The JSE inched higher on Wednesday as it tracked other global indices higher which were inspired by the developments in Hong Kong.

Stocks rebounded after Hong Kong’s leader announced that she had formally withdrawn legislation which allows for extraditions to China, which has been the main cause of unrest over the past couple of months. Stocks on the Hang Seng surged 3.9% on Wednesday, while in mainland China the Shanghai Composite Index gained 0.84%. In Tokyo, the Nikkei only managed to add 0.12%. Equities in Europe and the USA also tracked mostly higher on the day.

The rand had a stellar day as it broke below R15/$ to peak at a session high of R14.81/$. The move in the rand is mainly attributable to the better than expected GDP numbers that were released on Tuesday as well as stronger demand for emerging market currencies. At 17.00 CAT, the rand was trading 1.84% firmer at R14.81/$.

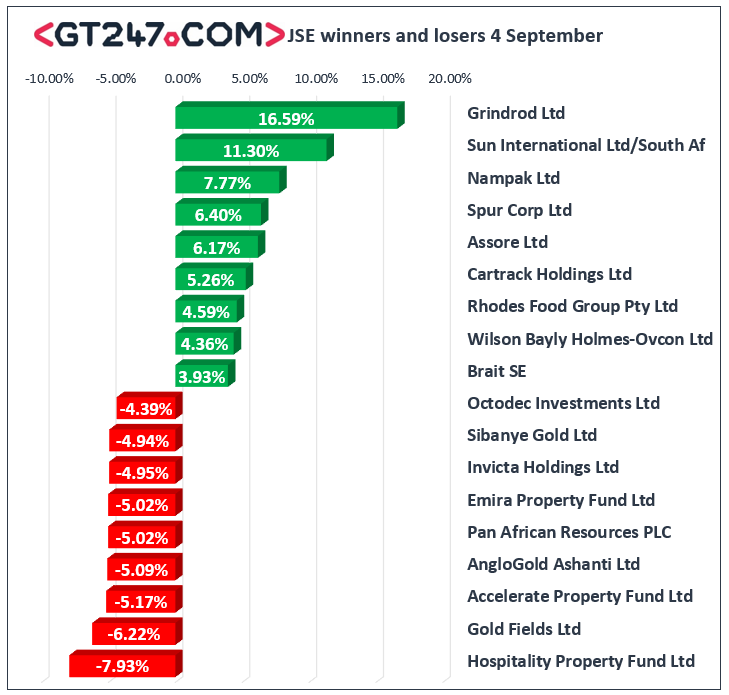

Some rand sensitives rose on the local bourse primarily on the back of the firmer rand. Retailer, Massmart [JSE:MSM] managed to gain 1.23% to close at R43.53, while Pick n Pay [JSE:PIK] added 1.26% to close at R58.67. Sun International [JSE:SUI] closed amongst the day’s biggest gainers after it rallied 11.3% to close at R45.20, while Grindrod [JSE:GND] also recorded significant gains of 16.59% to close at R4.78. Index heavyweight Naspers [JSE:NPN] surged 2.69% to close at R3594.00 after Tencent rose on the Hang Seng. Diversified mining giant Anglo American PLC [JSE:AGL] climbed 1.17% to end the day at R327.29. Other significant movers on the day included Old Mutual Ltd [JSE:OMU] which added 1.55% to close at R17.70, as well as Hammerson PLC [JSE:HMN] which closed at R42.05 after gaining 1.62%.

Gold miners led the losses on the day as rand-denominated commodity prices fell. Gold Fields [JSE:GFI] fell 6.22% to close at R84.50, AngloGold Ashanti [JSE:ANG] lost 5.09% to close at R334.91, and Harmony Gold [JSE:HAR] closed at R53.95 after dropping 2.09%. BHP Group [JSE:BHP] lost 2.62% to close at R313.50, while Sibanye Stillwater [JSE:SGL] weakened by 4.94% to close at R19.44. Other significant losers on the day included Aspen Pharmacare [JSE:APN] which lost 3.17% to close at R79.80, and Shoprite [JSE:SHP] which closed at R111.77 after falling 1.95%.

The blue-chip JSE Top-40 index eventually closed 0.32% firmer while the JSE All-Share index managed to add 0.24%. Resources came under significant pressure to close 1.46% lower, however the Industrials and Financials indices managed to gain 1.2% and 1.1% respectively.

Brent crude surged following positive economic data from China which is one of the world’s biggest oil consumers. The commodity was trading 3.45% higher at $60.27/barrel just after the JSE close.

At 17.00 CAT, Gold was 0.05% weaker at $1546.89/Oz, Palladium was up 0.87% at $1557.30/Oz, and Platinum had surged 2.32% to trade at $981.00/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.