The local bourse closed weaker on Thursday in a session that was mainly characterised by the release of earnings results from a number of listed companies.

Direction on the JSE was also drawn from the overnight sell-off in US equity markets which saw the Dow Jones and S&P500 indices close weaker after initially opening firmer. This filtered into Asian equity markets trading on Tuesday and subsequently onto the JSE. Surprisingly this resulted in some stocks which reported positive earnings trading softer, whilst some companies which reported weak earnings saw their stock price appreciate.

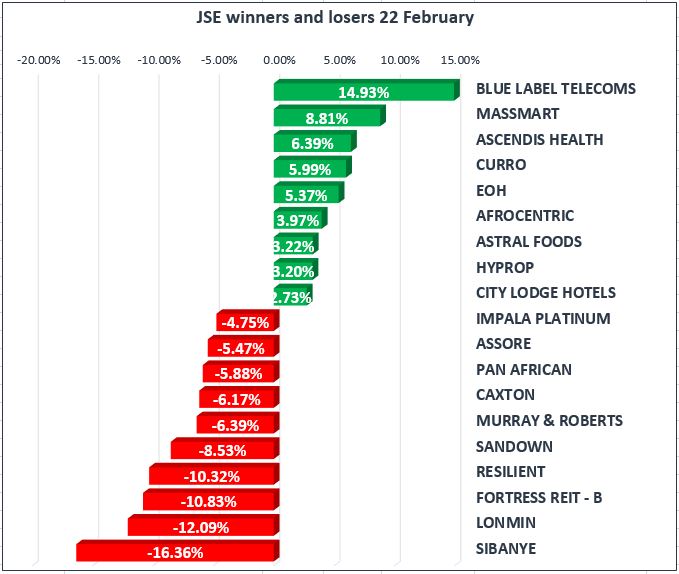

Woolworths [JSE:WHL] might have surprised a few market participants as it inched up to end the day 1.85% firmer. This was despite 26 week earnings results which highlighted tough trading conditions for the group and decreased profitability. Blue Label Telecoms’ [JSE:BLU] half year results exceeded market expectations and as a result the stock jumped 14.93% to close at R13.19 per share. Massmart [JSE:MSM] released full year results which indicated healthy increases in headline EPS and headline earnings, and as a result the stock closed 8.81% firmer.

The blue chip index weighed down on the overall index as most of the constituents in that index were trading in the red. The biggest losers in the Top-40 index were listed property stocks Resilient [JSE:RES] and Fortress B [JSE:FFB] which lost 10.83% and 10.32% respectively. Sibanye-Stillwater’s [JSE:SGL] 6 month earnings results did not impress the market as the stock lost 16.36% to close at R11.30 per share. British American Tobacco [JSE:BTI] lost 4.31% to close at R696.62 per share despite a relatively impressive set of results. Lonmin [JSE:LON] also came under significant pressure to end the day down 12.09%, whilst miners Impala Platinum [JSE:IM] and African Rainbow Minerals [JSE:ARM] lost 4.75% and 3.85% respectively.

The JSE Top-40 Index eventually closed the day down 0.91% whilst the broader All-Share Index shed 0.77%. All the major indices came under pressure in today’s session which saw the Resources Index losing 0.63%, whilst the Industrials Index and Financials Index lost 0.69% and 1.03% respectively.

Commodity markets were volatile today as huge swings were witnessed across both the metal and energy commodities. Brent Crude slipped to an intra-day low of $64.62/barrel before managing to climb back above $65/barrel. The commodity was trading at $65.62/barrel just after the JSE close with Crude Oil stockpiles data out of the USA still to be released at 18.00 CAT.

Gold opened weaker following the overnight rally in the US dollar. The precious metal slid to day’s low of $1321.04/Oz before rebounding to trade $1328.38/Oz just after the close.

Palladium did open weaker but it quickly erased the losses and was trading in the green for the better part of today’s trading session. The metal was trading at $1037.65/Oz just after the close. Platinum was marginally firmer at the JSE close as it was recorded at $994.03/Oz.

US equity markets opened firmer on Thursday and at 17.00 CAT the Dow Jones and the S&P500 indices were 0.48% and 0.63% firmer.