The local bourse continued to struggle to find direction in early trade on Tuesday after US markets closed the day weaker on Monday evening, heightened by concerns of a FED rate hike this week. President Trump’s rhetoric remains a significant catalyst in the swings we have seen on international markets as nations brace for an impending “trade war” with the US. Data breaches at Facebook [NYSE:FB], saw the social media giant shedding 7% on the day.

The local unit was steady on, despite better than expected inflation numbers that were released by Stats SA earlier in the day. The year on year inflation rate came in at 4% for the month of February, beating market expectations as the market anticipated inflation to increase by 4.2% in the reviewed period. The strong inflation numbers could create a state of quagmire for the MPC as the SARB would be inclined to cut interest rates in an environment where other economies are entering a rate hiking cycle. The SARB will be left with very few options, if inflation declines towards the floor of the SARB inflation band of 3%. A rate cut could see a flight of capital from South African shores as international investors seek higher yields. The rand was trading at R11.94 to the USD at the time of writing having traded at an intra-day low of R12.03.

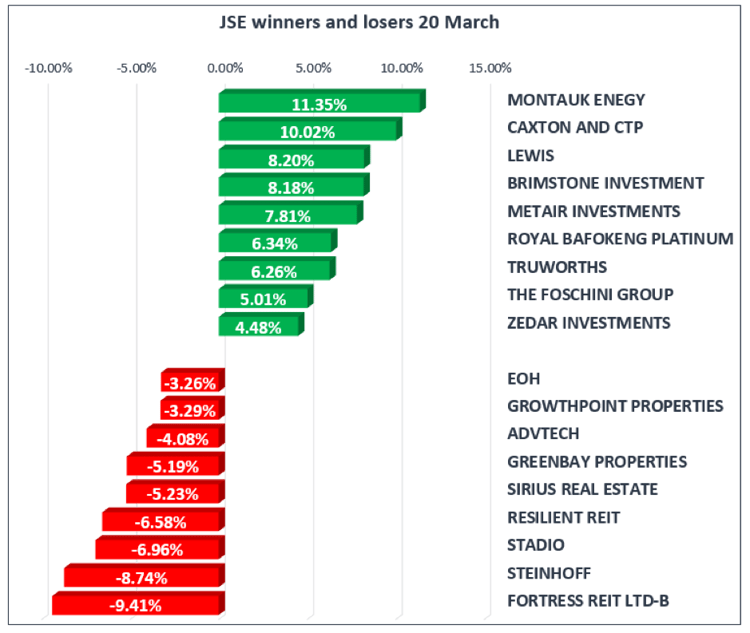

Truworths [JSE:TRU], MR Price [JSE:MRP] and The Foschini Group [JSE:TFG] , lead the pack on the JSE Top-40 notching up gains of 6.26%, 5.01% and 4.1% respectively. Embattled Tigerbrands, [JSE:TBS] closed the day up 4.23% recording its first positive close since the outbreak of listeriosis in their Polokwane factory.

Steinhoff international [JSE:SNH] remains under pressure as rumours around the liquidity of the business intensify. The former global retail giant has had a fire sale with assets flying out of the window in a bid to shore up the balance sheet. The retailer exited the Top 40 index this weak and has not been finding it easy in its new surrounds. The retailer closed the day down 8.74% to trade at 355c a share. The local listed REITS dominated the losers today with Fortress [JSE:FFB] closed the day down 9.41%, whilst Resilient [JSE:RES], Sirius [JSE:SRE] and Growth point shed 6.58%, 5.23% 3.29% respectively.

The JSE ALL-Share Index closed the day firmer at 58288 points, whilst the JSE Top- 40 index closed the day up 180 points to trade at 51615 on the day. The resource index failed to recover losing 0.13%, whilst the Industrial Index closed up 0.75 however the Financial index chalked up a loss of 0.11%.

Brent crude advanced on Tuesday as geopolitical tensions in the middle east sent panics in the market with the commodity soaring to its highest level since late February. Speculation of further output cuts from Venezuela sent more jitters in the markets which saw a barrel of crude changing hands at $67. Saudi Arabia described the Iran deal as a “flawed deal” ahead of the Crown Prince’s meeting with Donald Trump on Tuesday.

Gold was weaker on the day, as the yellow metal slid to $1309/Oz as at 17:00 CAT. The market will have a keen eye on the developments in the middle east and tomorrow evenings FED interest rate announcement.

Platinum continued to trade softer today, as pressure on metal prices intensified towards the close of the South African market. At the time of writing, Platinum was trading at $942.8/ ounce, whilst Palladium faced a similar fate today, easing lower to trade at $982/ ounce.