The EUR/USD trade has just missed the take profit by 5 points, Harry Hindsight suggests that I should have started to take some profits once the EUR fell below 1.1720 – alas whilst the move was pre-empted the bulls picked up the Euro before we could take our profits off the table.

The reason why the Euro was able to rebound has been attributed to strong German CPI data, indicating that inflation is returning to the Eurozone, this will boost confidence for the ECB to reduce their balance sheet and raise interest rates.

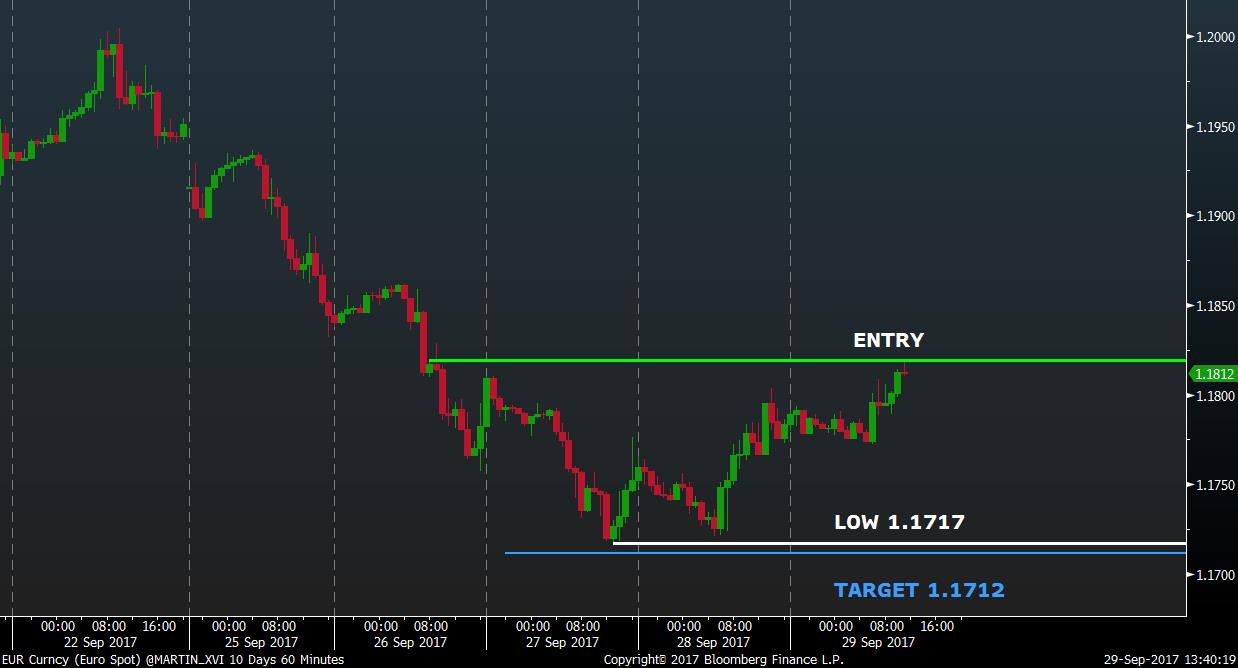

While the trade is still ‘in the money’ at 1.1812

- Traders may want to bring in their stop loss levels to 1.1835 to mitigate losses.

Initial Trade Note...

Source: Bloomberg

EUR/USD

Potential short trade is setting up

The Euro has come under added pressure this week after ECB Draghi caught the market off guard on Monday, saying the Euro recovery needed to translate into stronger inflation, while substantial accommodation was still needed. The comments come in the aftermath of a less than impressive weekend election result for Germany’s Merkel and rising political unrest in Europe as reflected in Spain.

Taking a look at the daily chart on the Euro we can see that a potential Head & Shoulders pattern has formed. The currency pair has been under pressure over the last few sessions since topping out at year high just shy of 1.210.

Pullbacks have however been well supported, and we have been watching to see where the market settles relative to the 50-day moving average. A close below would be the first close below the moving average since April and could open the door for a deeper corrective decline to 1.1590, but if the market holds out above the 50-day, the pressure remains on the topside and the uptrend remains intact.

Read full note for trade summary of entries and stop losses.

TRADE SUMMARY

- Short (sell) enter: 1.1820

- Stop Loss: 1.1857

- Take Profit: 1.1712

- Take Profit (Extended)*: 1.1590

*the extended take profit shows the full potential profit that could be reached should the H&S pattern play out in textbook fashion. We recommend that traders take +80% of their profit at the first target.

If the trade reaches the first target, bring your stop losses in tighter so as not to lose out on the banked profit.

Happy Trading

Martin Harris

Twitter: @martin_xvi

GT247.com: +27 87 940 6101

IT support & help desk: +27 87 940 6107

Client relations (new accounts): +27 87 940 6106

Sales: +27 87 940 6108

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

%20@MARTIN_X%202017-09-29%2013-40-17%20(002).jpg?width=583&height=314&name=EUR%20Curncy%20(Euro%20Spot)%20@MARTIN_X%202017-09-29%2013-40-17%20(002).jpg)