The JSE capped off a week of gains as it closed firmer on Friday mainly on the back of improved global sentiment for stocks despite a difficult month of August.

Major world indices tracked higher on the day starting off in Asia where the Nikkei rallied 1.19%, while the Hang Seng and Shanghai Composite Index gained 0.08% and 0.25% respectively. In Europe, the major counters advanced on the day while in the USA stocks also managed to open firmer.

On the currency market, the rand edged higher against the greenback to peak at a session high of R15.17/$. At 17.00 CAT, the rand was trading 0.74% firmer at R15.18/$.

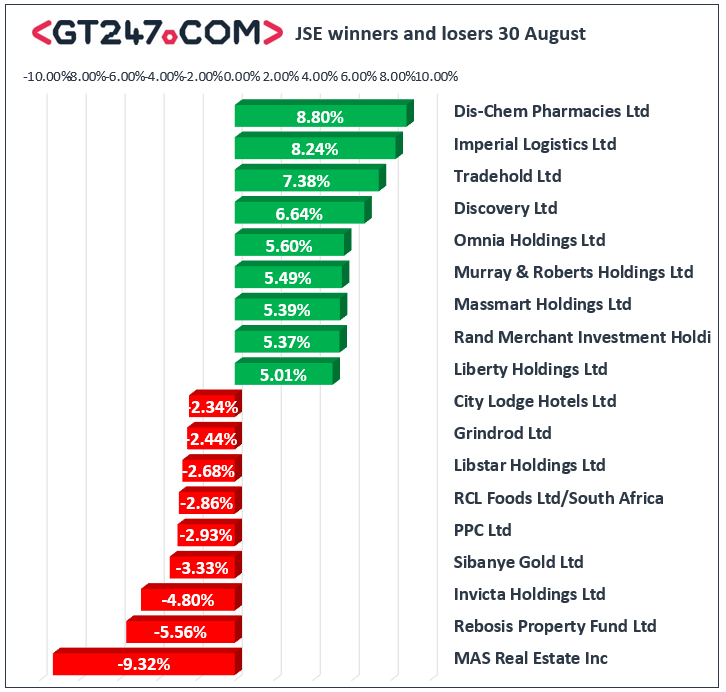

Blue-chips led the gains on the JSE as they tracked mostly firmer on the day. Gains in index giant Naspers [JSE:NPN] were modest as it only added 0.9% to close at R3453.80, while BHP Group [JSE:BHP] gained 1.6% to end the day at R327.27. The firmer rand saw rand sensitives gain on the day with gains being recorded for banks such as ABSA Group [JSE:ABG] which rallied 4.2% to close at R153.69, as well as FirstRand [JSE:FSR] which closed at R59.99 after adding 3.82%. Retailer, Massmart [JSE:MSM] managed to post gains of 5.39% to close at R44.99, while Truworths [JSE:TRU] rose 2.61% to close at R52.67. Discovery Ltd [JSE:DSY] was buoyed by the release of a relatively positive trading statement for its full trading year. This saw the stock close 6.64% higher at R115.17.

MAS Real Estate [JSE:MSP] closed as one of the day’s biggest losers after it fell 9.32% to close at R15.95. Sibanye Stillwater [JSE:SGL] fell 3.33% to end the day at R20.87, while DRD Gold [JSE:DRD] lost 2.8% to close at R6.95. Grindrod Ltd [JSE:GND] lost 2.44% as it closed at R4.39, while cement maker PPC Ltd [JSE:PPC] lost 2.93% to close at R3.98. Other significant losers on the day included RCL Foods [JSE:RCL] which dropped 2.86% to close at R10.20, and Nampak [JSE:NPK] which lost 1.38% to close at R9.30.

The JSE All-Share index closed 1.35% higher while the blue-chip JSE Top-40 index also gained 1.35%. All the major indices closed firmer on the day with the biggest gainer being the Financials index which gained 2.46%, while the Industrials and Resources indices added 0.86% and 1.52% respectively.

Brent crude slipped on the day as a report from OPEC indicated an increase in production output which is contrary to the intended policy of decreasing output. The commodity was trading 2.93% lower at $58.67/barrel just after the JSE close.

At 17.00 CAT, Gold had rocketed 4.66% to trade at $1544.30/Oz, Platinum was up 2.12% to trade at $936.35/Oz, and Palladium was only up 0.11% at $1529.23/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.