The JSE managed to close higher on Friday after trading higher for most of the day, in line with positive world markets. The rand fell sharply in response to dollar strength, slipping 1.33% to R13.66 against the greenback at the close of the JSE.

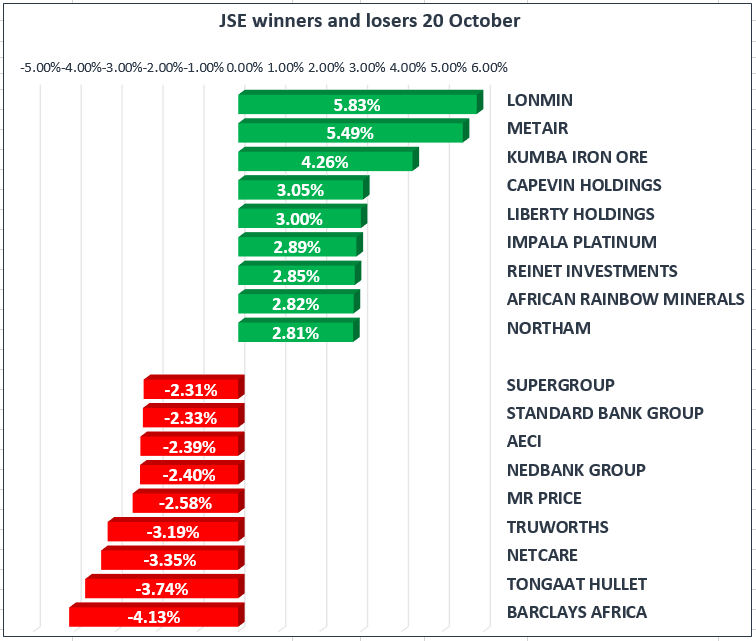

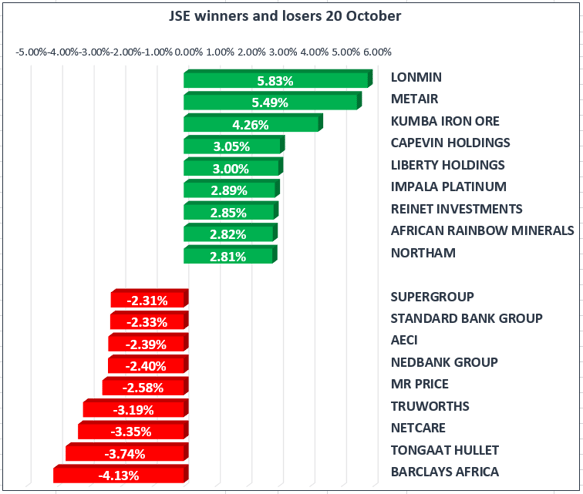

Banks and retailers were under pressure, partly affected by a weaker rand, with Barclays Africa [JSE:BGA] -4.13% to R144.59, Nedbank [JSE:NED] -2.40% to R219.42, FirstRand [JSE:FSR] -2.15% to R53.19 and Capitec [JSE:CAP] -0.97% to R921

The All Share index edged higher by 0.09% while the blue-chip Top 40 gained 0.15% largely supported by dual listed shares benefitting from the weaker rand, led by Naspers which climbed 1.29% to R3301.12 per share.

The local market awaits the medium-term budget policy statement next week, with investors cautious over the prospects of loose fiscal spending.

Gold prices eased to $1280/Oz as global stock markets continue to push after reaching record highs on Wednesday, after a flurry of underwhelming earnings reports in the US. Demand for safe-haven assets has eased as equity markets have soared.

U.S. stocks traded higher on Friday after the Republicans took a step toward achieving tax reform.

The Dow Jones industrial average rose 100 points, reaching an intraday record. UnitedHealth and Boeing both rose more than 1.3 percent to lead advancers. Shares of JPMorgan Chase, meanwhile, hit an all-time high after also jumping 1 percent.

The S&P 500 also notched an intraday all-time high, advancing 0.32 percent as financials led advancers.

The Senate approved a $4 trillion budget measure Thursday by a 51-49 vote. Passing a budget unlocks reconciliation, which enables the GOP to pass a tax bill with a simple 51-vote majority in the Senate. Using the tool removes the need for winning Democratic support, which would likely sink a GOP tax measure.

Rising expectations of lower corporate taxes have helped stocks rise to record highs recently, along with strong corporate earnings and solid economic data. The Dow first crossed above 23,000 earlier this week.