Industrials lead gains on the JSE

The JSE got off to a strong start for the week as it closed firmer on Monday led by gains on the industrials index.

The local bourse took a leaf from the firmer closes in Asian markets where the Hang Seng and Shanghai Composite Index closed 1.35% and 0.8% higher respectively, while the Nikkei managed gains of 0.49%. Unfortunately, this momentum did not carry into the European trading session where stocks traded mostly softer. The drop in European stocks coincided with the drop in US equity futures which retreated on the back of renewed pessimism about a trade deal being reached between the USA and China.

Weakness was also recorded for rand which weakened against the US dollar to a session low of R14.82/$. The local unit was recorded trading 0.69% weaker at R14.80/$ at 17.00 CAT.

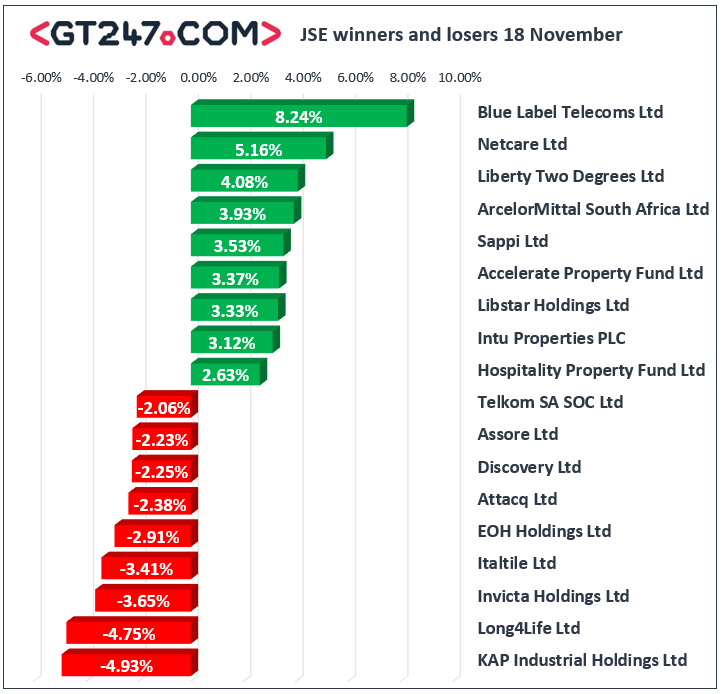

Industrials led gains on the local bourse mainly on the back of gains recorded in index heavyweights Naspers and Prosus. Prosus [JSE:PRX] which is subsidiary of Naspers released a half-year trading statement indicating that company is expecting a small increase in core headline earnings, which resulted in the stock closing 2.5% higher at R1012.49. Naspers [JSE:NPN] which also released a trading statement recorded gains of 2.37% to close at R2160.00. Netcare [JSE:NTC] highlighted a significant jump in headline earnings per share in its full-year results which saw the stock rally 5.16% to close at R18.55. Rand hedge, British American Tobacco [JSE:BTI] gained 2.58% as it closed at R549.85, while Sappi [JSE:SAP] managed to post gains of 3.53% to close at R37.88. Other significant risers on the day included Hammerson PLC [JSE:HMN] which advanced 2.48% to close at R55.41, Sibanye Gold [JSE:SGL] which rose 1.64% to close at R28.48, and Bid Corporation [JSE:BID] which closed at R344.19 after gaining 1.61%.

Of the day’s losers, KAP Industrial Holdings [JSE:KAP] came under significant pressure as it fell 4.93% to close at R4.24. Investment holding company, Long4Life [JSE:L4L] also struggled on the day as it fell 4.75% to close at R4.21, while EOH Holdings [JSE:EOH] dropped to close at R13.01 after losing 2.91%. The weaker rand saw rand sensitives such as Vodacom [JSE:VOD] fall 1.51% to close at R128.98, while ABSA Group [JSE:ABG] lost 1.45% to close at R160.52. Gold miners traded moderately softer as losses were recorded for DRD Gold [JSE:DRD] which lost 1.2% to close at R6.56, as well as Gold Fields [JSE:GFI] which dropped 0.22% to close at R79.90. Losses were also recorded for Old Mutual [JSE:OMU] which dropped 1.15% to close at R19.83, Massmart [JSE:MSM] which lost 1.02% to close at R44.59, and Sasol [JSE:SOL] which shed 0.96% to end the day at R281.77.

The JSE All-Share index closed 0.62% higher while the JSE Top-40 index rose 0.82%. The Financials index came under pressure because of the weaker rand as it lost 0.31%, however the Industrials and Resources indices gained 1.28% and 0.65% respectively.

Brent crude retreated as news of China’s pessimism about getting a trade deal surfaced. The commodity was trading 0.96% softer at $62.69/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.11% firmer at $1468.79/Oz, Palladium was up 0.67% at $1716.30/Oz, and Platinum was barely firmer as it was up 0.04% at $890.75/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.