The JSE inched higher on Friday as rand hedges rose on the back of the firmer rand.

Most of the focus was on USA GDP numbers which were released at 2.30pm this afternoon. The numbers came in slightly worse than expected at 4.1% annualized QoQ, which missed most analysts’ estimate of 4.2%.

The rand strengthened to a session high of R13.13 against the US dollar as the greenback pulled back from its session highs because of the weaker data. At 17.00 CAT, the rand was trading 0.52% firmer at R13.16/$.

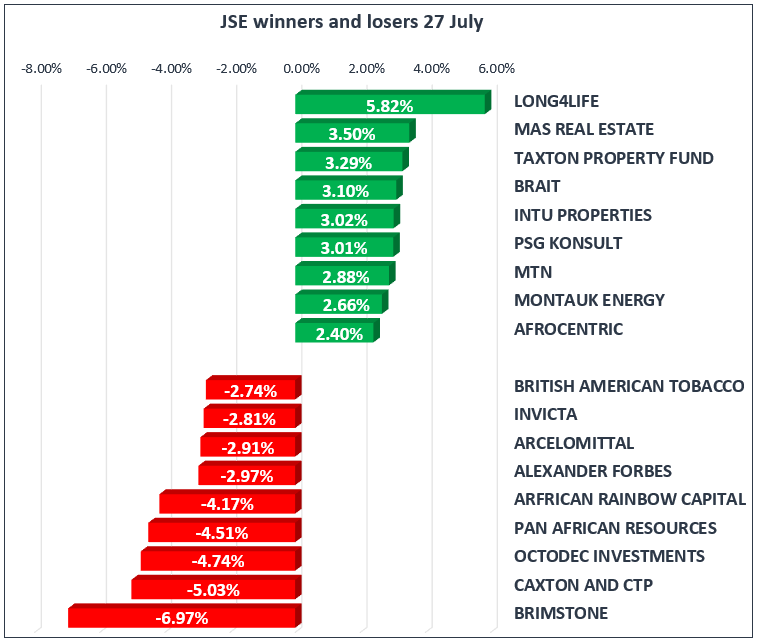

Long4Life [JSE:L4L] rallied to R5.09 per share after adding 5.82%, while Texton [JSE:TEX] added 3.29% to close at R5.96. Brait [JSE:BAT] firmed to R43.25 after the stock posted gains of 3.1%, while Intu Properties [JSE:ITU] rebounded from Thursday’s slump to end the day 3.02% firmer at R29.36 per share.

On the blue-chip index, MTN Group [JSE:MTN] was among the index’s biggest gains after adding 2.88% to close at R110.95 per share. Sappi [JSE:SAP] closed 2.28% firmer at R93.69, while diversified miner, BHP Billiton [JSE:BIL] managed to add 2.16% to close at R298.89 per share following the announcement of the disposal of USA onshore assets.

African Rainbow Investments [JSE:AIL] came under some pressure which saw the stock relinquish 4.17% to close at R6.20 per share. EOH Holdings [JSE:EOH] weakened to R41.25 after shedding 2.09% while Harmony Gold [JSE:HAR] pulled back to close at R21.67 per share after dropping 1.99%.

The JSE All-Share index traded mostly firmer eventually closing the day up 0.74%, while the JSE Top-40 index gained 0.83%. The Resources index rallied to end the day up 1.17%, while the Industrials and Financials indices added 0.6% and 0.8% respectively.

Brent crude struggled to gain any momentum as it traded relatively flat on the day. It was trading at $74.53 just after the JSE close, only managing to eke out gains of 0.01%.

Gold got a lift following the release of weaker US GDP data. The precious metal rebounded to reach a session high of $1225.90/Oz before retracing to trade at $1224.97/Oz. Platinum was up 0.6% to trade at $829.82/Oz, and Palladium was 0.12% firmer at $930.58/Oz.

At 17.00 CAT, Bitcoin was down 3.16% to trade at $7967.20/coin, while Ethereum had lost 2.54% to trade at $465.08/coin.