Potential Long Trades:

Musa Makoni gives us two possible long trades to consider. BHP Billiton and Anglo American PLC.

Will one take off? Will they both take off? Find out below:

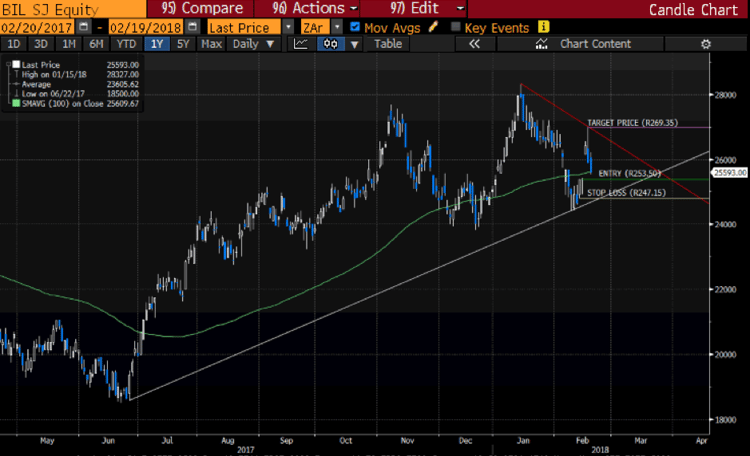

BHP BILLITON (JSE:BIL)

ENTRY: R253.50

STOP LOSS: R247.15

TARGET PRICE: R269.35

There is a gap on the daily chart for BHP Billiton created last week as a result of the big jump in local equities on Wednesday. From a technical perspective there is room for BHP Billiton to come off and close that gap which should create a good entry level for buying.

The stock is also testing its 100-day moving average which could potentially form a support level. Aggressive traders can buy at current levels (R255.93 or lower) or alternatively wait for the entry to trigger.

DAILY CHART

Source: Bloomberg

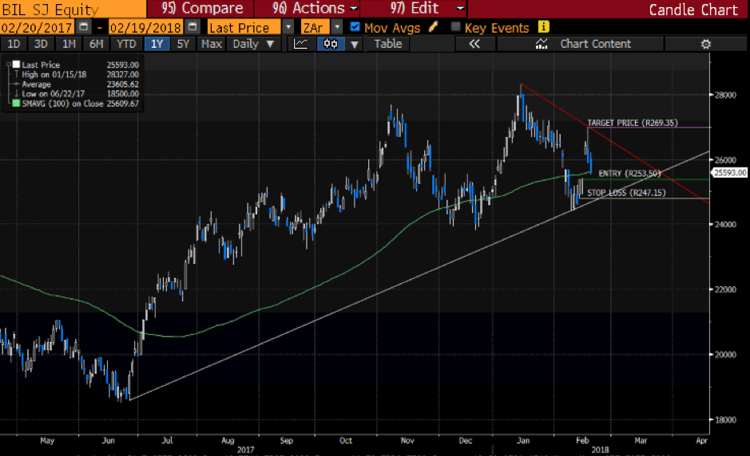

ANGLO AMERICAN PLC (JSE:AGL)

ENTRY: R277.14

STOP LOSS: R265.48

TARGET PRICE: 304.09

The Anglo American chart is also exhibiting similar characteristics to the BHP Billiton chart in that there was also a gap created on the chart last week. Entry on the trade is on the presumption that Anglo American PLC is going to close this gap which should create a good buying level.

Aggressive traders can buy closer to R280 or lower instead of waiting for the entry-level to be triggered.

DAILY CHART

Source: Bloomberg

The other support behind these two trades is that BHP Billiton is expected to release results on Tuesday 20 February, Anglo American’s results are expected on Thursday the 21st of February. Initial estimates are forecasting decent increases in profit for the two stocks which should be positive for the stock prices.