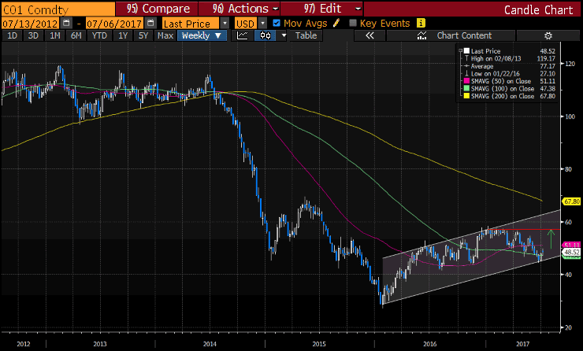

Brent Crude Weekly Setup

On the weekly chart Brent Crude is in a gently sloping uptrend channel. It has bounced off the bottom of this channel over the past 2 weeks, and this week it managed to break out above the 100-week moving average. If Brent Crude manages to close the week above this 100-week moving average, then the next significant level to watch out for is the 50-week moving average just above $51 per barrel.

This week the upside in Brent Crude hit a snag after Russia announced that they are not going to participate in more oil production cuts. This resulted in an immediate sell-off in Brent Crude given how big Russia’s contribution is to global supplies. This position puts OPEC in a tricky position given how aggressively they have tried to push prices higher by initiating production cuts amongst the cartel’s biggest producers. Nonetheless there is still some upside opportunity in the long-term and the setup is highlighted below.

Long-term set up

Entry: Buy from current price levels, and if it retraces then add to your existing position, just below $48.

Take Profit: Initial take profit is at the 100-week moving average just above $51.10 where we expect to face resistance. If it does break above this level, it will bring new opportunities to buy therefore we will update accordingly at the time. The one level that is glaring above the 50-week moving average is the possible resistance at $58, therefore if you are willing to withstand the minor retracements you can hold & take full profits at this level. If you are holding out for that level, then it is advisable to take some profits along the way as the retracements can be severe.

Stop Loss: First stop loss is quite tight at the bottom of the channel just below $47. The reason is that the reversals can be quite sharp, therefore if it reverses it is best to honour the initial stop loss. If the upside continues in the coming weeks adjust your stop losses up to match the current stop loss & entry-level spread.

(Weekly Chart)

Source: Bloomberg

On this longer-term timeline it does seem that Brent Crude has reversed from a significant downtrend which lasted for 5 consecutive weeks. It’s setting up for some upside but there could be bumps along the way. I have highlighted some key points that Brent Crude traders need to be aware of below.

WHAT TO LOOK OUT FOR?

- Look out for comments from OPEC members since the commodity is very sensitive to any news that affects supplies.

- Brent Crude is quoted in US Dollars therefore the strength of that currency relative to other major currency pairs affects the revenue of producers. There is a negative correlation between the strength of the US Dollar & Brent Crude prices.

- Weekly data with regards to global stockpiles particularly from the USA, normally results in volatility in Brent Crude prices. All things being equal, a decline in oil inventories is bullish for oil prices and a build (increase) is bearish.

- Oil rig counts have become increasingly more important over the past few years. This is a measure of the number of oil rigs which use fracking to extract crude oil from the ground. The biggest measure is the Baker Hughes Oil Rig Count of US based oil rigs. An increase in this number means more producers are coming online and adding to the level of stockpiles, which is bearish for the price of crude oil. Inversely, a decrease in this count is bullish for the price of crude oil.

- There are several global agencies who release oil inventory data each month. The impact is usually limited with the exception of extreme irregular data which might materialize from time to time.

GT247.com: +27 87 940 6101

IT support & help desk: +27 87 940 6107

Client relations (new accounts): +27 87 940 6106

Sales: +27 87 940 6108