The seesaw on the JSE continued as the local bourse managed to close firmer on Wednesday.

The big discussion in global markets today was Donald Trump’s decision to exit the Iran nuclear deal which resulted commodities such as Brent Crude soaring. The deal which was intended to limit Iran’s nuclear program leaves the future of the agreement with the remaining European partners in doubt.

Closer to home, the SACCI Business Confidence number for April slowed down 96.0 from a prior recording of 97.6. The Rand also slipped in today’s trading session to reach an intra-day low of R12.72/$ mainly due to US dollar strength. The US dollar did ease in the afternoon session which resulted in the Rand retracing back to trade at R12.56/$ at 17.00 CAT.

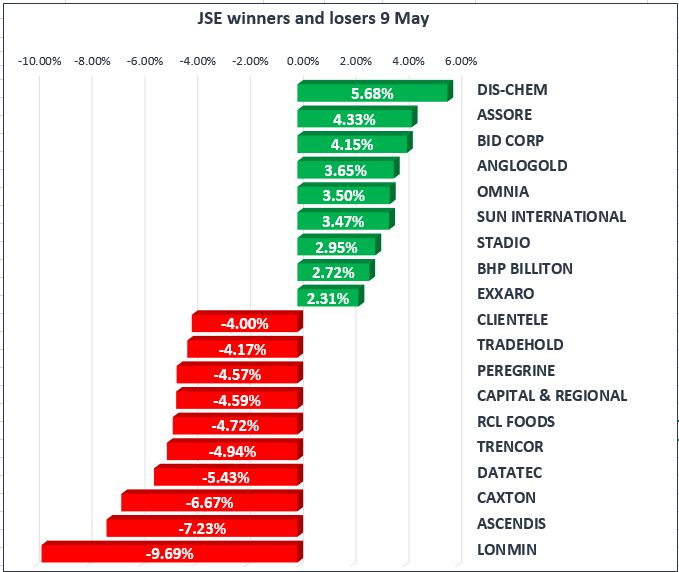

On the local index, Dis-Chem [JSE:DCP] and Assore [JSE:ASR] recorded gains of 5.68% and 4.33% respectively as they ended amongst the day’s biggest gainers. Gold miners, AngloGold Ashanti [JSE:AGL] and Gold Fields [JSE:GFI] managed to close the day up 3.65% and 1.29% respectively despite Gold trading softer earlier on. Exxaro [JSE:EXX] and African Rainbow Minerals [JSE:ARM] added 2.31% and 2.72% respectively.

Retailers, The Foschini Group [JSE:TFG] and Mr Price [JSE:MRP] gained 1.78% and 1.98% respectively, whilst bankers such as Nedbank [JSE:NED] and Standard Bank [JSE:SBK] climbed 1.76% and 0.95% respectively. Naspers [JSE:NPN] traded mostly firmer but closed only 0.05% higher which was supported by the announcement of the sale of its stake in Flipkart to Walmart. Other notable moves higher were recorded in British American Tobacco [JSE:BTI], Vodacom [JSE:VOD] and Tiger Brands [JSE:TBS] which gained 1.3%, 1.5% and 1.04% respectively.

Lonmin [JSE:LON] slid by 9.69% to close at R8.67 per share as the bearish tone around Platinum miners persisted. Impala Platinum [JSE:IMP] lost another 1.87% to close at R19.43 per share. Sibanye-Stillwater [JSE:SGL] came under significant pressure as it slid to a session low of R9.06 per share, before rebounding to close at R9.31 per share, down 3.52% for the day.

Ascendis Health [JSE:ASC] and Datatec [JSE:DTA] lost 7.23% and 5.43% respectively, whilst on the blue-chip index, Aspen [JSE:APN] was one of the index’s biggest losers after shedding 1.18% to close at R263.06 per share. MTN [JSE:MTN] came under significant pressure in the morning session after the company announced that they might face challenges repatriating funds from Iran in the wake of fresh US sanctions on that country. The stock closed at R124.22 per share, down 0.58% for the day after having reached a session low of R120.00 per share earlier on.

The JSE Top-40 Index closed 0.54% firmer whilst the broader JSE All-Share Index managed to add 0.43%. Modest gains were recorded across most of the major indices with the exception of the Resources Index which gained 1.39%. The Industrials and Financials Indices recorded gains of 0.19% and 0.31% respectively.

At 17.00 CAT Gold was trading flat at $1316.01/Oz, after having reached a session low of $1304.34/Oz earlier on. Platinum was trading 0.32% firmer at $916.05/Oz, whilst Palladium was 0.5% firmer at $978.55/Oz.

Brent Crude was trading firmer on the back of increased geopolitical tensions and lower crude oil stockpiles numbers. The commodity was trading at $76.87/barrel just after the JSE close.

On the cryptocurrency market, Bitcoin is still holding above $9000 per coin, and at 17.00 CAT it was trading at $9300 per coin. At that same time Ethereum was trading at $746.76 per coin.