The JSE turned the tide on Wednesday to end the day in the green after the delivery of South Africa’s 2018 budget speech by finance minister Malusi Gigaba.

The belt tightening measures and tax increases outlined in the budget speech buoyed rand sensitive stocks, and as a result they reversed earlier losses to end the day in the green. The Rand also jumped to an intra-day high of R11.62 to the US dollar after the commencement of the speech, and at 17.00 CAT the Rand was trading at R11.64/$.

Inflation data released earlier today by StatsSA was in line with market expectations. The CPI year-on-year number was recorded at 4.4% which is well within the South African Reserve Bank’s target band of between 3% and 6%. The next MPC meeting will highlight whether this recording is sufficient for the Reserve Bank to consider a possible rate cut.

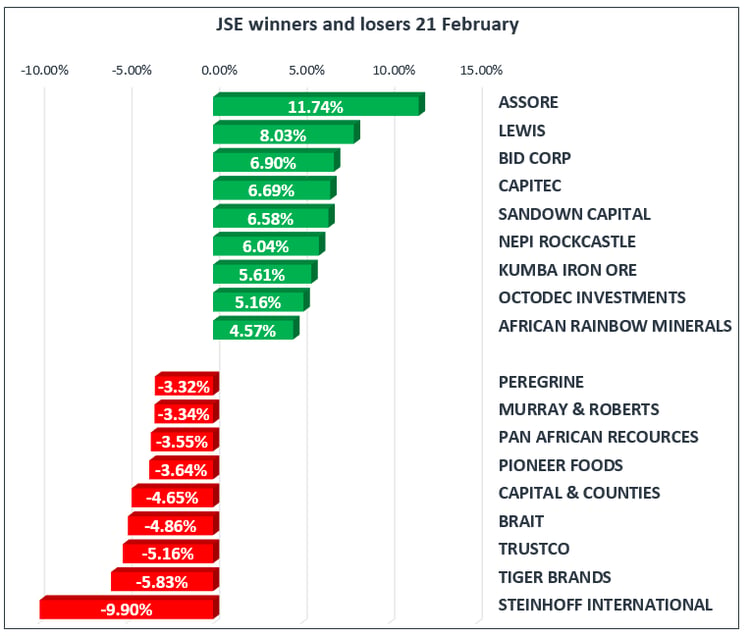

The top movers as a result of the budget speech were Standard Bank [JSE:SBK], Nedbank [JSE:NED] and Rand Merchant Investment Holdings which gained 1.87%, 2.24% and 3.02% respectively. Capitec Holdings [JSE:CPI] and NEPI Rockcastle [JSE:NRP] were among the biggest gainers on the blue chip index as they gained 6.69% and 6.04% respectively, whilst index heavyweight Naspers [JSE:NPN] gained 3.93%.

Assore [JSE:ASR] jumped 11.74% to close at R328.63 per share whilst Kumba Iron Ore [JSE:KIO] gained 5.61%. Retailers Pick n Pay [JSE:PIK] and Shoprite [JSE:SHP] added 1.39% and 3.98% respectively whilst Glencore [JSE:GLN] firmed by 3.02% on the back of a decent set of results which indicated healthy increases in earnings.

Steinhoff [JSE:SNH] continued to trade under pressure and the stock closed at R4.74 per share, down 9.71% for the day. Tiger Brands [JSE:TBS] traded weaker to end the day down 5.83% whilst Brait [JSE:BAT] lost 4.86%. Miners BHP Billiton [JSE:BIL] and South32 [JSE:S32] shed 1.05% and 1.36% respectively whilst Sasol [JSE:SOL] closed 1.86% lower.

After a slow start the JSE All-Share Index jumped to close the day up 1.17% whilst the blue chip Top-40 Index gained 1.39%. The Resources Index was the only index to close in the red as it lost 0.28%. The Industrials Index and the Financials Index jumped 1.66% and 1.53% respectively.

The commodities market was fairly mixed with Palladium and Platinum trading under pressure whilst Gold failed to gain any significant direction. Gold in particular did trade under pressure earlier on but it managed to turn positive as the US dollar eased from its intra-day highs. The precious metal peaked at $1332.39/Oz before retracing to trade at $1330.95/Oz just after the JSE close.

Platinum and Palladium traded marginally softer with the former sliding down to $994.03/Oz, before rebounding to trade at $1000.11/Oz just after the close. Palladium followed a similar trend as it also traded weaker to be recorded at $1031.33/Oz just after the close. This was after it managed a day’s high of $1037.89/Oz.

Brent Crude did gain some momentum towards the close after trading softer earlier on. The commodity slipped to a low of $64.40/barrel in early morning trading before bouncing to trade at $65.09/barrel just after the close.