The JSE closed on a high on Wednesday, with resources and industrial stocks driving the positive momentum.

The rand steadied to R13.59 against the dollar near the close of trading, recovering a few cents against the greenback.

At the close of the JSE, the Top 40 index was 0.76% higher on an all-time high of 50509 points. Much of the gains on the JSE have been driven by the weaker rand, inflating foreign earnings.

Naspers [JSE:NPN] extended its record run, climbing 1.19% to R3095.00 per share, on the back of a 0.75% move in Hong Kong listed, Tencent. Naspers is now up over 53% for the year

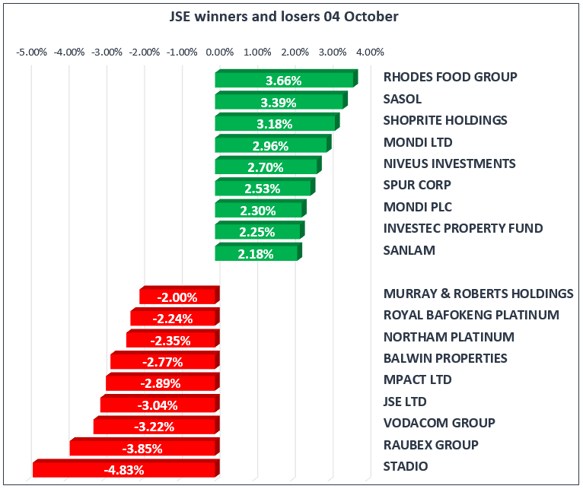

Sasol [JSE:SOL] emerged as the main winner of the Top40, gaining 3.39% to close at R380.50 per share.

Vodacom [JSE:VOD] took an 8.5% dive, reaching a low of R143.11 before recovering to close only 3.22% lower at R151.36 following news that the Competition Commission had started an investigation into the company over an “abuse of dominance”.

The commission said the investigation came in the wake of the cell phone giant securing an "exclusive four-year agreement" with National Treasury to be the sole provider of mobile telecommunication services to the government.

The commission said the contract would entrench Vodacom’s dominant position in the market, raise barriers to entry and expansion, distort competition in the market, and result in a loss of market share for other network operators.

The French CAC index fell 0.08%, the UK FTSE 100 edged 0.01% lower while the German DAX gained 0.53%. The rand firmed 0.25% against sterling, and traded at R18.02 against the pound.

The European Commission has moved to refer Ireland to the European Court of Justice for failing to recover up to €13B of illegal state aid from Apple [NASDAQ:AAPL]. In a parallel case, Europe's competition chief said that Luxembourg must collect around €250M of taxes from Amazon [NASDAQ:AMZN], adding to a growing list of scalps in a crackdown on tax loopholes.

Brent Crude prices edged 0.11% lower to $55.94/bbl as higher prices have resulted in an uptick in US shale production, increasing supply.