Global stocks retreated on Thursday as concerns arose that China and the USA might not reach a deal on their trade spat soon.

These sentiments were triggered because of the recent deal signed between Mexico and the USA, as well as the possibility of a deal between the US and Canada increasing. In Asia, the Hang Seng and the Shanghai Composite Index lost 0.89% and 1.05% respectively, while the Nikkei closed flat.

The rand retreated along with other emerging market currencies and particularly the Turkish lira. The lira has declined this week following a credit downgrade by Moody’s of at least 20 Turkish financial institutions. The rand slumped to a session low of R14.70 against the US dollar before retracing to trade at R14.67/$ at R17.00 CAT.

The JSE opened on the back-foot and continued to trade weaker for the entirety of today’s trading session. The biggest mover of the day was MTN Group [JSE:MTN] which slumped 19.41% to close at R86.50 per share. This was following the news that the Nigerian central bank had ordered four major banks including Standard Bank South Africa, to return $US8.1 billion which the bank says was illegally expatriated by MTN over 8 years through to 2015.

Standard Bank [JSE:SBK] also traded under pressure as the share retreated to a session low of R181.53 before retracing to close 2.39% weaker at R185.00 per share. Other financials stocks also pulled back mainly because of the weaker rand which saw Capitec Holdings [JSE:CPI] shed 1.36% to close at R996.22, while ABSA Group [JSE:ABG] fell by 0.74% to close at R163.50 per share. Retailer, Massmart [JSE:MTN] weakened to R110.82 per share after dropping 4.44%, and index heavyweight, Naspers [JSE:NPN] lost 6.42% to close at R3350.00 per share.

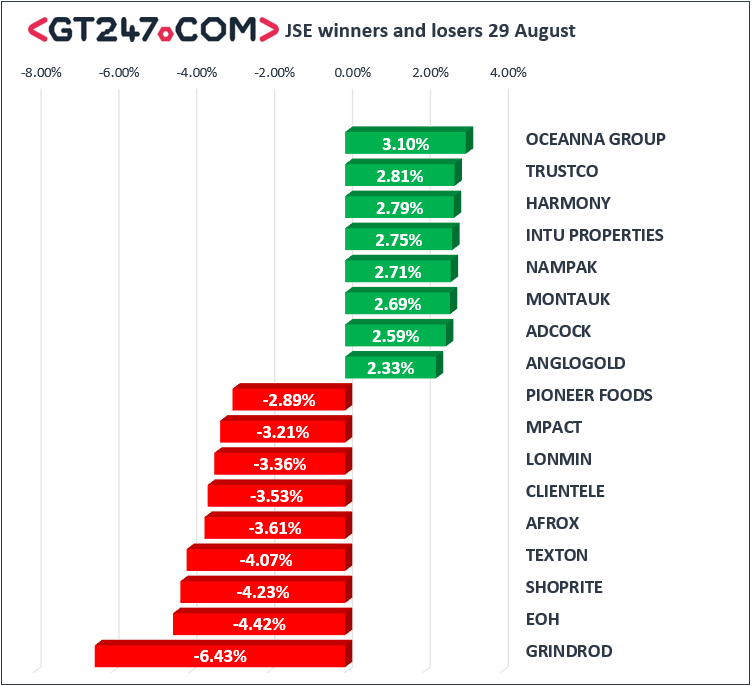

Lonmin [JSE:LON] was one of the day’s lone stars after the stock climbed 5.01% to close at R7.55 per share. EOH Holdings [JSE:EOH] rebounded by 2.91% to close at R40.01, while South32 [JSE:S32] posted gains of 2.05% to close at R38.34 per share. Pioneer Foods [JSE:PNR] added 1.75% to close at R105.57 per share, while its sector peer, Famous Brands [JSE:FBR] closed at R103.86 after gaining 0.76%.

Gains were fairly modest on the JSE Top-40 index where NEPI Rockcastle [JSE:NRP] firmed by 1.11% to close at R137.07, while Richemont [JSE:CFR] managed to add 1.21% to close at R132.51 per share. Mondi PLC [JSE:MNP] closed the day up 0.3% at R409.55 and Sappi [JSE:SAP] rose to R98.37 after adding 0.7%.

The JSE All-Share index eventually ended the day down 2.27%, while the JSE Top-40 index lost 2.55%. The Resources index managed to eke out gains of 0.2%, however other major indices struggled. The Industrials and Financials indices lost 3.82% and 1.43% respectively.

Brent crude continued to track higher which saw it trading 0.74% firmer at $77.71/barrel just after the JSE close.

At 17.00 CAT, Gold was trading 0.5% weaker at $1200.21/Oz, Palladium was up 0.91% to trade at $974.34/Oz and Platinum was 0.58% weaker to trade at $792.94/Oz.

Bitcoin traded weaker on the day to be recorded at $6869.00/coin at 17.00 CAT, down 2.65%. Ethereum was down 4.44% to trade at $278.55/coin.