Local equity markets closed firmer on Tuesday as retail and financial stocks led gains on the JSE.

The market was trading in positive territory on Tuesday as it digested the cabinet reshuffle announced by President Cryil Ramaphosa on Monday night. The biggest relief for financial market participants was more than likely the reinstatement of Nhlanhla Nene back to the position of finance minister. The Rand only managed to strengthen to a high of R11.56/$ following the announcement. On Tuesday the Rand traded softer and at 17.00 CAT it was trading R11.70/$.

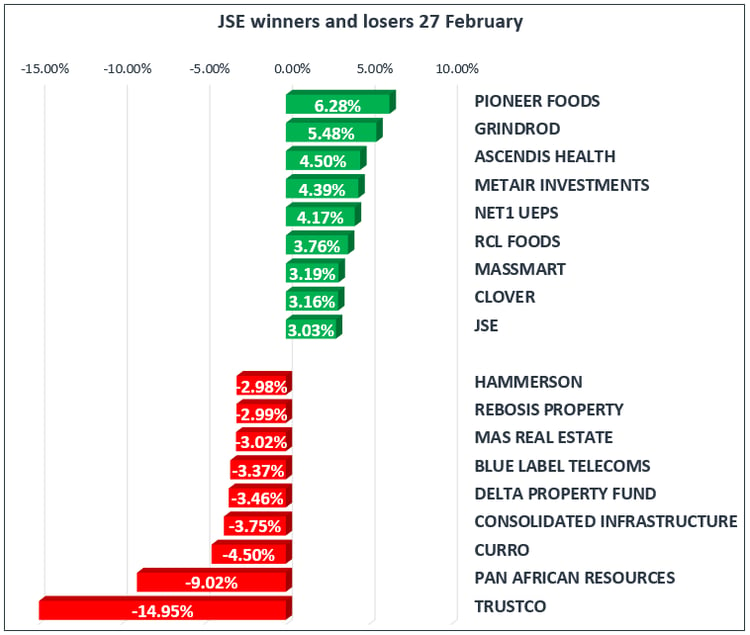

Top gainers in the blue-chip index included Aspen [JSE:APN], Standard Bank [JSE:SBK] and Investec PLC [JSE:INV] which gained 2.34%, 2.17% and 2.07% respectively. Shoprite [JSE:SHP] which released a decent set of 6 month results after the close on Monday, gained 2.11% to close at R267.20 per share, whilst MTN [JSE:MTN] added 2.03%. On the broader index Ascendis Health [JSE:ASC] jumped 4.50% to close at R11.84 per share following the announcement of the appointment of a new chief executive officer, and Pioneer Foods [JSE:PNR] also had a significant move higher as it gained 6.28%.

Intu Properties [JSE:ITU] and Capitec Holdings [JSE:CPI] anchored the bottom of the Top-40 index as they lost 2.15% and 1.71% respectively. Miners AngloGold Ashanti [JSE:ANG], Sibanye-Stillwater [JSE:SGL] and Kumba Iron Ore [JSE:KIO] lost 1.76%, 2.83% and 0.54% respectively. Index heavyweights Naspers [JSE:NPN] and Richemont [JSE:CFR] ended the day 0.25% and 0.28% softer respectively.

The JSE All-Share Index recorded modest gains of 0.27% whilst the Top-40 Index inched up 0.33%. All the major indices on the JSE closed in the green with the biggest gainer being the Financials Index which gained 0.52%, whilst the Industrials Index and Resources Index were 0.24% and 0.43% firmer respectively.

The US dollar gained against a basket of major currencies as indicated by the US dollar index which climbed above 90 index points to reach a high of 90.167 index points. The US dollar strengthened following the new US Fed governors’ first testimony before US lawmakers. The Fed governor indicated that the US Fed would be looking to gradually raise interest rates as the outlook for the US economy remains strong. As a result the Rand traded softer and on the commodity front Gold subsequently came under pressure despite earlier gains.

Gold opened firmer on Tuesday and it peaked at an intra-day high of $1336.80/Oz. However as the US dollar strengthened the precious metal traded softer and it was trading at $1326.08/Oz just after the close.

The trend was similar in the other precious metal such as Platinum and Palladium which also traded softer. Platinum slid below $1000/Oz once again as it lost 0.98% to trade at $990.38/Oz just after the close, whilst Palladium was 0.54% softer to trade at $1055.94/Oz.

Following the gains recorded overnight, Brent Crude eased marginally to trade at $67.34/barrel just after the close. This was after the metal managed to a day’s high of $67.61/barrel. JSE listed oil and gas producer, Sasol [JSE:SOL] gained 1.26% to close at R406.54 per share.