The JSE cooled on Thursday, in line with global markets, with the negative direction in line with the strengthening rand.

The rand firmed to R14.04/$ after closing near R14.14/$ yesterday. The strengthening rand typically dictates the direction of the JSE, putting pressure on rand hedge stocks which make up most of the market weight.

The rand had gained 0.20% against the dollar and more than 1.2% against the pound on Thursday afternoon following the decision by the Bank of England (BoE) to hike interest rates by 25 basis points to 0.50%, the first rate hike since 2007.

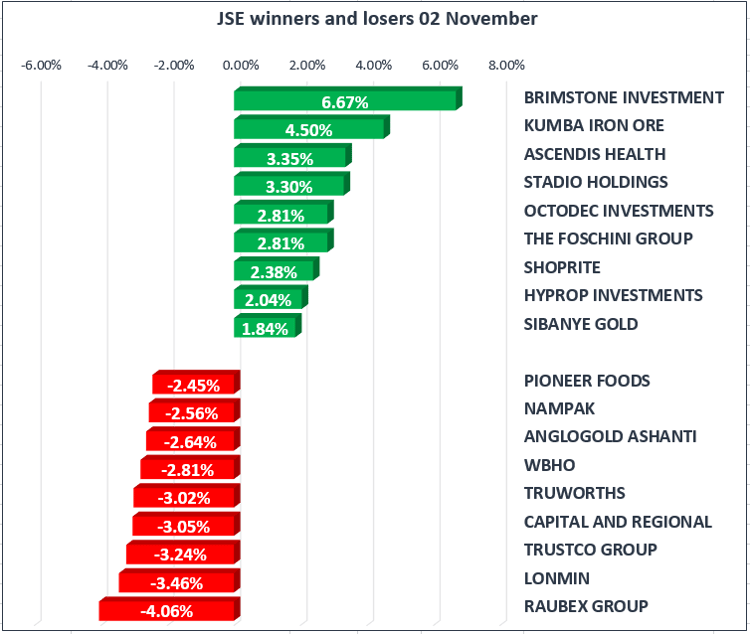

Commodity prices were generally lower, pushing the Resources index down 0.52% and the Gold index down 0.72%

The JSE All-Share Index closed the day 0.31% softer, matched by the blue-chip JSE Top-40 Index which closed 0.40% down. Financials could take advantage of the stronger rand and the index gained 0.39%

Firstrand [JSE:FSR] led the banks, and climbed 1.65% to R52.50 per share.

Kumba Iron Ore [JSE:KIO] bucked the weaker trend in the resources sector, gaining 4.05% to R287.72, despite only steady iron-ore prices.

AngloGold [JSE:ANG] fell 2.64% to R121.06 on the weaker rand-gold price.

Truworths [JSE:TRU] stumbled 3.02% to R75.29 fter announcing earlier in the day that its retail sales had declined 3% to R5.5bn during the first 17 weeks of its financial year. The retailer has struggled to increase earnings, and the share price has been range bound as a result.

South African new vehicle sales increased to 51 037 units in October, the highest volume since November 2015. Passenger vehicles sales were boosted by rental industry purchases, while commercial sales moderated after four months of improvement. Vehicle sales figures continue to rebound off a low base. However, the numbers still do not indicate a strong upturn and are unlikely to have policy consequences. In the short term renewed pressure on the rand, higher oil prices, an uncertain political climate and a squeezed consumer have reduced the scope for further easing.

President Trump is set to pick Fed Governor Jerome Powell to be the next Fed chair, succeeding Janet Yellen, whose four-year term expires in early February, WSJ reports. He is seen as the "safe choice" because he's not expected to veer drastically from current Fed policy. That would mean gradually raising short-term interest rates in quarter-percentage-point steps through 2020, while slowly shrinking the Fed's $4.2T balance sheet.

US October employment data is due this Friday afternoon. Traders will be eager to hear the US Non-Farm Payroll numbers released with most surveyed economists expecting a large increase in jobs created in October, as the US market nears full employment. The previous NFP (September) was disastrous, with the economy losing 33,000 job's position due to hurricane damage stalling industry.

Bitcoin climbed past $7,000 overnight for the first time ever, giving investors serious thought if it will hit $10,000 by year's end. The cryptocurrency had a staggering $3.5B trade volume in the past 24 hours and got new impetus this week after CME said it planned to introduce bitcoin futures.

Platinum producers emerged as the frontrunners, with Lonmin [JSE:LON] +5.07% to R19.48 , Implats [JSE:IMP] +3.21% to R39.22, and Anglo American Platinum [JSE:AMS] +1.30% R265.09. The platinum index gained 1.61% overall as miners react to stronger platinum prices and the weaker rand.

South African labour force data released today showed that unemployment rate remained unchanged at 27,7% in the third quarter as the labour force increased, while the labour absorption rate remained steady.

The formal sector employment increased by 1,7% over the quarter, manly driven by increased employment in the financial as well as community and social services industries, while the informal sector recorded job losses. The statistics provide further evidence that general economic conditions remain subdued and the economy is struggling to create jobs

Brent Crude continued its climb, trading at $61.01/bbl at the close of the local session. Sentiment remains largely bullish in the commodity as geopolitical uncertainties stem from the conflict between the Kurds and Iraqis, North Korea's nuclear ambitions, and the potential for President Trump to decertify the Iran nuclear deal. Another positive factor is the upcoming OPEC meeting at the end of November where many expect the agreement limiting crude oil output to be extended beyond March 2018

China's official manufacturing PMI missed expectations in October, coming in at 51.6, with both production and demand falling during a week-long national holiday. Activities in the energy and manufacturing industries also slowed due to the country's crackdown on pollution in some regions. The official services PMI meanwhile fell to 54.3 from 55.4 in September, according to the National Bureau of Statistics

In the US, Janet Yellen is likely presiding over one of her final meetings as the FOMC begins its latest two-day policy get-together. Fed Governor Jerome Powell is widely expected to be named chair; he has been seen as closest to Yellen of all the candidates and is set on normalising interest rates.

Want market news and free trade research direct to your email?