The JSE closed weaker on Wednesday as the local bourse followed the trend in other major global indices.

The Dow Jones December Futures contract was down by more than 150 points at some stage in the morning whilst in Germany, the Dax also took a hit as it was down by more than 1% by the time the JSE closed.

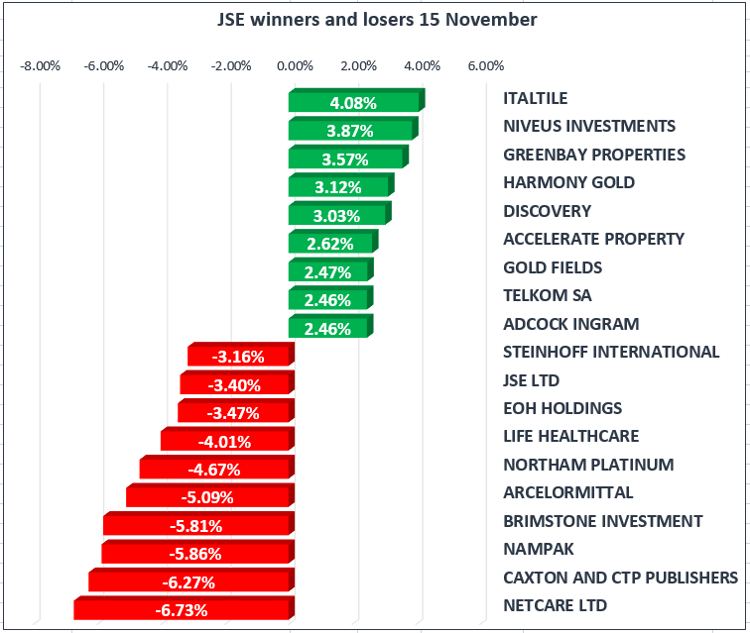

Netcare [JSE:NTC] was one of the biggest losers of the day as it lost 6.73% to close at R23.55 per share. This was on the back of a trading statement which was released this morning which indicated that they are expecting earnings to be down by between by 130.0% and 135.0%. The statement also indicated that they expecting headline earnings and headline earnings per share to decrease by between 5% and 10%.

Brait [JSE:BAT] released a relatively weak set of 6 months results which indicated a decrease of its Net Asset Value of 14.8% compared to the same period last year. For the full-year this equates to a decrease of 36.6%. As a result, the stock traded under pressure for the better part of today to eventually close down 2.03% at R47.70 per share.

Nampak [JSE:NPK] also came under significant pressure as it lost 5.86%, whilst EOH Holdings [JSE:EOH] and Northam Platinum [JSE:NHM] also came under pressure to lose 3.47% and 4.67% respectively. Miners traded softer today due to the weaker metal commodity prices. This resulted in stocks such as Anglo American PLC [JSE:AGL], Glencore [JSE:GLN] and BHP Billiton closing the day 3.06%, 2.20% and 2.61% weaker respectively.

Naspers [JSE:NPN] which opened weaker today managed to close the day firmer as it was buoyed by good 3rd quarter results from its Hang Seng listed associate Tencent Holdings. Tencent Holdings reported a jump in quarterly net profit of 69% which exceeded analyst estimates. As a result Naspers reached a new all-time high of R3739.89 per share, before it retraced slightly to close at R3661.42 per share, up 1.95% for the day.

Gold miners AngloGold Ashanti [JSE:ANG] and Gold Fields [JSE:GFI] benefitted from higher gold prices to close the day up 2.15% and 2.47% respectively.

The JSE All-Share Index closed the day down 0.56% whilst the blue chip Top-40 Index lost 0.51%. The Resources Index came under pressure as it lost 2.26% whilst the Financials Index lost 0.61%. The Industrials Index managed to record gains 0.11%.

Despite a weakening US dollar the Rand failed to gain any significant momentum from yesterday. The local currency weakened to an intra-day low R13.42/$, and at 5pm the USD/ZAR was trading at R13.38. The US dollar index broke below 94 index points overnight and today it managed to bottom out at 93.402 Index points.

Gold bounced on the back of safe-haven buying to peak at an intra-day high of $1289.61/Oz. The precious metal lost a bit of that upward momentum to trade at $1282.40/Oz when the JSE closed.

Other metal commodities were softer with Palladium in particular losing the most ground. The metal managed an intra-day high of $992.22/Oz before it slid to trade at $980.85/Oz when the JSE closed. Platinum managed to score gains towards the close of the JSE to trade in the green. Platinum was trading at $931.60/Oz when the JSE closed.

Brent Crude traded weaker as it followed the trend in the bulk of metal commodities. The commodity was trading at $61.48 per barrel when the JSE closed.