The JSE slipped further on Thursday as it closed softer led by losses on the resources index.

Miners have surged over the past couple of sessions on the back of firmer metal commodity prices, which have risen on the back of the tensions between the USA and Iraq. There was disappointment in terms of local economic data as South African manufacturing production for the month of November came in worse than expected. Manufacturing production YoY was recorded at -3.6% which was worse than the prior recording of -0.8% and the estimated -1.6%. Manufacturing production MoM contracted 1.5% which was worse than the prior recording of 2.5%.

There was improvement in terms of the SACCI Business Confidence indicator for December which was recorded at 93.1, which was better than the forecasted 90.5. The rand eased from its session high of R14.11/$ as it bottomed out at R14.22/$. At 17.00 CAT, the rand was trading 0.26% weaker at R14.18/$.

The trend on the JSE contrasted with the trend recorded in other global markets which advanced, with a bigger surge being recorded in Asian counters.

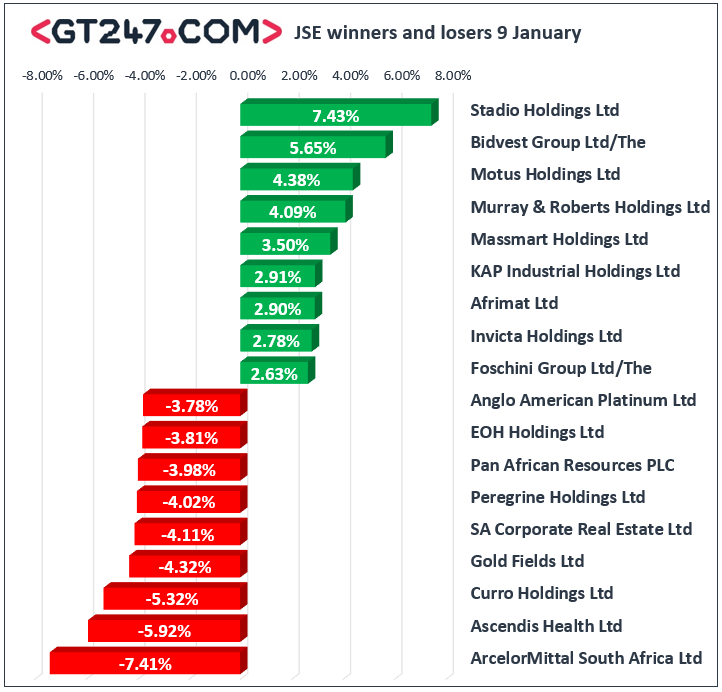

Intu Properties [JSE:ITU] came under pressure in today’s session following poor updates from UK retailers and reports of increasing distress amongst the bulk of them. Intu which specializes in shopping malls came under pressure as a result, eventually closing the day 14.89% lower at R4.80. Other UK focused listed property stocks were not spared as losses were recorded for Hammerson PLC [JSE:HMN] which lost 2.98% to close at R52.04, as well as Capital & Counties [JSE:CCO] which dropped 1.68% to close at R47.90. Gold Fields [JSE:GFI] led losses amongst the miners as it fell 4.32% to close at R89.41, while Sibanye Gold [JSE:SGL] lost 3.05% to close at R35.92. Anglo American Platinum [JSE:AMS] retreated 3.78% as it closed at R1331.16, while Impala Platinum [JSE:IMP] closed at R150.31 after losing 1.69%. Other significant losses were recorded for Dis-Chem Pharmacies [JSE:DCP] which lost 3.16% to close at R26.63, and Sappi [JSE:SAP] which weakened by 3.22% to close at R42.12.

Stadio Holdings [JSE:SDO] closed amongst the day’s biggest gainers as it surged 7.43% to close at R1.88. Despite the softer rand, retailers advanced on the day which saw gains being recorded for Massmart Holdings [JSE:MSM] which gained 3.5% to close at R47.95, and Truworths [JSE:TRU] which rose 2.59% to close at R48.30. Financials also recorded gains as stocks such as ABSA Group [JSE:ABG] which gained 1% to close at R144.38, and Capitec Bank Holdings [JSE:CPI] which inched up 0.84% to close at R1444.55. Gains were also recorded for Prosus [JSE:PRX] which added 1.5% to close at R1093.08, and Bidvest Group [JSE:BVT] which surged 5.65% to close at R216.50.

The JSE Top-40 index eventually closed 0.34% softer while the broader JSE All-Share index also dropped 0.34%. The Resources index came under significant pressure as it fell 1.73%, while the Industrials and Financials indices managed to gain 0.37% and 0.27% respectively.

Brent crude slipped lower in today’s session as the commodity was recorded trading 1.22% lower at $64.69/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.28% weaker at $1551.38/Oz, Platinum was up 1.27% at $965.97/Oz, and Palladium was 0.89% firmer at $2123.56/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.