Bitcoin has been thrusted back into the spotlight and its resurgence in value have gripped the imagination of its followers trying to make sense of it all. Bitcoin has been gaining momentum and has broken through some of the major psychological price levels.

Bitcoin

The most likely reason we have seen the new uptake in Bitcoin is because there is a supply shock expected next year. The cost of mining seems to be taking its toll as the mining reward (Bitcoin) have decreases by half over the years which would lead to a shortage of the Cryptocurrency expected to come through by 2020.

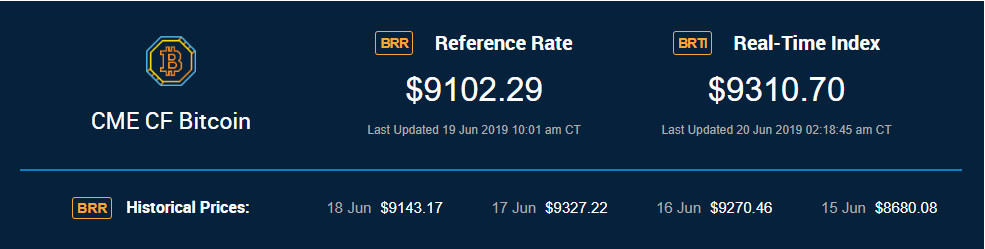

Technical Analysis outlook – Bitcoin is currently up 150% YTD and is pushing higher to a major psychological level, the $10000 per coin level which is currently a major resistance level. The price action needs to breach this level for any hopes to remain alive for Bitcoin to push higher back to its former glory days.

Adoption – although reports state that adoption of Cryptocurrency as a form of payment has been very slow, investment prospect seems to be picking up once more.

Besides the regulatory hurdles cryptocurrencies still face, Bitcoin has now met its match with Facebook announcing they are also moving into this space with Libra. The major difference is that Libra will be a stable coin, a digital version of the Dollar, Yen or Pound of sorts. It will be backed by major corporations and will be used to purchase goods and services on Facebook. So, the question remains, is Facebook’s Libra a Cryptocurrency?

The Bitcoin Chart

Technical Analysis on Bitcoin:

- The price action is closing in on the $10000/ BTC mark fast but will encounter some resistance at the 9894-price level.

- The move higher is supported by the Golden Cross formation that played out as mentioned in our previous Cryptocurrency note.

- Take note that the Relative Strength Index (RSI) is heading to overbought levels once more and will be watched closely.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by Barry Dumas, Market Analyst at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.