The JSE closed firmer on Wednesday after a relatively flat trading session in which the local bourse struggled for direction.

Local economic data released today, particularly the ABSA Manufacturing PMI number beat estimates. The April number jumped to 50.9, which was better than the forecasted 48.0 and higher than the prior recording of 46.9. Year-on-year numbers for Naamsa Vehicle Sales also surprised to the upside to come in at 3.6%, which was higher than the estimated 2.0%.

Gold miners Gold Fields [JSE:GFI] and AngloGold Ashanti [JSE:ANG] gained 5.8% and 4.38% respectively as higher Rand-valued Gold prices propelled the miners. Investec Ltd [JSE:INL] and Investec PLC [JSE:INP] gained 3.14% and 2.69% respectively, whilst index heavyweights Richemont [JSE:CFR] and BHP Billiton inched up 1.76% and 0.93% respectively.

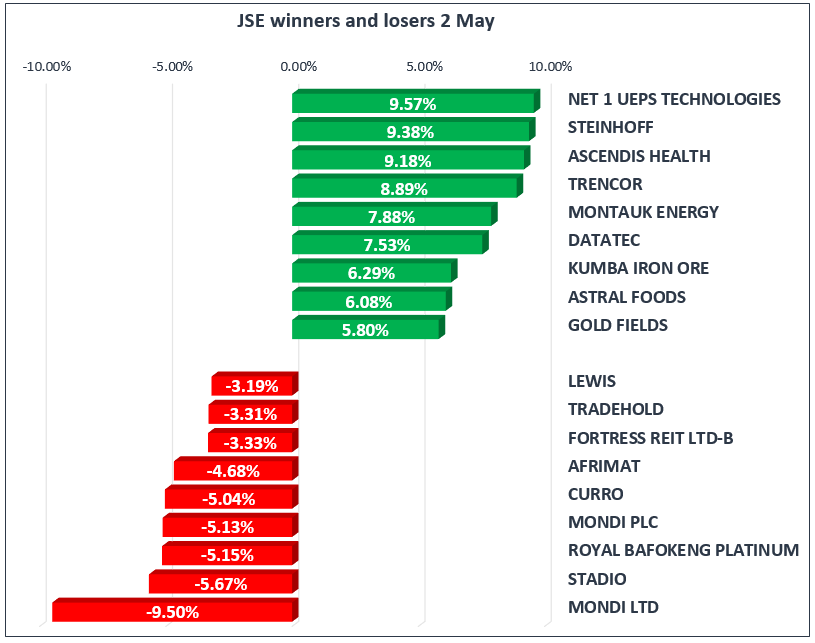

On the broader index Net 1 UEPS [JSE:NT1] closed amongst the day’s biggest gainers after gaining 9.57% to close at R103.00 per share. Trencor [JSE:TRE] jumped 8.89% after the announcement that it had successfully managed to appeal the suspension of trading in its shares. Platinum miners Lonmin [JSE:LON] and Northam Platinum [JSE:NHM] climbed 5.05% and 5.18% respectively.

Mondi Ltd [JSE:MND] which was trading ex-dividend today lost 9.5% to close at R329.40 per share. Resilient [JSE:RES] and Fortress B [JSE:FFB] shed 8.84% and 3.33% respectively as Resilient unbundled its Fortress shareholding to its shareholders. Education sector peers, Stadio Holdings [JSE:SDO] and Curro Holdings [JSE:COH] lost 5.67% and 5.04% respectively.

Bankers, Capitec Holdings [JSE:CPI] and Nedbank [JSE:NED] shed 2.15% and 0.49% respectively, whilst Naspers [JSE:NPN] and Bid Corporation [JSE:BID] eventually closed 1.53% and 2.46% softer respectively.

The JSE All-Share Index closed 0.40% higher, whilst the JSE Top-40 Index gained 0.33%. The Industrials Index traded softer to end the day 0.08% lower, however the Resources and Financials Indices managed to record gains of 1.17% and 0.52%.

The Rand strengthened earlier on to a session high of R12.55/$ as the US dollar traded marginally softer. However the US dollar rebounded after the release of positive US economic data, which saw the Rand slide to a session low of R12.71/$. At 17.00 the local currency was trading at R12.70 against the greenback. Markets now await the US Fed rate decision expected at 20.00 CAT on Wednesday for more signals on the direction of the US dollar.

Gold came close to testing the $1300/Oz price level as the metal slid to a session low of $1303.85/Oz. The metal had managed a session high of $1311.98/Oz earlier on but at 17.00 CAT it was trading at $1306.20/Oz.

Palladium jumped by more than 2.5% to peak at a session high of $973.55/Oz. At 17.00 CAT it was trading at $973.22/Oz. Platinum did not fare as well as Palladium, and it struggled to maintain its earlier momentum. Platinum was trading flat at 17.00 CAT to be recorded at $897.65/Oz.

Brent Crude slid from its session high of $73.63/barrel to trade weaker on the day. The slide was mainly as a result of the higher than expected build recorded in US stockpiles data released this afternoon. The commodity was trading at $72.79/barrel just after the JSE close.