The JSE retreated to close softer on Wednesday as it was dragged down mainly by blue-chips on the financials index.

Financials on the local bourse weakened as the rand had another volatile trading session. The rand fell to a session low of R14.15/$ before it recovered to trade 0.1% firmer at R14.08/$ at 17.00 CAT. There was some positive economic data for South Africa as Standard Bank released its PMI reading for June which came in at 49.7 from a prior recording of 49.3. The US dollar traded relatively flat on the day even after disappointments from US ISM Non-Manufacturing PMI data and ADP jobs data.

Local stocks took a leaf from Asian markets which fell in Wednesday’s trading session which saw the benchmark Shanghai Composite Index drop 1.11%, while in Hong Kong the Hang Seng lost 0.07%. In Japan the Nikkei closed 0.53% weaker. Stocks in Europe shrugged off the negative sentiment from the East as they advanced on the day while US markets also edged higher ahead of the USA’s Independence Day holiday on Thursday.

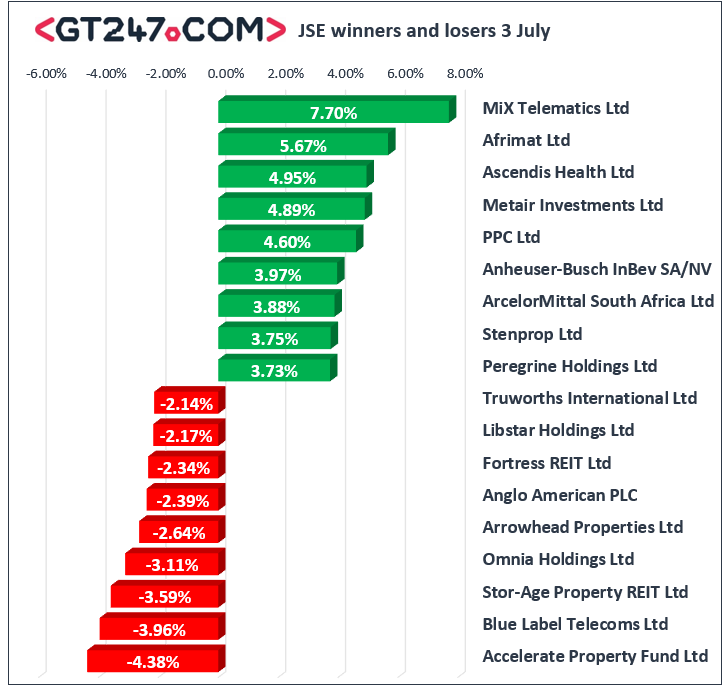

Banker FirstRand [JSE:FSR] slipped further in today’s session as it closed at R65.97 after dropping 1.76%, Nedbank [JSE:NED] lost 0.92% to close at R247.70, while insurer Old Mutual [JSE:OMU] lost 1.04% to close at R20.88. Mining giant Anglo American PLC [JSE:AGL] lost 2.39% as it closed at R391.75, while commodity trading giant Glencore [JSE:GLN] fell 1.27% to end the day at R48.83. Blue Label Telecoms [JSE:BLU] featured amongst the day’s biggest losers after the stock lost 3.96% to close at R4.37. Truworths [JSE:TRU] weakened by 2.14% to close at R67.38, while Shoprite [JSE:SHP] lost a more modest 0.76% to end the day at R156.76.

Afrimat [JSE:AFT] gained 5.67% to close at R33.55 after the company issued a statement that it was not going to proceed with its acquisition of Universal Coal following a due diligence process. Ascendis Health [JSE:ASC] found some traction as it advanced 4.95% to end the day at R5.09, while PPC Limited [JSE:PPC] gained 4.6% to close at R5.23. British American Tobacco [JSE:BTI] rose 2.35% to end the day at R526.77, while Sasol [JSE:SOL] managed to post gains of 1.48% to end the day at R345.73. Gold miners rebounded as well which saw stocks such as Sibanye Stillwater [JSE:SGL] gain 2.54% to close at R16.15, while AngloGold Ashanti [JSE:ANG] added 2.07% to close at R250.00.

The blue-chip JSE Top-40 index eventually closed 0.25% weaker while the broader JSE All-Share index dropped 0.13%. The Financials index pulled back marginally towards the close as it closed 0.81% while the Resources index dropped 0.33%. The Industrials index recouped earlier losses to end the day 0.15% firmer.

Brent crude edged higher as stockpiles data indicated lower than forecasted oil inventories in the USA. The commodity was trading 0.93% firmer at $62.98/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.02% firmer at $1418.54/Oz, Palladium had gained 0.59% to $1570.80/oz, and Platinum was 1.43% firmer at $841.70/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.