The local bourse rallied to close higher on Monday mainly on the back of a broad-based rebound across the sectors which fell in the prior session.

The trend on the JSE was in sharp contrast to other major world indices which traded mostly weaker. Significant losses were recorded across most of Europe’s major indices which tumbled on the back of news from Chinese media on the possible retaliations China could pursue with regards to the USA’s tariffs. Asian closed weaker in earlier trading while US futures also pointed lower before the cash market opened.

The moves on the JSE may have broken some of the usual fundamental rules particularly across rand sensitives. The rand slumped further in today’s session as it bottomed out at a session low of R14.89/$. Despite this trend, rand sensitive stocks advanced on the day. At 17.00 CAT, the rand was 0.27% weaker at R14.76/$.

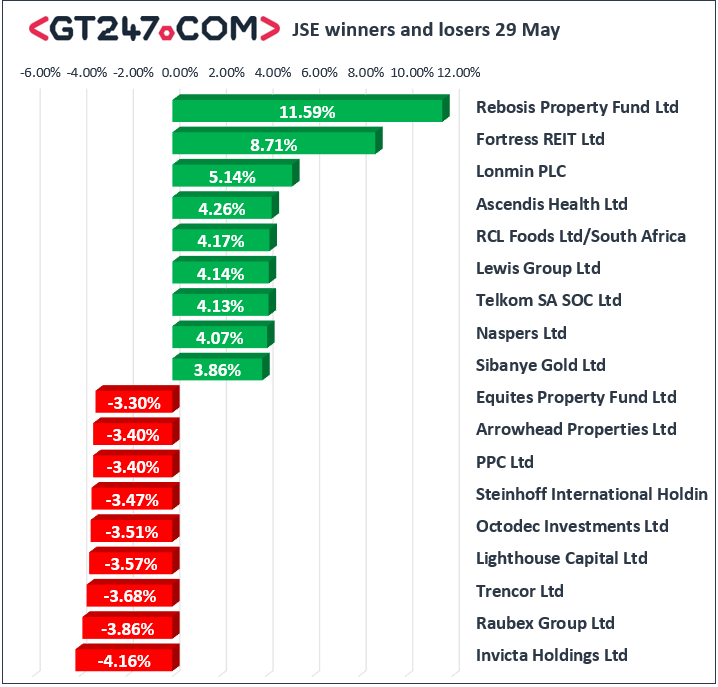

On the local bourse, another volatile trading session ensued for Rebosis Property Fund [JSE:REB] which climbed 11.59% to close at R0.77, while its sector peer Fortress B [JSE:FFB] rallied 8.71% to close at R11.36. The biggest surprise of the day was probably in the gains recorded across most stocks in the financials index. FirstRand [JSE:FSR] gained 3.58% to close at R64.00, ABSA Group [JSE:ABG] rose 2.65% to close at R162.55, and Nedbank [JSE:NED] gained 3.33% to close at R250.56. Retailers also advanced on the day which saw significant gains being recorded for Truworths [JSE:TRU] which added 2.78% to close at R69.52, while The Foschini Group [JSE:TFG] gained 2.85% to close at R171.50. Naspers [JSE:NPN] rallied on the day despite its associate Tencent Holdings closing lower in Hang Seng. Naspers eventually closed 4.07% firmer at R3221.30.

Of the day’s losers, Arrowhead Properties [JSE:AWA] struggled on the day as it fell 3.4% to close at R3.69, while Lighthouse Capital [JSE:LTE] dropped 3.57% to close at R6.75. Cement maker PPC Limited [JSE:PPC] fell 3.4% to end the day at R5.12, while Raubex [JSE:RBX] lost 3.86% to close at R19.42. Pepkor Holdings [JSE:PPH] dropped 2.15% to close at R17.32 despite releasing a decent set of half-year financial results. Rand hedge British American Tobacco [JSE:BTI] retreated by 1.98% to close at R523.57, while diversified miner Anglo American PLC [JSE:PLC] dropped 2.17% to close at R355.67.

The JSE All-Share index eventually closed 1.01% firmer while the JSE Top-40 index gained 1.08%. The Resources index was the only index which closed weaker after it lost 0.98%. The Industrials and Financials indices gained 1.68% and 2.03% respectively.

At 17.00 CAT, Palladium was up 0.11% to trade at $1341.75/Oz, Platinum had lost 0.72% to trade at $793.90/Oz, and Gold was 0.23% firmer at $1282.26/Oz.

Brent crude stumbled in today’s session mainly on the back of increased fears over the trade war. Brent crude was trading 1.75% weaker at $67.47/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.