The JSE advanced to close firmer on Wednesday after a lukewarm start to the session.

The local bourse seemed to shrug off the worse than expected South African GDP data which was released on Tuesday as it soldiered higher with other global markets. World indices rose on the back of speculation that the USA and China will reach a trade deal following reports over the past couple of sessions to the contrary. This trend of the markets reacting to trade headlines seems likely to persist well into the new year as both parties try to come to an agreement.

There was further disappointment in terms of local economic data as the Standard Bank PMI reading for November fell to 48.6 from a prior recording of 49.4, which was also worse than the forecasted 49.1. The rand took direction from a weakening US dollar which saw it advance to a session high of R14.53 before it was recorded trading 0.32% firmer at R14.58/$ at 17.00 CAT.

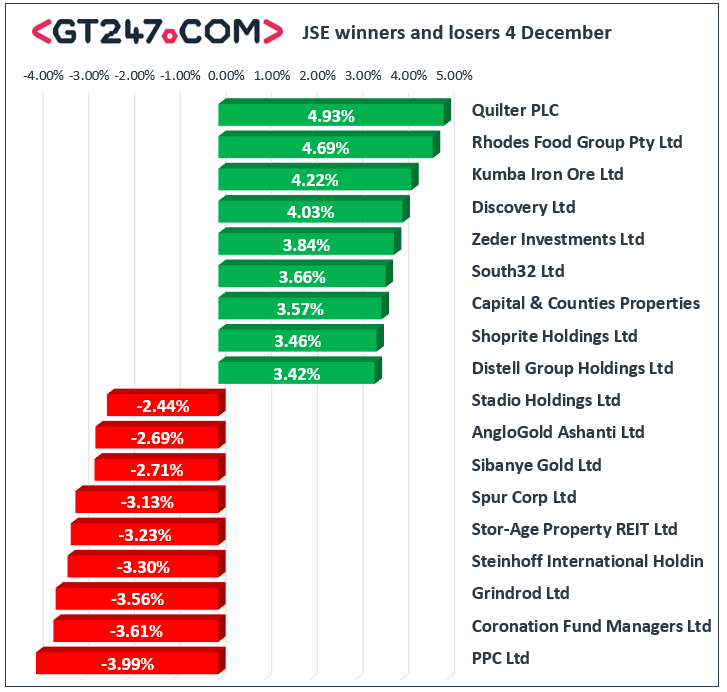

On the local market, Quilter [JSE:QLT] closed amongst the day’s biggest gainers as it advanced 4.93% to close at R28.50, while Old Mutual [JSE:OMU] gained 2.11% to close at R18.38. Food producer, Rhodes Food Group [JSE:RFG] surged 4.69% to close at R16.98, while Zeder Investments [JSE:ZED] climbed 3.84% to close at R4.87. Index heavyweight, Naspers [JSE:NPN] added 2.18% to close at R2065.00, while diversified mining giant Anglo American PLC [JSE:AGL] rose 1.61% to close at R389.66. Other significant gainers on the day included Shoprite Holdings [JSE:SHP] which gained 3.46% to close at R131.79, Sasol [JSE:SOL] which gained 2.94% to close at R263.99, and Bid Corporation [JSE:BID] which closed at R332.14 after gaining 1.81%.

Accelerate Property Fund [JSE:APF] plummeted 18.24% to close at R1.39 following the release of weaker half-year interim results. Cement maker, PPC Ltd [JSE:PPC] lost 3.99% as it close at R2.89, while Afrimat [JSE:AFT] shed 1.66% to close at R32.00. Coronation Fund Managers [JSE:CML] dropped 3.61% to close at R40.00, while Alexander Forbes [JSE:AFH] lost a more modest 0.77% to close at R5.13. Losses were also recorded for Sibanye Gold [JSE:SGL] which dropped 2.71% to close at R31.57, Hyprop Investments [JSE:HYP] which retreated 1.27% to close at R54.50, and Anglo American Platinum [JSE:AMS] which closed at R1285.00 after losing 1.09%.

The JSE All-Share index eventually closed 0.82% firmer while the JSE Top-40 index gained 1.06%. All the major indices advanced on the day with the Financials index taking the bulk of the gains as it rose 1.16%. The Industrials and Resources indices gained 0.9% and 0.75% respectively.

At 17.00 CAT, Gold was 0.12% softer at $1475.45/Oz, Platinum had shed 0.55% to trade at $904.95/Oz, and Palladium was up 0.43% to trade at $1864.00/Oz.

Brent crude was bolstered by the positive news on the trade war which saw the rise on the day before it was recorded trading 3.5% firmer at $62.95/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.