BHP BILLITON

Sector: Mining

Share price: AUD33,33 ASX, GBP16,42 LSE, ZAR287,87 JSE

Net shares in issue: 2,11 billion LSE and JSE

Net shares in issue: 3,21 billion ASX

BHP Billiton Limited and BHP Billiton PLC is a dual listed company; PLC has a secondary JSE listing

Market cap: R607,1 billion JSE

Fair value DCF: $23,56, A$31,81 on ASX, £15,72 on LSE (including a 12% discount) and R275 per share on the JSE at an exchange rate of ZAR17,50/£

Trading Buy and Portfolio Buy

Fundamentals are summarised in this note:

BHP has had a good end to the financial year with iron ore shipments out of Western Australia in June up 5% month on month. Total industry iron ore demand remained buoyant in the June quarter, up 11,6% compared with the March quarter, higher than for the past two years.

This suggests that BHP will ship 274 million tons for F2018 on a 100% basis, in line with earlier revised guidance. This compares with 268 million tons in F2017 and 257 million tons in F2016. On a BHP attributable basis, the above tonnage is 236 million, 231 million, and 222 million respectively. For the fiscal year I have iron ore averaging $66/ton.

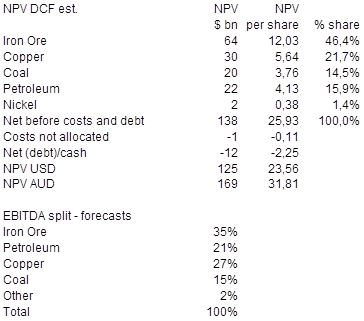

Iron ore remains the most influential commodity in BHP Billiton’s valuation, almost half as a rule of thumb, whilst accounting for around 35% of forecast EBITDA. On my DCF, I have iron ore has the largest asset by value on a sum-of-the-parts basis at 46%, followed by copper at 22%, coal at 15%, petroleum at 16%, and nickel and other the balance.

BHP Billiton is largely exposed to Australia (iron ore, coal, petroleum), United States (petroleum), Chile and Peru (copper), Brazil (iron ore), and Canada (potash).

Petroleum will consume approximately 40% of group capex for the foreseeable future, iron ore capex 20%, and copper capex 30%. Coal capex is likely to only be 5%.

My update earnings estimates indicate a strong result for the year ended June 2018, with EBITDA at $24,5 billion, an increase of 20%. Adjusted earnings I forecast to rise by 34% to $9 billion, which translates to 170 US cents per share. The full year dividend is 101 US cents.

Given current commodity prices, it is feasible for EBITDA to exceed $25 billion in F2019 and F2020, with earnings also exceeding $9 billion or 170 US cents.

The balance sheet is sound. I forecast net debt at $12 billion as at June 2018, implying gearing of 18% on equity of $66 billion. EBITDA interest cover is a hefty 22x.

For South African investors seeking alternatives in mining, BHP remains a good option as it has less of the geographic and political risk you get in South African orientated stocks such as AngloGold Ashanti, Sibanye, Impala, or Amplats. BHP has no mining exposure in South Africa as those assets were previously unbundled in to South32 in May 2015.

There are 2,1 billion shares in issue on the LSE and the JSE and 3,2 billion shares in issue on the ASX. Combined, there are 5,3 billion shares in issue and this is the denominator for calculating earnings per share. PLC holds 40% of the aggregate number of issued shares and Ltd holds 60% of the shares. South African shareholders hold 17% of the PLC structure and 7% of the combined entity.

At the time of writing the discount of PLC to Ltd is 12%, in line with the average for the past two or three years. The Australian price is A$33,33 and the PLC price is £16,42, 12% below what it would notionally be (£18,73) at an exchange rate of AUD1,78/GBP£. The JSE share price of R288 is thus in line with the LSE price as an exchange rate of R17,50/£.

Enterprise value is $138 billion and equity value $125 billion or $23,56 per share. This equates to an equity value of A$31,81 at an exchange rate of AUD1,35/$. Assuming a 12% LSE and JSE discount the value per share is £15,72 on the LSE and R275 per share on the JSE at an exchange rate of ZAR17,50/£.

The stock is up by more than 25% since year-to-date lows of below R230 in March. Fair value is R275 at current exchange rates and rallies are an opportunity to take money off the table unless the currency weakens markedly. Given the solid fundamentals I retain a Trading Buy and Portfolio Buy.

Mark N Ingham

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.