The JSE rose along with European and US equities after Chinese officials indicated that China was not going to retaliate immediately to the recent US tariff increase.

This helped spur stocks as investors sort after riskier assets on the back of this reassurance. However, skepticism remains rife given how easily circumstances can change with a single comment from either China or the USA. Positive GDP growth out of the USA also aided in reassuring market participants that the US economy was still strong despite the risks associated with trade war.

On the currency market, the US dollar held firm against a basket of major currencies. Emerging market currencies also held their own as they tracked mostly firmer on the day. The rand managed to strengthen to a session high of R15.25/$ before it retraced to be recorded trading 0.45% firmer at R15.32/$ at 17.00 CAT.

There was positive news in terms of local economic data as Statistics SA released South Africa’s producer inflation data for the month of July. PPI YoY slowed to 4.9% from a prior recording of 5.8%, which also beat the forecasted level of 5.2%. PPI MoM was recorded at -0.2% compared to a prior recording of 0.4%.

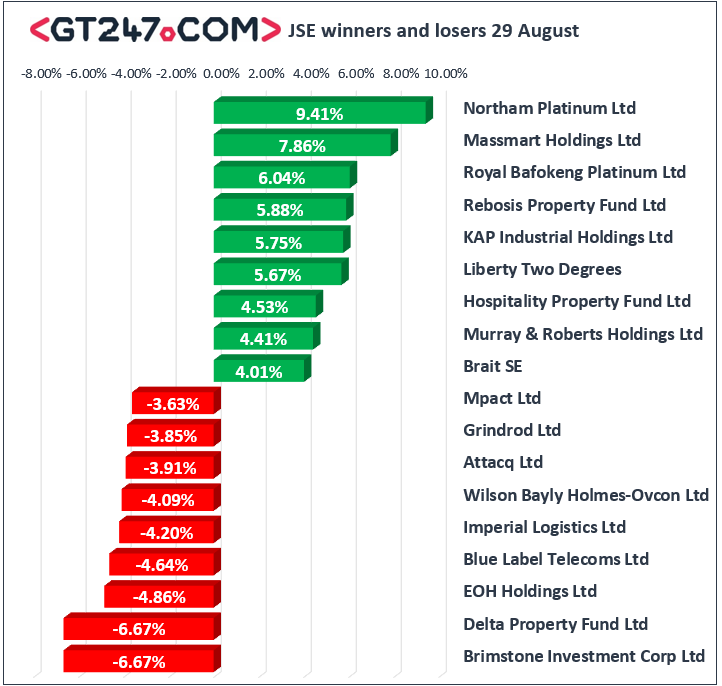

On the local bourse a couple of retailers released their earnings results which did not come as a surprise given indications from recent trading statements. The strength in the retailers in today’s session can mainly be attributed to a firmer rand as well as the market having priced-in the bulk of today’s results. Massmart [JSE:MSM] which released its half-year results closed 7.86% firmer at R42.69, Woolworths [JSE:WHL] which released its full-year results rose 4.55% to close at R54.42, while Mr Price [JSE:MRP] also advanced as it gained 2.41% to close at R166.60.

Sibanye Stillwater [JSE:SGL] released its half-year results which highlighted that they are expecting an improved outlook for the remaining half of the year. The stock closed 2.81% firmer at R21.59. Northam Platinum [JSE:NHM] closed amongst the day’s biggest gainers after rallying 9.41% to close at R76.53. Other significant gainers on the day included Glencore [JSE:GLN] which rose 2.94% to close at R43.36, Mediclinic [JSE:MEI] which gained 2.75% to close at R62.35, and Bid Corporation [JSE:BID] which closed at R319.20 after adding 2.64%.

Imperial Logistics [JSE:IPL] came under pressure as it fell 4.2% to close at R50.86, while Grindrod Ltd [JSE:GND] lost 3.85% to end the day at R4.50. Bankers tracked mostly lower on the day with losses being recorded for FirstRand [JSE:FSR] which dropped 1.37% to close at R57.78, as well as ABSA Group [JSE:ABG] which lost 1.76% to close at R147.50. Other significant losses on the day were recorded for Truworths [JSE:TRU] which fell 2.88% to close at R51.33, Dis-Chem [JSE:DCP] which dropped 2.11% to close at R20.45, and Sappi [JSE:SAP] which closed at R43.41 after falling 1.83%.

The JSE Top-40 index eventually closed 0.27% firmer while the JSE All-Share index only closed 0.04% firmer. The Financials index closed 0.6% weaker while the Resources and Industrials indices managed to gain 0.32% and 0.59% respectively.

At 17.00 CAT, Gold was flat to trade at $1539.74/Oz, Platinum had rallied 3.26% to trade at $930.50/Oz, and Palladium was up 1.36% to trade at $1485.60/Oz.

Brent crude was trading relatively firmer on the day before it was recorded trading only 0.03% firmer at $59.95/barrel just after the JSE close.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.