The JSE traded firmer on Wednesday, as increased optimism surrounding South Africa’s political economy boosted financials.

The rand continued to strengthen on Wednesday, trading below R12.00 to the US dollar. The rand benefited from a weaker dollar as worries about a protectionist stance have added to the dollar’s woes after U.S. President Donald Trump slapped steep tariffs on imported washing machines and solar panels on Monday.

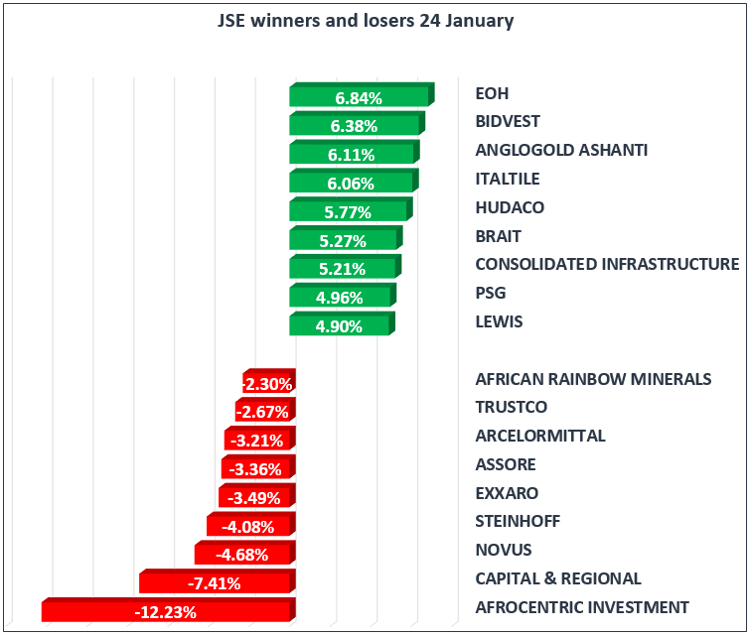

The All Share index gained 0.24% while the blue-chip Top 40 gained 0.10%, held back by larger exposure to Steinhoff [JSE:SNH] which fell 4.08% to R7.46

Bidvest [JSE:BVT] gained 6.30% to trade at R229.49

Brent crude remained firm, and held above $70/bbl at the close of local markets, while the gold price extended to $1353/Oz. Commodities have benefitted from a weaker dollar, making them more affordable relative to foreign currency, increasing their demand.

South African headline consumer inflation accelerated to 4,7% in December from 4,6% in November in line with the market’s expectation. The main driver of the increase was the transport category, where the fuel price increased by 14,2%, exerting the most upward pressure. For the year as a whole - consumer inflation averaged 5,3%, significantly lower than the 6,4% recorded in 2016

Food prices increased by 0,5% m-o-m in December. Meat prices were the main driver, followed by fruit, fish and dairy product prices. Declines were recorded for vegetables and sweets.

While consumer inflation is expected to remain contained below the Reserve Bank’s 6% upper target range throughout 2018, risks to the inflation outlook exist that might lift inflation. The biggest risks include a possible downgrade to sub-investment grade by credit rating agency Moody’s

In the US, the Dow Jones Industrial Average was up more than 100 points on Wednesday morning, powered by gains in industrial stocks such as GE, Boeing and Caterpillar.

Tesla has unveiled a bold pay package for CEO Elon Musk that again ties his compensation entirely to key performance benchmarks. They include an aim of hitting $650 billion in market value vs. a current valuation of around $59 billion. If Elon were to meet this target he is set to receive a bonus of $55 billion dollars.