An intro to the different order types available on MT5 with GT247

Missing a great trade opportunity while away from your platform is heartbreaking. Also, being glued to your screen waiting and watching as each candles stick moves towards that perfect entry point is no way to live your best life...

In this educational note on Pending Orders we explain the different types of orders that will ensure your trades are automatically executed at your desired entry point.

The 6 types of pending orders available are:

- Buy Limit

- Sell Limit

- Buy Stop

- Sell Stop

- Buy Stop Limit

- Sell Stop Limit

Once you have done your due diligence through fundamental and technical charting analysis on an instrument and you have a roadmap of where you want to enter and exit a trade, it is time to open a new trade ticket on the platform and enter your data points, Order Type, Entry level, Stop Loss and Take Profit.

All these pending order options are available on the mobile trading app, the webtrader and the desktop application and can be selected when opening a new order trade ticket.

Accessing the pending orders:

Open a new order > by default the trade type is set to Market Execution which basically means the current market price > change the type to pending order > you now have the option to select your order type:

Source Screen Recording: Metatrader5 GT247 Webtrader

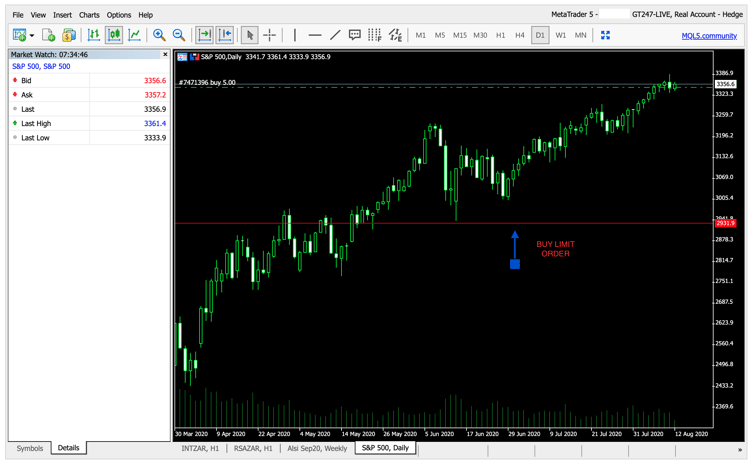

Buy Limit:

This is called a Limit order because you limit the price you are willing to enter into a trade.

When you use a buy limit order, you are expecting price to go in the opposite direction from the limit order price. Once price hits this level, a trade only gets executed if the price is below the buy limit price.

A Buy execution will only take place if the price goes below the Buy Limit Order price.

Chart: Buy Limit illustration MT5 WebTrader

Sell Limit:

On the sell side (short trade), it's the same idea… but turned upside down. Traders use this order to ensure they don't pay too much for a short trade.

The short trade will only get executed if the price is at the desired level or above.

Chart: Sell Limit illustration - MT5 WebTrader

Buy Stop:

Use a Buy Stop if you expect price to go higher and break through the buy stop level.

This type of entry is perfect for a trader who is looking for a break above a previous candle or breakout of an important resistance level.

When price hits the buy stop level, your order turns into a market order and is executed at the market.

In this example, a trader might be looking for the price to break the top of the range at 54586 So the trader would set a buy stop at that price.

Chart: Buy Stop illustration - MT5 WebTrader

Sell Stop:

Yip, you guessed it... A Sell Stop pending order is just the opposite to a Buy Stop.

You are expecting price to go lower and break below the sell stop level you set in order for the short trade to automatically execute.

In the below illustration we would want our short trade to automatically trigger if the price goes below 33851.

Chart: Buy Stop illustration - MT5 WebTrader

Buy Stop Limit:

A buy stop limit combines characteristics of the stop and limit orders. Stop Limit orders are the least used types of pending orders.

Basically, this is for traders who want all the of the benefits of a limit order, but also want to take advantage of price moving in the anticipated direction.

When the market price hits the Buy Stop Limit level, the order turns into a buy limit order. From there, the trade won't be executed unless price is at the Stop Limit level or below.

It's worth noting that there's the possibility that this order might not get executed if price gaps above the stop limit price. This can happen in fast moving markets.

So if you're trading in a fast moving market and absolutely need to get in, then consider using a Market Order or a Buy Stop order.

Sell Stop Limit:

A sell stop limit allows you to get in as price is moving down, but it won't allow the trade to be executed unless price is at or above the stop limit price.

Your trade might not executed if price gaps down quickly.

