The JSE continued its climb on Tuesday, aligned with positive global markets.

Japanese markets reacted positively to the Bank of Japan’s decision to continue aggressive monetary easing, with the Nikkei gaining 1.29% to reach its highest level in 26 years. Japan’s central bank kept monetary settings unchanged overnight, maintaining its massive stimulus program, lagging behind global peers in normalizing policy.

The rand eased slightly to R12.11 against the greenback, as the end of the US government shutdown allowed the dollar to recover slightly.

The All Share Index gained 0.74% matched by the blue-chip Top 40 which gained 0.73%.

Banks continued to lead the market, as positive political sentiment pushes financial stocks higher. Leading the banking stocks, FirstRand [JSE:FSR] gained 3.95% to R69.13, followed by Barclays Africa [JSE:BGA] 3.38% to R189.19, Nedbank [JSE:NED] 1.89% to R270.50 and Standard Bank [JSE:SBK] climbing 1.55% to R203.00

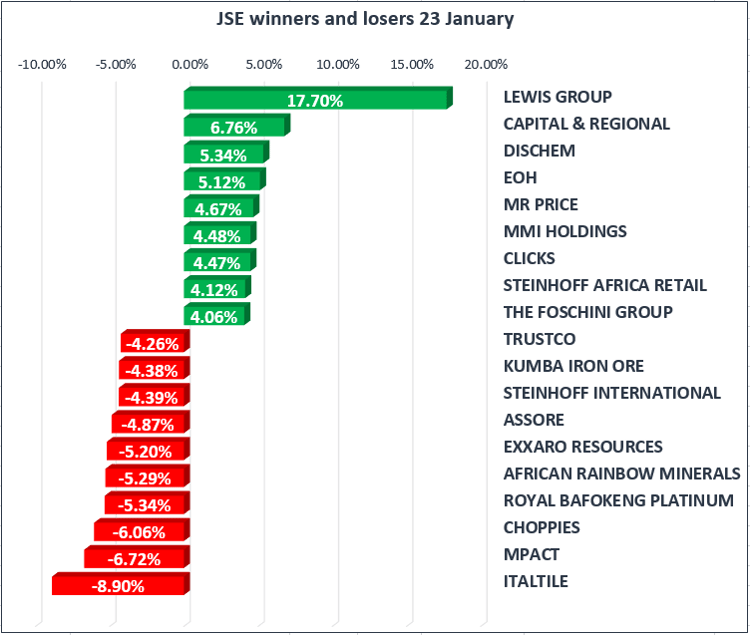

Furniture retailer Lewis [JSE:LEW] climbed 17.70% off a low base to R28.03, after delivering a trading update for December 2017. Revenue for the nine months declined by 1.7%, according to their trading update this was largely due to lower credit sales in prior years, compounded by the implementation of the prescribed maximum credit life insurance rates in August 2017. This is despite the positive news that merchandise sales for the quarter were 9.8% higher compared to the corresponding period, resulting in a seven percent sales growth for the nine months.

Consumer brands company AVI [JSE:AVI] continued its impressive run and gained 2.12% to R111.00, following the release of a trading update for the six months ended 31 December 2017. The company reported that group revenue rose 2.3% as increased selling prices offset a decline in sales volume.

Brent Crude oil prices continued their climb, gaining 1.14% to $69.82/bbl lifted by positive global growth prospects and continued production cuts by OPEC.

Gold traded flat at $1338/Oz, unaffected by the ongoing politics of the shutdown in the US government