US stocks were flat ahead of this evenings FED rate decision as the S&P futures traded at 3033 points. The market is beginning to question the feasibility of the outcomes of the US-China trade deal talks announced last week. The market anticipates a rate cut tonight which could be the last one for the year, the devil will be in the details of Fed Chair Powell’s speech this evening. What would be key to note is the central banks aggression or lack thereof to cut interest rates.

Asian markets traded softer on the day ahead of the US Fed Reserve interest rates decision later this evening. The ASX200 the Nikkei, the CSI 300 and the Hang Seng eased 0.83%, 0.57%, 0.49% and 0.44% respectively.

In todays MTBPS Minister Mboweni indicated that the government needs to continue its expenditure and increase revenues. THE MTBPS appears to not have satisfied the expectations of the market as the Rand softened and SA Inc shares came under pressure. It is very clear that if not addressed quickly the government will not be able to address this budget deficit. The Minister hinted that there could be restructuring of some of the SOE with a potential equity partner taking up a stake in South African Airways. Government has deployed funds to SARS and the NPA in a bid to bolster revenue collection and put breaks on corruption and tax evasion.

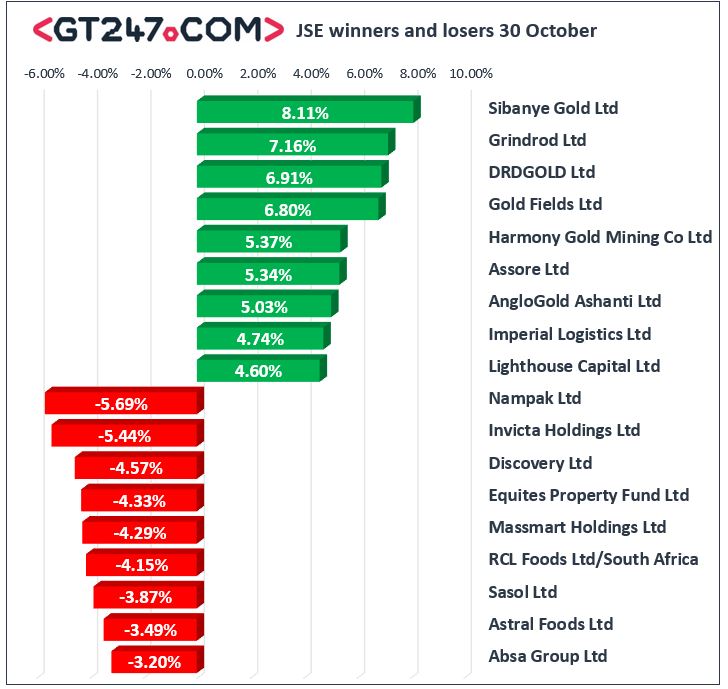

Gains were posted by gold shares today as Sibanye Gold Ltd [JSE: SGL], DRD Gold [JSE:DRD], Gold Fields Ltd, [JSE:HAR] Harmony Gold [JSE:HAR] and AngloGold Ashanti Ltd [JSE:ANG] which gained 8.11%, 6.91%, 6.8%, 5.37% and 5.03% respectively.

Losses were sustained by Nampak Ltd [JSE: NPK], Invicta Holdings Ltd [JSE: IVT] and Discovery Ltd which shed 5.69, 5.44% and 4.57% respectively. Most South African in shares were on the backfoot on Wednesday as the rand weakened.

The JSE All-Share index closed 0.29% firmer whilst the JSE Top-40 index gained 0.31%. The Financial index retreated 2.01% to close the day at 15835 points. The Industrial and Resource indices rallied adding 0.92% and 1.11% respectively.

The Rand continued its downward spiral on Wednesday as the Finance Minister Tito Mboweni announced the MTBPS in parliament today. Prior to the minister reading the MTBPS the local unit was trading at R14.65 against the greenback. The local unit posted an intra-session low of 14.94 during the MTBPS. At 17:00hr the Rand was trading at R14.90 to the dollar, R165.56 to the Euro and R19.20 to the Great British Pound.

Brent crude slipped on Wednesday as worries about a possible delay in resolving the US-China trade war. US crude inventories came in higher than market expectations this week recording a build of 5.7 million barrels. Gold was generally firmer on the day to trade at $1492 at the time of writing up $3 from Tuesday’s levels.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.