Massmart Holdings [JSE:MSM] managed to gain 1.28% to close at R63.15.

Motus Holdings [JSE:MTH] closed amongst the day’s biggest losers after the stock fell 5.05% to close at R74.30. The gold metal price took a breather from its recent 4-year highs as it retreated in today’s session. Gold Fields [JSE:GFI] lost 4.17% to close at R76.71, while Harmony Gold [JSE:HAR] dropped 2.21% to end the day at R31.35. Impala Platinum [JSE:IMP] lost ground as it fell 4.49% to close at R68.78, while Sibanye Stillwater [JSE:SGL] closed 2.14% lower at R16.49. Tobacco firm British American Tobacco [JSE:BTI] lost 2.3% as it closed 499.17, while logistics specialist Imperial Logistics [JSE:IPL] closed at R52.24 after falling 1.84%.

The JSE Top-40 index scored some minor gains towards the close eventually ending the day 0.24% firmer while the broader JSE all-Share index only added 0.08%. The Resources index closed 0.15% softer, however gains were recorded for the Industrials and Financials indices which both added 0.31% respectively.

The rand managed to strengthen later on during today’s session to a session high of R14.24/$ before it was recorded trading 0.46% firmer at R14.27/$ just after the JSE close.

Brent crude rallied today on the back of increased evidence of declining US stockpiles as well as concerns over US-Iran political tensions. The commodity was trading 2.41% firmer at $65.82/barrel.

At 17.00 CAT, Platinum was up 0.8% to trade at $815.75/Oz, Palladium was up 0.38% at $1536.95/Oz, and Gold had lost 1% to trade at $1409.13/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.