Global equity markets started the week on the mixed as markets anticipate this week’s earnings out of the US. Tensions between the US and China, continue to make the headlines as no firm deal appears to have been made by the two economic giants. The Trump regime continues to utter statements that provide very little confidence to the market. The farce called Brexit will take another twist this week as the Conservative party are anticipated to announce Boris Johnson as its next leader and should present himself before the Queen on Wednesday as the new British Prime Minister.

Asian shares pulled lower on Monday as the markets priced in a smaller Fed rate cut. The Hang Seng shed 1.37% whilst the Shanghai Composite and the Nikkei retreated 0.69% and 1.37% respectively. The Star Market, Chinas equivalent to the Nasdaq launched on Monday with the best performing share gaining 140% on the day. The Chinese authorities would like to see the new exchange tap into the vast wealth held by local investors. Some firms on the new exchange had already run up hard on the first trading day with earnings multiples increasing to an average of 120times earnings by the close of business.

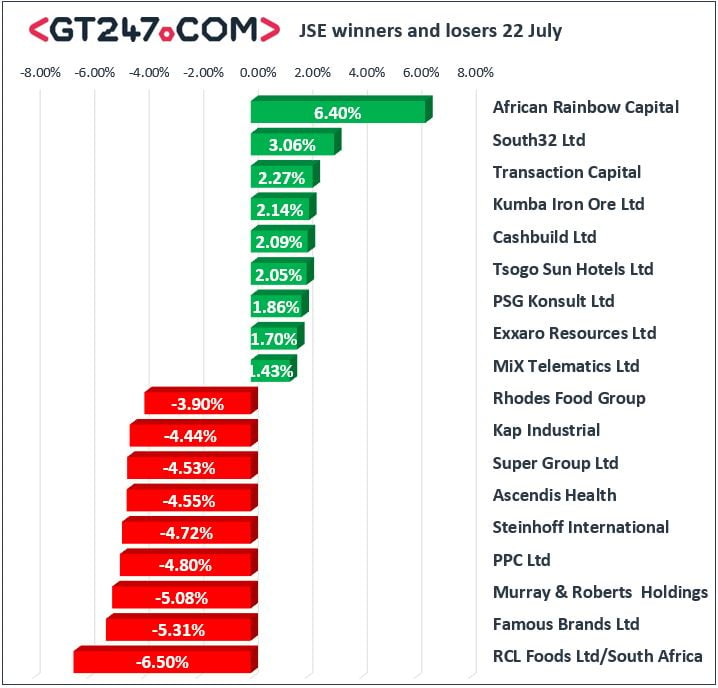

A handful of counters posted gains as African Rainbow Capital [JSE: AIL] gained 6.4% to close the day at 449c per share. Gains were also notched up by diversified miner South 32 ltd [JSE:S32], which posted gains of 3.06%, whilst Transactional Capital [JSE:TCP] and Kumba Iron ore [JSE:KIO], added 3.06%, 2.27% and 2.14% respectively to Fridays closing prices.

Losses were recorded by RCL Foods Ltd [JSE: RCL], which shed 6.5% to close the day at 1122c per share. Other significant losses were seen in Famous Brands [JSE: FBR], Murray and Roberts [JSE:MUR], PPC Ltd [JSE:PPC], and Steinhoff [JSE:SNH] retreating 6.5%, 5.31% , 5.08% and 4.8% respectively.

The JSE All-Share index closed 0.68% weaker whilst the JSE Top-40 index shed 0.42%. The Resource index retreated 0.33%, whilst the Industrials and the Financials retreated 0.26% and 0.75% respectively.

At 17.00 CAT, Palladium was 0.7% firmer to trade at $1519/Oz, Platinum was softer on the day shedding 0.15% to trade at $850.9/Oz, whilst Gold was 0.09% firmer at $1428.05/Oz.

Brent crude was firmer on the day as geo-political tensions continue to mount in the middle east. Brent crude was trading at $63.06 per barrel at 17:00 CAT, as Iran continues to play the aggressor in the middle east. Over the weekend the US navy ship the USS Boxer moved through the Strait of Hormuz as a sign of force to the Iranian aggression.

The Rand was firmer on the day to trade at R13.84 against the USD, R15.53 to the Euro and R17.30 to the Pound Sterling. All eyes are on the FED next week as the market looks at what action they will take with regards to interest rates in the US economy.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.