The JSE closed weaker on Monday as global markets were stuck in a whirlwind on the back of Donald Trump’s threats to slap more tariffs on Chinese goods into the USA.

In retaliation, on Friday China also threatened to impose further tariffs on about $US75 billion worth of goods sending jitters all over global markets. In a turn of events on Monday, Donald Trump seemed to change his stance on his Friday’s comments as he stated that prospects for a deal with China were more than likely to happen now compared to when talks began.

Asian markets never got a chance to recover as Donald Trump u-turned on his Friday comments after their closure. The Japanese Nikkei caught tumbled 2.17%, while the Hang Seng and Shanghai Composite Index lost 1.91% and 1.44%. In Europe, markets in the UK were closed for holiday but the other major indices stocks swung into gains as the better news on the trade war filtered. In the USA, all the major indices managed to open firmer on the day.

On the currency market, the rand had a volatile session as it fell to a session low of R15.44/$ before recovering to be recorded trading 0.04% firmer at R15.23/$ at 17.00 CAT.

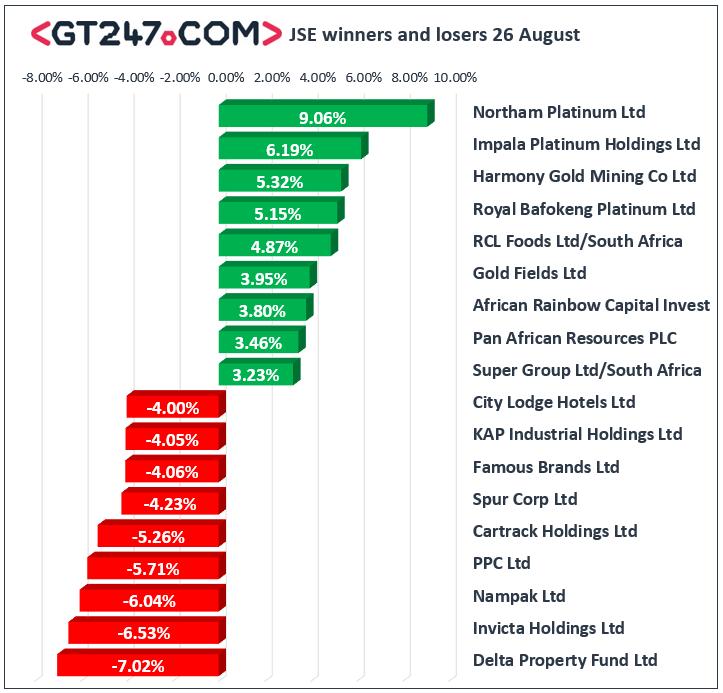

On the JSE, index heavyweight Naspers [JSE:NPN] came under pressure after its Hang Seng listed associate Tencent Holdings closed lower in today’s session. Naspers eventually closed 1.14% lower at R3380.00. Mining giant BHP Group [JSE:BHP] lost 0.64% to close at R313.55, while Kumba Iron Ore [JSE:KIO] shed 0.65% to end the day at R383.15. Nampak [JSE:NPK] closed amongst the day’s biggest losers after it fell 6.04% to close at R9.34, while cement maker PPC Limited [JSE:PPC] lost 5.71% to close at R4.13. Sasol [JSE:SOL] dropped 1.92% to end the day at R266.00 following an update on the ethane cracker unit in the Lake Charles Chemicals Project. Other significant losers on the day included Shoprite [JSE:SHP] which lost another 1.865 to close at R114.13, as well as Investec PLC [JSE:INP] which closed at R75.69 after losing 2.01%.

Gold miners on the JSE remain buoyant and in today’s session most of them advanced. DRD Gold [JSE:DRD] advanced 8.62% to R7.06, Harmony Gold [JSE:HAR] added 5.32% to close at R55.28, and Gold Fields [JSE:GFI] gained 3.95% to close at R92.90. Platinum miners also recorded gains which saw Northam Platinum [JSE:NHM] rally 9.06% to close at R64.50, while Impala Platinum [JSE:IMP] added 6.19% to close at R80.50. Retailer Mr Price [JSE:MRP] continued to claw back some of last week’s losses as it advanced 1.37% to close at R157.25, while Pick n Pay [JSE:PIK] climbed 1.36% to close at R55.90.

The JSE Top-40 index closed 0.42% weaker while the JSE All-Share index also shed 0.42%. The Resources index was the only index to record gains on the day as it added 0.28%. The Industrials and Financials indices dropped 0.69% and 0.35% respectively.

The Sino-USA trade war continues to impact negatively on sentiment surrounding brent crude. The commodity was recorded trading 0.54% weaker at $58.48/barrel just after the JSE close.

At 17.00 CAT, Platinum was flat at $857.30/Oz, Gold had gained 0.52% to trade at $1534.89/Oz, and Palladium was up 0.27% to trade at $1466.60/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.