With central banks following the U.S Federal Reserve dovish outlook on Global economic growth concerns, the U.S Dollar has been taking strain since the FED’s last meeting. The greenback posted its worst weekly decline in four months and we might see more downside to come.

To add to the frustration, market participants will be waiting on the Group of 20 (G20) summit to see what transpires between U.S President Trump and China’s President Xi Jinping.

Taking a closer look at the DXY

The Dollar Index (DXY) is finding support at the March lows which coincides with the 95.82 level acting as support. The price action has broken out of the uptrend (green dotted line) and might continue to tick lower as economic uncertainty remain.

Source - Bloomberg

Source - Bloomberg

Let’s take a closer look at two major currency pairs:

EURUSD

ECB President Mario Draghi also stated last week that Quantitative Easing is on the table if growth in the Eurozone continue to falter. We saw the Euro lose momentum as the market started to digest the information. The Euro has since then benefited greatly from the depreciating Dollar (USD) which has seen the currency pair gain momentum to the upside.

Some technical analysis points to look out for on the EURUSD:

- The price action on the EURUSD is currently finding resistance at the 1.1422 level as some Dollar strength filters through to the market.

- Support at the pivot (green line) will be watched closely as support before the currency pair pushed higher once more.

- The Relative Strength Index (RSI) is closing in on overbought territory at this time but might just move higher from current level.

Source - Bloomberg

Source - Bloomberg

GBPUSD

The Cable has seen its fair share of ups and downs over the last couple of months as Brexit or a lack of a Brexit has weighed on the British Pound (GBP). Sterling has also benefited from a weaker U.S Dollar as it has reached highs last seen a month ago and gaining momentum.

Prime Minister candidate Boris Johnson appeared on the BBC and continues to hold firm on his October 31st deadline for a Brexit. He also said “it’s not just up to us” signalling that he would need the EU’s co-operation in this regard to avoid a hard-Irish border.

Some technical analysis points to look out for on the GBPUSD:

- The GBPUSD has been forming a megaphone or broadening Technical Pattern and will be watched closely for a breakout above 1.2773

- If the 1.2773 resistance level holds then we might expect the price to move lower once more with a pivot (purple line) coming into focus which might give some support.

Source - Bloomberg

Source - Bloomberg

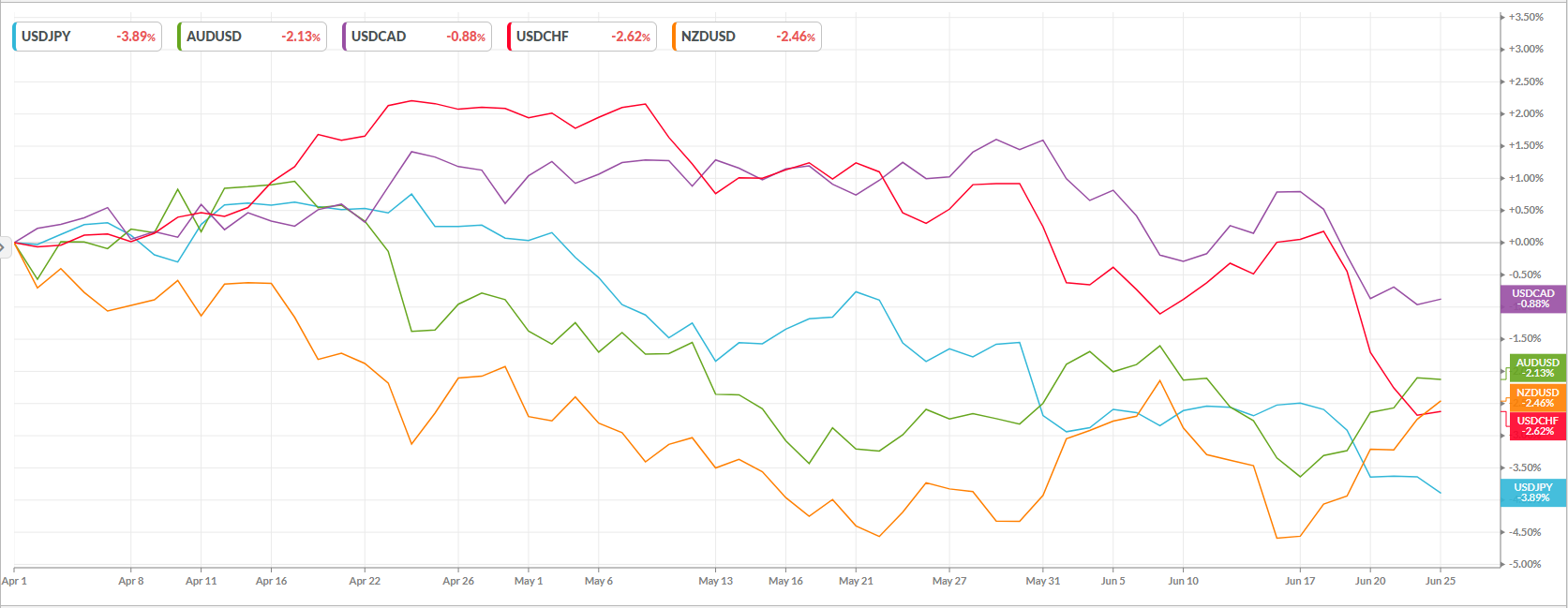

What the rest of the Majors have been up to over the last quarter:

Source - KOYFIN

Source - KOYFIN

Outlook on an emerging market currency pair:

USDZAR

Like most emerging market currencies, the Rand (ZAR) has benefited greatly from the weakness we have seen on the U.S Dollar (USD). There is still a lot of work to be done to get the economy back on track as failing SOE’s remain firmly in the spotlight.

Some technical analysis points to look out for on the USDZAR:

- The USDZAR currency pair has finally broken out of the ascending channel (green lines) and is expected to move lower in the short term.

- We might expect the currency pair to move lower with a first target price of R14.13 which acts as a support level.

Source - Bloomberg

Source - Bloomberg

Economic event to look out for today while trading Forex:

- FOMC member Williams speaks at 14:45 SAST.

- US New Home Sales at 16:00 SAST.

- US FED Chair Powell speaks at 19:00 SAST.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.