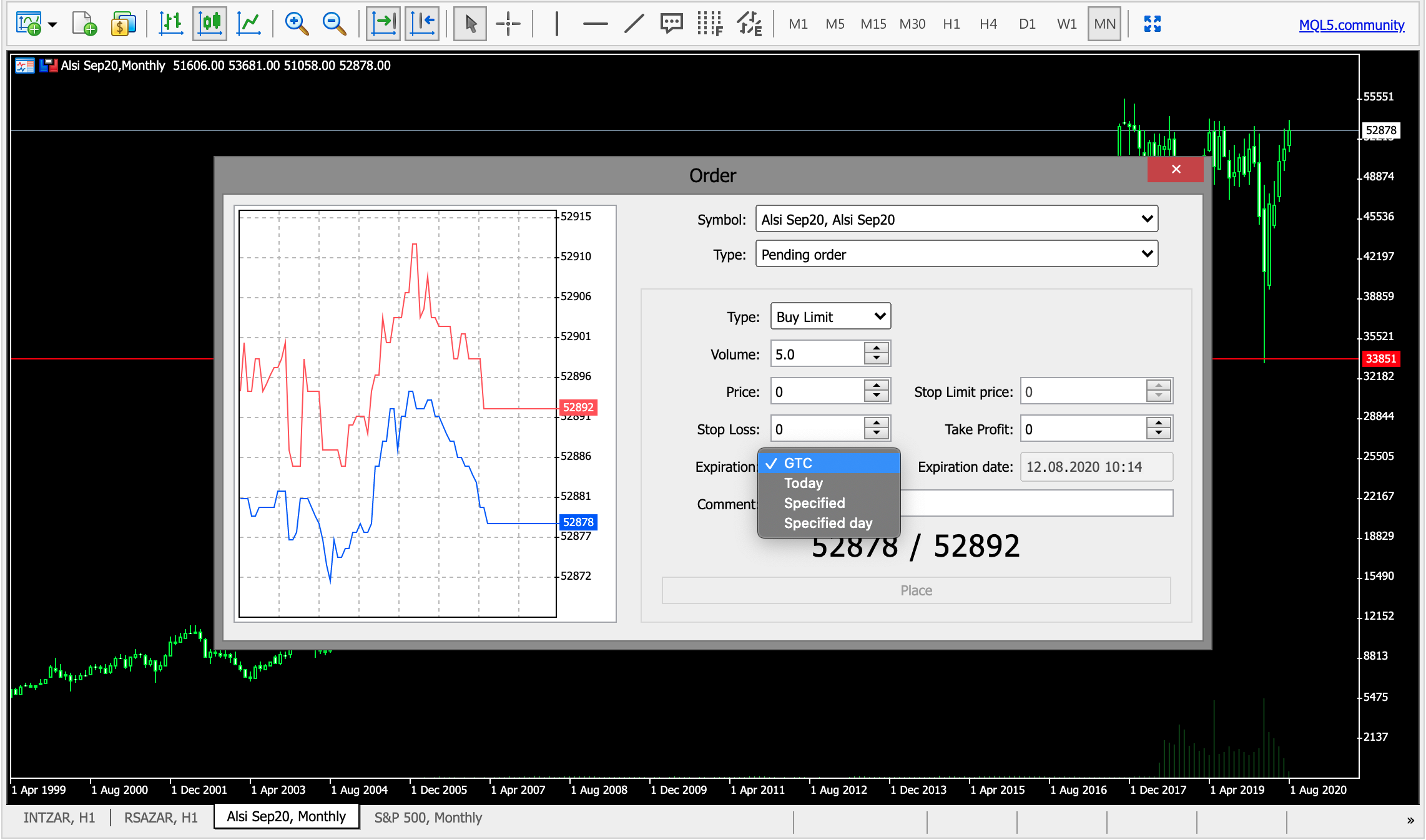

How to manage your orders:

You may find that you have stacked a few orders up, some executed and others didn't and probably don't stand a chance to ever execute again. You can cancel / delete these orders from within your platform.

You may want to set a date for the orders to auto expire. In this case you have a few options on the platform to auto manage your orders.

Once you have set up your pending order on your trade ticket, the duration of the order is by default on GTC (Good till cancelled) - this means that this order will stay as a pending order indefinitely until you decide to manually cancel the order.

Other options you have for auto managing your orders can be accessed via the Expiration dropdown menu:

- Today - order will be cancelled at market close.

- Specified - you choose the date and the time you want to expire the order.

- Specified Day - order will be cancelled at the close of a specified date you choose

Chart: Order Management - MT5 WebTrader

Conclusion

Pending Order functionality are used by meticulous and disciplined traders who have taken the time to apply proper technical analysis to an instrument. These orders allow you to plan your trade and trade your plan with confidence.

Too often, novice traders execute trades on a whim and close trades at a loss after the anxiety of not knowing how far the trade can go against them. Panic wins, trader loses.

Trade responsibility, apply sound risk management, and never ever trade more than you can afford to lose.

Jono Bruton | Brand at GT247.com

With more than 16 years of experience in the digital marketing realm, Jono works closely with the GT Trading Desk and market analysts to serve educational and market analysis content with our trading community. Unless the surf is cooking, you will find him on our social media channels and in your inbox .

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this note is provided by Jonathan Bruton, Brand at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.