The JSE stumbled on Monday as it tracked other global markets lower which retreated on the back of weaker economic data.

Services and Manufacturing PMI numbers in the Eurozone came in much lower than widely forecasted which reignited worries of an economic slowdown in the region and the rest of the world. In Asian, Japanese markets were closed for a holiday however the Hang Seng and Shanghai Composite Index fell 0.81% and 1.14% respectively. US markets also opened softer on Monday following the release of a mixed set of economic data.

On the currency market, the rand weakened significantly against the greenback as it looked set to breach R15/$ after peaking at R14.96/$. At 17.00 CAT, it had rebounded marginally to trade 0.52% firmer at R14.84/$.

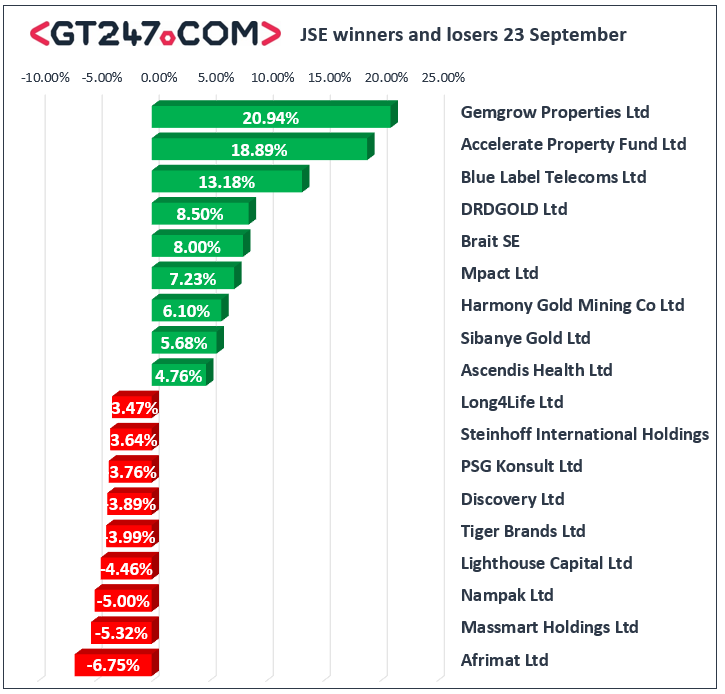

On the local bourse, the weaker rand saw rand sensitives trade mostly weaker on the day. Retailer, Massmart [JSE:MSM] tumbled 5.32% as it closed at R44.50, Pick n Pay [JSE:PIK] fell 2.84% to end the day at R61.20, while Woolworths [JSE:WHL] retreated by 2.61% close at R56.70. Nampak [JSE:NPK] closed amongst the day’s biggest losers after it lost 5% to close at R9.50, while Discovery Ltd [JSE”DSY] closed at R114.24 after losing 3.89%. Banker, ABSA Group [JSE:ABG] lost 0.86% to close at R161.60, while its sector peer Nedbank [JSE:NED] fell 1.67% to close at R232.95. Other significant losers on the day included Bid Corporation [JSE:BID] which lost 2.8% to close at R322.70, and Naspers [JSE:NPN] which fell 2.655 to close at R2385.03.

Miners recorded most of the gains in today’s session. Gold miner DRD Gold [JSE:DRD] advanced 8.5% to close at R7.53, Harmony Gold [JSE:HAR] surged 6.1% to R48.54, and Gold Fields [JSE:GFI] rose 4.39% to close at R78.01. Brait [JSE:BAT] rallied on the back of the release of a shareholder update in which the company highlighted its intention to reduce its net operating costs. The stock ended the day 8% higher at R17.15. Platinum miner, Northam Platinum [JSE:NHM] gained 4.11% as it closed at R83.28, while Impala Platinum [JSE:IMP] added 1.81% to close at R95.25. Other significant gainers on the day included RCL Foods [JSE:RCL] which gained 4.62% to close at R9.73, and Bidvest [JSE:BVT] which added a more modest 0.98% to close at R193.05.

The JSE Top-40 index eventually closed 1.55% lower while the JSE All-Share index lost 1.48%. The Industrials index took the biggest knock of the day amongst the major indices as it lost 2.01%. The Financials and Resources indices lost 1.34% and 0.9% respectively.

Brent crude continues to be volatile as traders look for clues on output resumption from Saudi Arabia. The commodity was trading 0.08% firmer at 64.32/barrel just after the JSE close.

At 17.00 CAT, Platinum was up 1.55% at $961.10/Oz, Palladium had surged 1.19% to trade at $1662.10/Oz, and Gold was 0.63% firmer at $1526.40/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.