The JSE closed weaker on Tuesday after coming under significant pressure following the opening of US equity markets this afternoon.

The local index was trading weaker right from the open this morning, however the losses were compounded after trading in the US opened. This was mainly as a result of comments made by US Federal Reserve President, Robert Kaplan, around inflation and potential interest rate hikes from the US Fed.

Locally, bonds traded softer as the Rand weakened against the greenback significantly. US 10-year Treasury yields reached a new four-year high of 3.0668% which supported the US dollar and negatively impacted emerging market currencies such as the Rand. The weakness in the Rand was exacerbated by a sector wide sell-off in emerging market currencies as a result of the slump in the Turkish Lira.

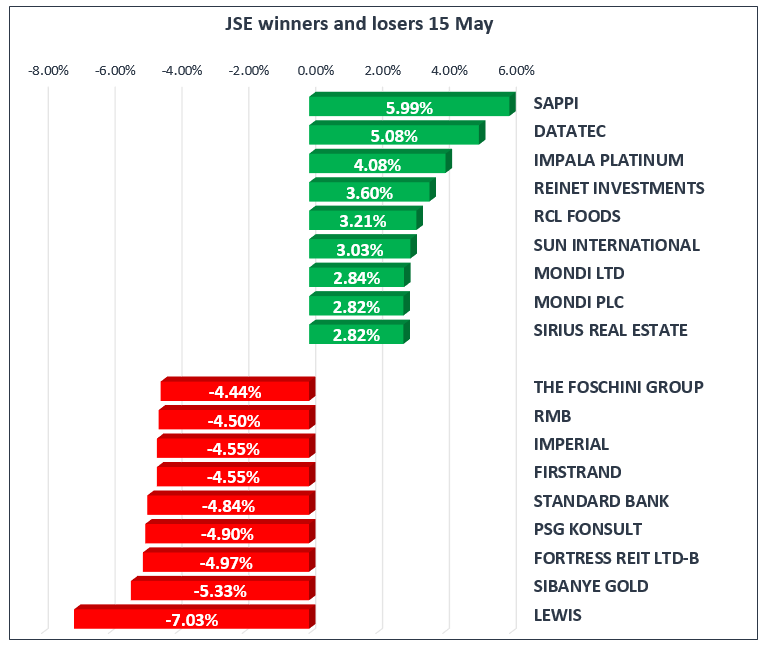

On the JSE, there were not too many positives to mention as the weaker Rand resulted in banks and retailers trading under pressure. Stocks such as First Rand [JSE:FSR], Standard Bank [JSE:SBK] and Nedbank [JSE:NED] lost 4.55%, 4.84% and 4.12% respectively, whilst Truworths [JSE:TRU] and Massmart [JSE:MSM] shed 4.03% and 2.9% respectively.

Naspers’ [JSE:NPN] Hang Seng listed associate, Tencent Holdings, closed 3.35% weaker in today’s trading session and as a result this put pressure on the JSE listed Naspers. The stock lost 3.94% to close at R3124.09 per share. Other stocks which came under significant pressure included Lewis [JSE:LEW], Fortress B [JSE:FFB] and Sibanye-Stillwater [JSE:SGL] which shed 7.03%, 4.97% and 5.33% respectively.

There were a couple of positives to note particularly from Sappi [JSE:SAP] which gained 5.99% and Sasol [JSE:SOL] which also recorded significant gains to end the day up 2.64% at R468.36 per share. Other Rand hedges such as Mondi Ltd [JSE:MND], British American Tobacco [JSE:BTI] and Richemont [JSE:CFR] gained 2.84%, 2.28% and 1.92% respectively. Significant gains were also recorded in Datatec [JSE:DTC] and Impala Platinum [JSE:IMP] which gained 5.08% and 4.08% respectively.

The blue-chip JSE All-Share Top-40 Index closed 1.28% weaker, whilst the broader JSE All-Share Index lost 1.23%. The Resources Index was the only major index to close in the green after it gained 1.72%, however the Industrials and Financials Indices lost 1.87% and 2.65% respectively.

The Rand weakened considerably against the US dollar as it peaked at a session low of R12.64/$. This was on the back of the US dollar which strengthened as depicted by the US dollar index which jumped back above 93 index points. The Rand was trading at R12.58/$ at 17.00 CAT.

Gold slid below $1300/Oz to reach a session low of $1291.99/Oz. It was trading weaker at 17.00 CAT as it was recorded at $1293.82/Oz, down 1.5% for the day. Palladium had shed 2.3% to trade at $972.25/Oz at 17.00 CAT, whilst Platinum was trading 1.37% weaker at $897.90/Oz.

Brent Crude traded relatively mixed as it peaked at $79.47/barrel before it retraced to trade at $78.59/barrel just after the JSE close.

Bitcoin traded less volatile compared to the previous session, it was trading softer on the day and at 17.00 CAT it was trading at $8525.20 per coin. A similar price action was also recorded in Ethereum which also traded softer on the day to be recorded at $717.89 per coin at 17.00 CAT.