The JSE advanced on Thursday along with other global stocks as investors were optimistic on the back of the European Central Bank’s rate decision.

Focus was primarily on the ECB which cut the deposit rate by 10 basis points to -0.50% and announced a restart to its quantitative easing program from 1 November, with net purchases of 20 billion euros per month.

The USA and China are taking steps to ease trade tensions between the two sides ahead of their scheduled meetings in the coming weeks, with both sides announcing delays and exclusions in some of the tariffs which are due to kick in soon. This positive sentiment saw markets in Asia close mostly firmer while in the USA the major indices opened marginally higher.

On the currency market, the euro against the greenback advanced following the ECB’s press conference. This saw the rand also gain against the US dollar to a session high of R14.55/$. At 17.00 CAT, the rand was trading 0.46% firmer at R14.60/$.

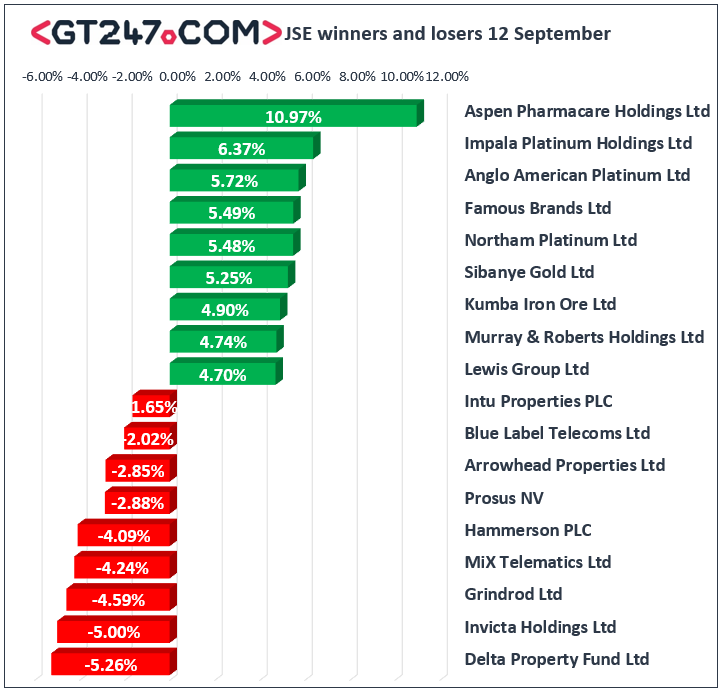

Aspen Pharmacare [JSE:APN] surged on the back of its full-year results which were released after the close on Wednesday. The company scrapped its full-year dividend in order to contain its debt levels. The stock rallied 10.97% to close at R94.25. Platinum miners had a good outing with stocks such as Impala Platinum [JSE:IMP] surging 6.37% to close at R5.39, Anglo American Platinum [JSE:AMS] gained 5.72% to close at R897.05, and Northam Platinum [JSE:NHM] closed at R77.00 after adding 5.48%. Barloworld [JSE:BAW] managed to post gains of 3.81% to close at R118.76, while Murray and Roberts [JSE:MUR] climbed 4.74% to close at R13.70. Naspers [JSE:NPN] extended its gains as it climbed 2.23% to close at R2519.98.

Commodity trading giant, Glencore [JSE:GLN] struggled in today’s session as it fell 1.47% to end the day at R45.47, while diversified miner South32 [JSE:S32] dropped 0.615 to R27.52. Luxury goods retailer, Richemont [JSE:CFR] weakened by 1.31% as it closed at R118.10, while oil and gas producer Sasol [JSE:SOL] shed 0.69% to end the day at R278.70. Other significant losers on the included Telkom [JSE:TKG] which lost 1.48% to close at R75.86, MTN Group [JSE:MTN] which shed 0.62% to R99.20, and Hammerson [JSE:HMN] which closed at R46.88 after falling 4.09%.

The JSE Top-40 index eventually closed 0.81% higher while the broader JSE All-Share index gained 1.1%. All the major indices advanced on the day led by the Financials index which rallied 2.04%. The Industrials and Resources indices gained 0.79% and 0.61% respectively.

Brent crude tumbled as data showed that the USA was producing more oil than some of OPEC’s biggest members. The commodity was trading 2.48% lower at $59.30/barrel.

At 17.00 CAT, Palladium was up 2.54% to trade at $1614.35/Oz, Platinum was up 0.98% to trade at $954.55/Oz, and Gold had gained 0.94% to trade at $1510.88/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.