The JSE was lifted on Friday mainly due to the resurgence in global stocks amid the resumption of coalition talks in Italy.

European counters tracked higher as investor sentiment improved which saw major indices such as the FTSE and the DAX surge by more than 1%. Asian counters failed to record significant gains earlier on but this did not hamper the JSE’s climb.

Despite the upward trend in the JSE, local economic data disappointed. The ABSA Manufacturing PMI index for May declined to 49.8 from a prior recording of 50.9. Naamsa vehicle sales YoY also came in weaker at 2.4% compared to a prior recording of 3.6%.

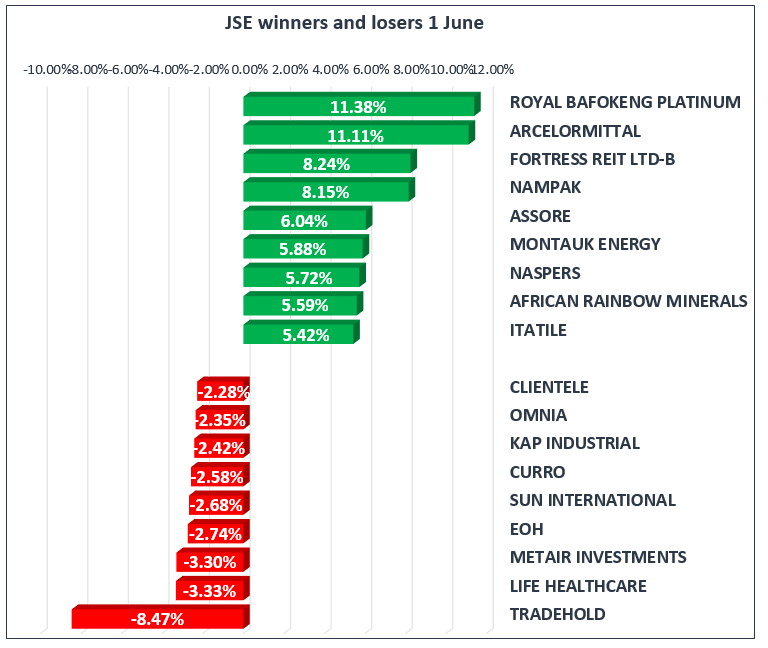

The JSE steamrolled right from the open to close significantly firmer on the day. Fortress B [JSE:FFB] jumped 8.24% to close at R16.02 per share, Alexander Forbes [JSE:AFH] added 3.97% to close at R6.55 per share and Nampak [JSE:NPK] closed at R16.45 per share after adding 8.15%. Miners, African Rainbow Minerals [JSE:ARM] and ArcelorMittal [JSE:ACL] closed 5.59% and 11.11% firmer respectively.

On the blue-chip index, Naspers [JSE:NPN] surged 5.72% to close at R3198.95 per share, Sasol [JSE:SOL] gained 5.25% to close at R481.50 per share and Anglo American PLC [JSE:AGL] added 2.74% to close at R310.79 per share. MTN [JSE:MTN] and Vodacom [JSE:VOD] managed to gain 2.8% and 2.98% respectively, whilst Mr Price [JSE:MRP] closed 1.85% firmer following the release of positive FY18 results.

Curro Holdings [JSE:COH] ended amongst the day’s biggest losers after shedding 2.58%, whilst EOH Holdings [JSE:EOH] slid by 2.74% to close at R32.67 per share. Hospitality group, Sun International [JSE:SUI] closed 2.68% weaker, whilst on the Top-40 index, Life Healthcare [JSE:LHC] and Shoprite [JSE:SHP] lost 3.33% and 1% respectively.

After a strong trading session the JSE All-Share Index closed 2% stronger, whilst the JSE Top-40 index gained 2.19%. The Industrials index was the biggest gainer after adding 2.37%, whilst the Resources and Financials indices added 1.85% and 1.57% respectively.

The Rand closed significantly weaker overnight however it traded relatively flat in today’s session. The local currency strengthened to a session high of R12.58/$ before it retraced to trade at R12.63/$ at 17.00 CAT.

Gold traded softer today due to the stronger US dollar, as well as a decrease in the appetite for safe-haven assets as a result of the positive news out of Italy. The metal slid to a session low of $1289.49/Oz before rebounding to trade at $1295.12/Oz at 17.00 CAT. Platinum was trading 0.17% firmer at $908.48/Oz, whilst Palladium was trading at $995.29/Oz, up 0.66% for the day.

Brent crude slid in the afternoon session despite recording small gains in the morning session. The commodity was trading at $76.69/barrel just after the JSE close, down 1.12% for the day.

Bitcoin erased earlier gains to trade at $7411.90/coin at 17.00 CAT, down 2.14% for the day, while Ethereum was down 0.61%, at $573.76/coin.