The major Indices have been gaining momentum to the upside throughout last week and with that dismal Jobs number reported we might just see an easing of U.S interest rates by the FED sooner than later.

The United States

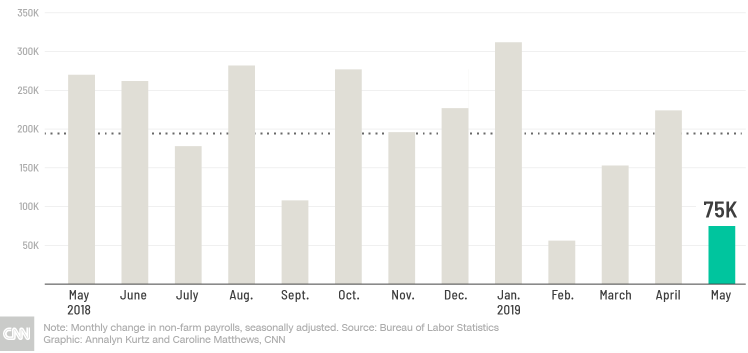

Is the labour market in the U.S Slowing down? Judging by the 223 000 jobs per month added on average in 2018 compared to 164 000 jobs per month added in 2019 we might think so. The U.S economy only manage to add 75 000 jobs in May from the 185 000 expected.

The decline might spark the FED to cut interest rates by 25 basis points as early as next week, but more evidence of a weakening economy might be needed.

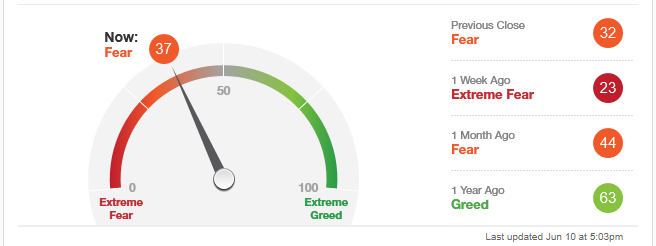

Fear in the market persists if the CNNBusiness Fear and Greed Index is anything to go by which has seen an uptick from a week ago when extreme fear overwhelmed market participants.

The U.S markets have been gaining momentum from the possibility that the FED might have to cut rates earlier that expected.

Some technical points to look out for on the S&P 500:

- The S&P has retraced back above the 2819 neckline and is pushing higher from the H&S breakout.

- The price action has closed above the right shoulder which technically negates the pattern and might just push higher from here.

- We might see the 50-day Simple Moving Average (SMA) (Blue line) act as support in the short term.

- The MACD is also about to cross the 0 line which would support a move higher and a bullish outlook moving forward.

Source – Bloomberg

Source – Bloomberg

The Eurozone

Brexit is back in the loop as the U.K’s top contenders battle it out to replace Theresa May by the end of July and it seems Boris Johnson is the firm favourite to take the top post in the land.

Johnson who came out over the weekend and stated that he would raise the point at which workers would pay 40% Tax from 50 000 pounds to 80 000 pounds to win favour. Another leading contender, Dominic Raab says he would rather leave without a deal than delay the exit, will launch his campaign under the banner of “Building a Fairer Britain” - Reuters

The U.K GDP numbers also disappointed to the downside on Monday as the GDP (MoM) number come in at -0.4%. The UK Industrial and Manufacturing Production also declined sharply across the board.

The British Pound (GBP) slipped lower after the news boke on Monday and might be under pressure for some time to come.

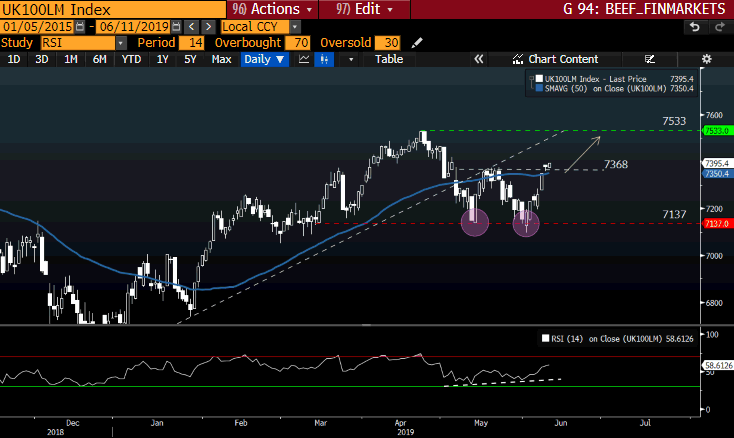

Some technical points to look out for on the FTSE 100

- The FTSE 100 has held up pretty good compared to other major Indices around the globe and looks like it wants to push higher.

- we can see a daily close above the neckline which would indicate buyers are willing to pay more and push the price higher.

- The 50-day Simple Moving Average (SMA) (blue line) might also act as support in the short term.

- The Relative Strength Index is also indicating a positive divergence in the making which supports the move higher at this stage of the race.

Source - Bloomberg

Middle East/ Africa

The South African economy has been placed firmly into the spotlight once more as the first quarter drop in Gross Domestic Product (GDP) the most in a decade has raised alarms with Moody’s. The credit rating agency is seeing the first quarter drop as a credit negative for the banks. Moody’s is the last rating agency to have South Africa’s sovereign debt at investment grade and is set to review in November 2019.

The South African Rand (ZAR) has been volatile over the last couple of weeks and might just lose more steam against the U.S Dollar (USD) if things don’t get better soon.

Some technical points to look out for on the ALSI:

- The ALSI has been pushing higher as the local currency depreciates further which might see some relief in the short term.

- The price action is currently at overhead resistance which was prior support of the main uptrend.

- The Relative Strength Index (RSI) is also nearing overbought territory which will be watched closely.

Source - Bloomberg ,

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.