Global markets including the JSE rallied on Tuesday mainly on the back of comments from the ECB’s president Mario Draghi, as well as comments from Trump on China ahead of the upcoming G20 summit.

The European Central Bank’s president sparked stocks after commenting that the ECB would ease its policy again if inflation fails to accelerate to its desired level. This was a sharp turnaround from the current bank’s stance which has seen it in what most would call a policy tightening cycle. With markets participants already pricing in a higher probability of a US Fed interest rate cut on Wednesday, this could be the catalyst for another surge in global stocks.

Donald Trump further fueled the optimism after making comments via social media that he would be meeting with the Chinese president at the G20 summit which is scheduled to take place in Japan between the 28th & 29th of June. This is of significant importance given the escalation of trade tensions between China and the USA since May, and more recently the threats made by Trump last week to increase tariffs should the Chinese leader refuse to meet him.

The higher probability of a rate cut being priced in by the market saw the greenback lose ground against a basket of major currencies including emerging market currencies such as the rand. The local currency surged by more than 1.8% against the US dollar as it peaked at a session high of R14.50/$. At 17.00 CAT, the rand was trading 1.9% firmer at R14.50/$.

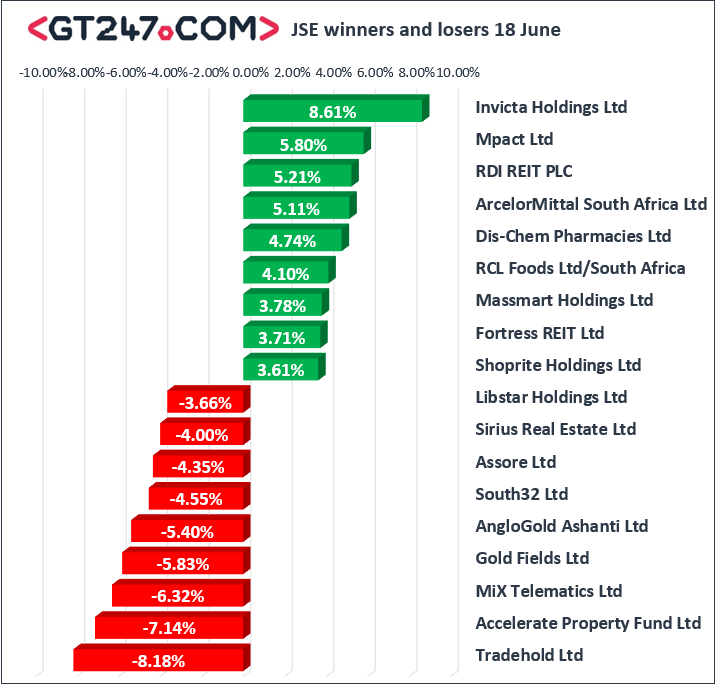

On the JSE, gains were led by financials which rose on the back of the firmer rand. Banks such as Nedbank [JSE:NED] gained 3.02% to close at R261.12, ABSA Group [JSE:ABG] added 1.48% to close at R174.53, while Standard Bank [JSE:SBK] rose 2.26% to end the day at R200.35. Retailers also found some traction on the day which saw Shoprite [JSE:SHP] climb 3.61% to close at R171.87, while Massmart [JSE:MSM] gained 3.78% to close at R65.38. Other significant gains on the day were recorded for Dis-Chem Pharmacies [JSE:DCP] which gained 4.74% to close at R25.84, Brait [JSE:BAT] which added 2.89% to close at R18.15, as well as Discovery Limited [JSE:DSY] which closed at R152.19 after gaining 2.07%.

Miners struggled on the day with gold miners in particular trading under significant pressure after the precious metal traded mostly flat on the day. Gold Fields [JSE:GFI] fell 5.83% to close at R73.45, AngloGold Ashanti [JSE:ANG] dropped 5.4% to close at R224.86, and Harmony Gold [JSE:HAR] lost 2.95% to close at R28.25. Rand hedge British American Tobacco [JSE:BTI] retreated to close 2.9% weaker at R523.71, while Sappi Ltd [JSE:SAP] lost 2.79% to close at R56.43. Aspen Pharmacare [JSE:APN] closed 3.31% lower at R97.67, while Mediclinic [JSE:MEI] closed at R54.95 after losing 2.05%.

The JSE All-Share index eventually closed 0.78% firmer while the JSE Top-40 index added 0.85%. The Resources index was the only major index which closed softer as it weakened by 0.35%. The Industrials and Financials indices gained 1.07% and 1.47% respectively.

At 17.00 CAT, Gold was up 0.43% to trade at $1345.46/Oz, Platinum was 0.64% firmer at $800.35/Oz, and Palladium had gained 2.14% to trade at $1489.95/Oz.

Brent crude surged after news emerged that Saudi Arabia is increasing pressure on other OPEC members to extend supply cuts. The commodity was trading 2.74% firmer at $62.63/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.