The JSE retreated on Thursday as pressure mounted on local retailers following the release of weaker trading statements from some of the bourse’s largest retailers.

Trading updates from Mr Price [JSE:MRP] and Woolworths [JSE:WHL] reflected lower than expected sales volumes during the December holidays. This came as a shock to most market participants given the jump that was recorded in South African retail sales data for the month of November released on Wednesday.

In terms of economic data, the South African Reserve Bank decided to keep the repo rate unchanged at 6.75% as the MPC indicated that it continues to assess the stance of monetary policy to be broadly accommodative.

On the financial markets, the bearish sentiment was also driven by weaker closes in Asian markets which saw most European counters trading softer. With US earnings releases ongoing, the current earnings releases from Wall Street’s biggest banks have seen a miss in reported trading revenues compared to what most analysts had forecasted, however the impact has been muted on the major US indices.

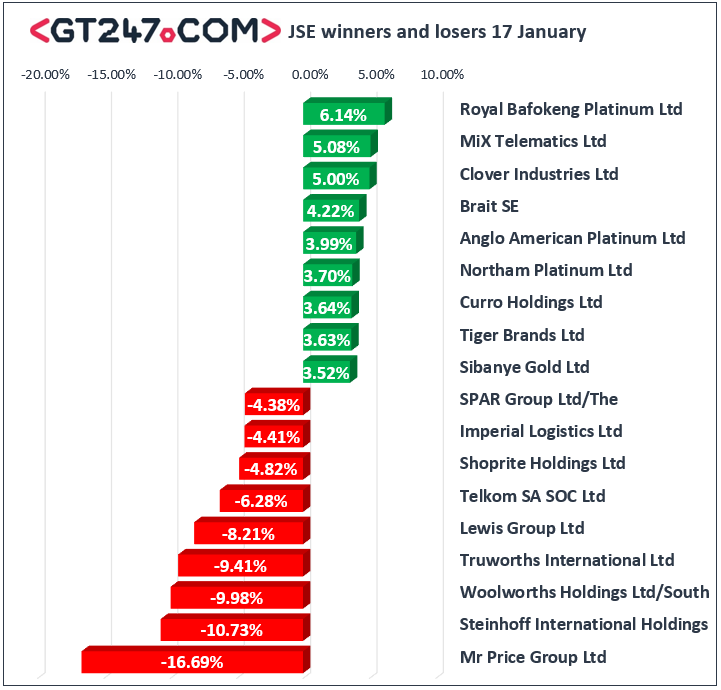

Retailers led the downtrend on the JSE as a sector wide sell-off ensued. Mr Price [JSE:MRP] fell 16.69% to R215.90, Woolworths [JSE:WHL] dropped 9.98% to R49.44, Shoprite [JSE:SHP] lost 4.82% to R186.25, and Truworths [JSE:TRU] closed 9.41% weaker at R80.70. Spar Group [JSE:SPP] closed at R201.50 after dropping 4.38%, while Massmart [JSE:MSM] lost 4.24% to close at R111.28. The bearish tone for retailers could continue in the short-term other retailers release their trading updates.

Clicks [JSE:CLS] weakened by 4.28% to close at R191.72, while its sector peer, Dis-Chem [JSE:DCP] also struggled as it closed 4.11% lower at R27.33. Imperial Logistics [JSE:IPL] also traded weaker as it lost 4.41% to end the day at R70.30, while its offshoot, Motus Holdings [JSE:MTH] fell to R93.54 after losing 2.98%.

Miners which fell considerably on Wednesday staged a minor recovery with stocks such as Anglo American Platinum [JSE:AMS] gaining 3.99% to close at R574.00, Impala Platinum [JSE:IMP] rose to R36.05 after adding 3.12%, whilst South32 [JSE:S32] was buoyant on the back of a positive quarterly update which saw the stock close 1.67% firmer at R33.54. British American Tobacco [JSE:BTI] managed to post gains of 1.83% to close at R449.45, while Mediclinic [JSE:MEI] rose to R58.49 after adding 2.99%.

The JSE All-Share Index eventually closed 0.77% weaker, while the JSE Top-40 index lost 0.88%. The Industrials and Financials indices dropped 1.06% and 1.21% respectively, but the Resources index managed mild gains of 0.48%.

At 17.00 CAT, Gold was down 0.18% to trade at $1291.28/Oz, Palladium was up 2.05% at $1394.11/Oz, and Platinum was 0.45% firmer at $810.49/Oz.

Brent crude was trading 0.95% softer at $60.74/barrel just after the JSE close. The weakness has been ignited by higher crude stockpile readings from the USA.

The rand relinquished earlier gains to trade 0.71% at R13.79/$ at 17.00 CAT.