Since the latest JOBS report, all eyes have been focussed on the FOMC’s Powell to give guidance to which direction the FED will head into with regards to interest rate cuts. The FED chair has made it clear that the Federal Reserve will remain independent and hinted that an interest rate cut is all but certain in July.

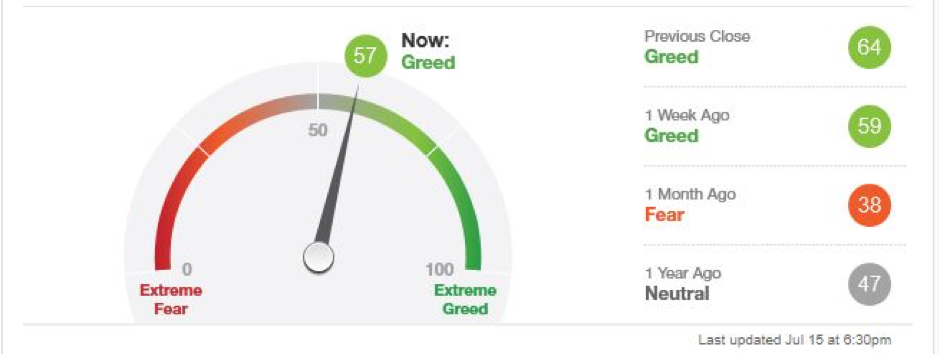

The markets have been gaining momentum since Powell’s testimony in front of Congress and by looking at the current CNNBusiness Fear and Greed Index we can see that we are entering a possible phase of “Greed” but we might get a better perspective once the FED makes its decision on rates.

Source: CNNBusiness

The United States

We have recently seen new all-time highs reached on the major stock Indices in the U.S. with the S&P 500 crossing the 3000 mark. The Dow Jones went well beyond the 27000 mark for the first time ever as talks of recession subsides.

Some headway is also being made with the trade negotiations between the U.S and China as U.S. Treasury Secretary Steven Mnuchin stated that if talks over the phone go according to plan this week, a trip to Beijing might be on the cards to hold trade negotiations.

The U.S earnings season has kicked off yesterday and this round of earnings reports will no doubtingly deliver a lot of surprizes. Some of the major investment banks are set to release their earnings today which include, J.P Morgan, Goldman Sachs and Wells Fargo.

Some technical points to look out for on the S&P 500:

- The 3000-price level will be watched closely as this might be the next support level on the Index to watch.

- The Relative Strength Index (RSI) is reaching overbought levels which might support the price moving lower to 3000 once more.

Source: Bloomberg

The Middle East / Africa

South Africa - Amidst fraud and corruption scandals becoming an everyday occurrence, SA Inc. has benefitted from the U.S Fed’s dovish outlook on interest rates. The South African Rand (ZAR) has gained over 1% since the start of July following a weaker U.S Dollar (USD).

Emerging Market currency might benefit more from the greenback’s decline but for South Africa a interest rate decision still looms this coming Thursday. We might see the South African Reserve Bank (SARB) cut rates which could see the Rand Battle to stay on its current trajectory. On the other side of the coin, we might see the risk-on sentiment towards emerging markets continue to 2020 if the FED stays on its current course.

The below chart gives us a closer look at YTD performance of the other main Middle East/ Africa markets to take note of:

Source: KOYFIN

Some technical points to look out for on the ALSI

- We might see more downside on the Alsi as the local currency gains strength against the Dollar (USD) and the local economy remain under pressure.

- Technical support at 50489 comes into focus and a break of support might target lower levels.

- The 50-day Simple Moving Average (SMA) is currently acting as support as the price action heads lower.

Source: Bloomberg

The Eurozone

Brexit is still at the top of the POPS in Britain as the British Pound (GBP) remains under pressure against the Euro as British holiday makers start to set sail. The latest Brexit date is set for the 31st of October 2019 with or without a deal it seems.

Across the pond the Eurozone has entered renewed fears of economic recession as an economic slowdown is gripping Europe. The Eurozone is facing a weaker second half of the year as the European Commission revises its outlook lower for 2020 despite industrial production growth this month.

- Industrial production in eurozone economies with higher exports-to-GDP shares, such as Germany, is still in danger. German manufacturing production was more than 4% down in May, compared to the same month last year. – Express

To add onto the economic pressure the U.S will get the go ahead by the World Trade Organization to start implementing new tariffs on Europe.

The below chart gives us a closer look at YTD performance of the other main Eurozone markets to take note of:

Source: KOYFIN

Some technical points to look out for on the DAX:

- The price action closed the “Gap” and is currently trading in a triangle formation which might see the price action breakout either side while the price fills the formation.

- Price is still above the 50-day Simple Moving Average (SMA) (white line) which might act as support in the future.

Source: Bloomberg

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.