Equity markets ended the week weaker as the JSE continues to fail to find a bid. The local market pulled lower on Friday as the Resource sector gave back some of the gains posted this week.

Asian markets traded lower on Friday as investors took profits. Main land China was closed this week for a national holiday as weaker Chinese PMI numbers indicated that the Chinese economy could be slowing down. There were no further changes on the “trade war” front as Beijing reserved action for next week when their markets are open. The Nikkei’s rally on Monday was its highest close since November 1991, there has been an element of missing out that has propped up the market to these levels. The Nikkei closed the day 0.8% to close the week at 23783, 400 points off last Fridays close, the Hang Seng closed the day 0.19% softer to trade at 26572, 261 points lower for the week.

MTN continues to fight a seemingly losing battle with the Nigerian authorities. The mobile giant was slapped with bad news on Friday, as the Central Bank of Nigeria (CBN) placed a counterclaim on the $8.1bn dividend repatriation debacle. The CBN indicated that they would levy interest of 15% pa on the $8.1 in dispute. Shares in MTN closed the day 4.01% lower to trade at 8380c having made an intraday low of 7800c when the news broke.

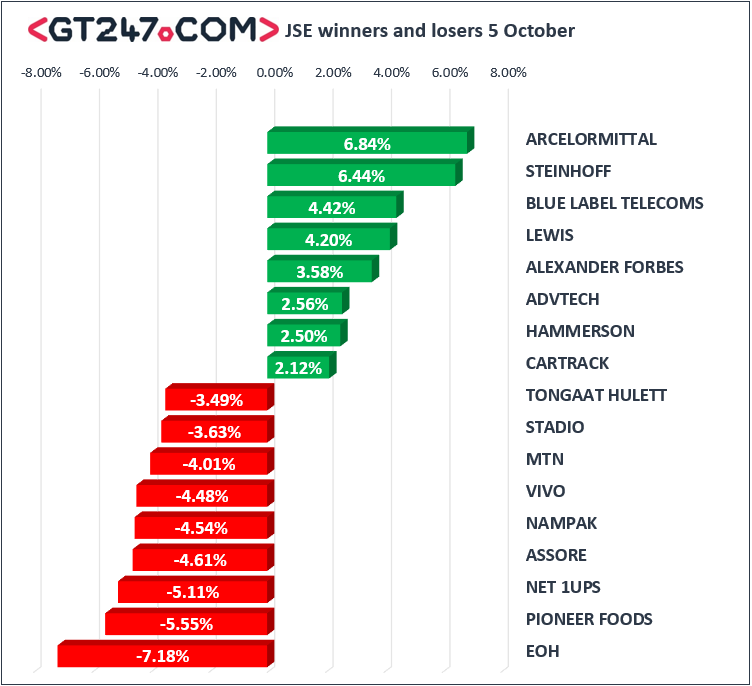

Losses were also recorded in EOH [JSE: EOH], Pioneer Foods [JSE: PFG], NET 1[JSE: NT1] and Assore [JSE: ASR] shedding 7.18%,5.55%, 5.11% and 4.61% respectively. Losses were sustained across the board on the day with major losses being posted by the banking and insurance shares and the rand sensitive shares.

Gains were posted in ArcelorMittal [JSE: NT1], Steinhoff [JSE: SNH], Blue Label [JSE: BLU] and Alexander Forbes [JSE: AFH], recording gains of 6.84%, 6.44% 4.42% and 3.58%.

All the major indices were lower on the day as the resource 10 index slid 1.99% to record its first loss for the week to close the week at 43884 points. The Financial index pulled back 1.12% whilst the industrial index shed 1.01%. The All share closed the day in the red 1.13% whilst the Top40 retreated 1.33% to trade at 54409 and 48258 points respectively.

The Rand was weaker against the dollar on Thursday to trade at 14.80 to the dollar. The rand recorded a 4% decline against the dollar for the week as it starts a new month and a new quarter on the back foot. The Rand was softer against the crosses on the day to trade at R17 to the Euro and R19.30 to the Pound. South African 10 Year Bond (R186) yields eased again on Friday to close the week at 9.24%, 24 basis points from Friday’s close

Commodities were generally firmer on the day as Gold traded above the key psychological level of $1200/ ounce. Platinum and Palladium were firmer too and were trading at $825/ ounce and $1063/ounce respectively. Brent crude was relatively unchanged on the day and was changing hands at $84.75 having posted an intra-day high of $85.12.

Crypto currencies were firmer on the day as Bitcoin gained 0.33% to trade at $6604/ coin whilst Ethereum rallied 0.38% to trade at $224/ ounce. The two main crypto currencies were weaker for the week as Bitcoin shed 1.05% and Ethereum shed 0.25% respectively.

Today’s release of the non-farm payroll data showed that the US economy was able to add 134k jobs in the month of September down from 270k jobs created in the month of August of this year. The Unemployment rate declined to 3.7% the lowest it has been in since 1969 whilst the average hourly earnings increased by 2.8% year on year. The FED is expected to increase interest rates in a gradually manner if the data continues to warrant monetary intervention.