The JSE surged on Wednesday as global markets rebounded on the back of good corporate earnings releases from US and European stocks.

Earnings from US tech giant Apple beat analyst estimates by a significant margin and as a result spurred the Dow Jones and S&P 500 to close firmer on Tuesday. Positive earnings from stocks such as McDonald’s and General Electric have also seen improved global sentiment. In Asia, the Hang Seng resumed trading and took a knock eventually closing 2.82% weaker, while in Japan the Nikkei advanced 0.71%. Chinese equity markets remain closed. Gains were relatively modest in Europe while US equities opened firmer.

Market participants await the Fed’s interest rate decision which is expected on Wednesday at 21.00 CAT. The Fed is forecasted to keep rates unchanged at 1.75% however more focus will be on the bank’s plans to inject further liquidity into the financial markets through asset purchases. The Fed has already embarked on extensive liquidity injections into the financial system through the repo market as liquidity in financial institutions has dried up.

The rand recovered overnight from its slump and today it was trading in a narrower range. The local unit barely traded firmer against the greenback as it peaked at a session high of R14.52/$ before it was recorded trading 0.45% weaker at R14.61/$ at 17.00 CAT.

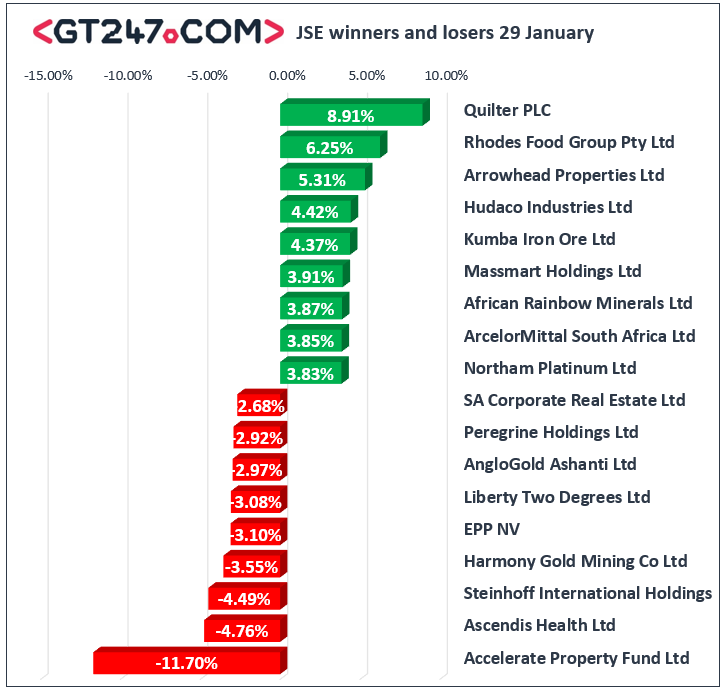

On the JSE, Quilter [JSE:QLT] advanced 8.91% to close at R32.75 following the release of its 4th quarter trading update which highlighted decent increases in assets under management and sales. Rhodes Food Group [JSE:RFG] also recorded decent gains on the day as it rallied 6.25% to close at R17.00. Kumba Iron Ore [JSE:KIO] climbed 4.37% to close at R373.92, while African Rainbow Minerals [JSE:ARI] added 3.87% to close at R169.64. Platinum miners advanced on the day which saw gains being recorded for Northam Platinum [JSE:NHM] which advanced 3.83% to close at R120.94, while Anglo American Platinum [JSE:AMS] rose 2.84% to close at R1177.00. Index heavyweight Naspers [JSE:NPN] surged 3.16% to close at R2451.76, while Vodacom Group [JSE:VOD] closed at R119.36 after gaining 1.58%.

Accelerate property Fund [JSE:APF] came under considerable pressure eventually closing 11.7% lower at R1.51. Harmony Gold JSE:HAR] struggled despite firmer gold metal prices as the stock fell 3.55% to close at R47.48, while Gold Fields [JSE:GFI] dropped 1.58% to close at R88.91. EOH Holdings [JSE:EOH] slipped 1.78% to close at R8.85, while Pioneer Foods Group [JSE:PFG] lost 1.54% to close at R109.00. Losses were also recorded for Hammerson PLC [JSE:HMN] which lost 1.23% to close at R48.30, and Shoprite [JSE:SHP] which closed at R117.18 after losing 0.69%.

The blue-chip JSE Top-40 index eventually closed 1.09% higher while the JSE All-Share index gained 1.12%. All the major indices closed in the green. Resources gained 0.54%, Financials added 1.03% while the Industrials index gained 1.48%.

At 17.00 CAT, Gold was up 0.4% at $1572.20/Oz, Platinum was only 0.01% softer at $985.50/Oz, while Palladium was down 0.85% at $2269.77/Oz.

Brent crude was trading 0.19% softer at $58.70/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.