The JSE closed higher on Tuesday, keeping up the positive momentum following the ANC presidential election victory by Deputy President, Cyril Ramaphosa.

The rand firmed, closing at R12.74 against the greenback. The local currency strengthened throughout Monday on positive sentiment that Ramaphosa would edge Dlamini-Zuma at the ANC elective conference.

South African bonds strengthened on Tuesday, with the 10-year bond firming 3.83% to a yield of 8.66%. Credit ratings agency, Moody’s, released a statement supporting the the outcome as positive, yet cautioned that substantial political obstacles to a marked policy shift remained. "Most importantly, it is unclear whether Ramaphosa will have the political weight in parliament to implement any such shift."

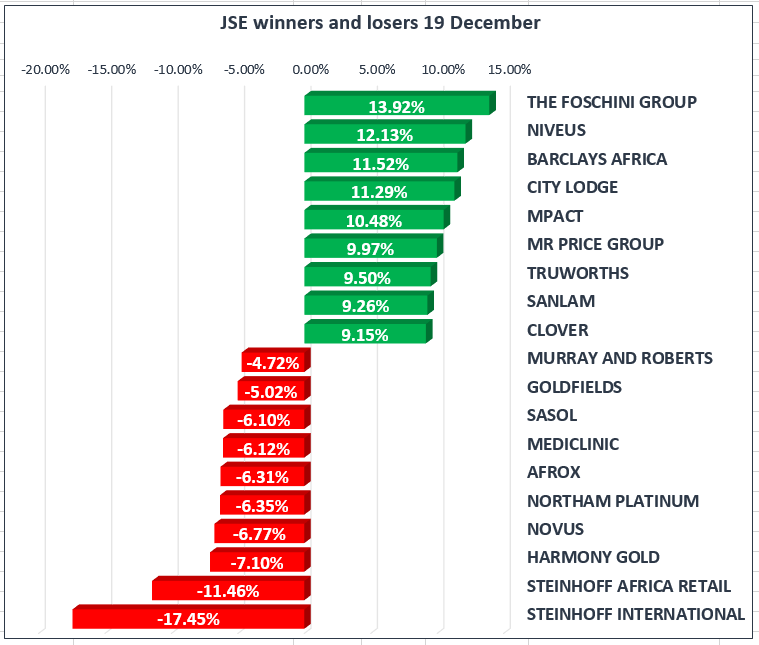

Banking stocks reached fresh highs, climbing 8.08% to drive the All Share 0.80% higher and the blue-chip Top 40 by 0.47%.

Barclays Africa [JSE:BGA] climbed 11.52% to R190.49, FirstRand [JSE:FSR] 6.69% to R66.69, Standard Bank 6.96% to R198.39, , Nedbank 5.73% to R254.35 and Capitec 4.9% to R1,050.02

Steinhoff International [JSE:SHN] fell 17.45% to close at R7.00, dragging down the Top 40 index. Steinhoff executives were scheduled to meet with global funders today in Germany. The business has multiple assets in South Africa that it can sell to raise capital, but the need for cash is offshore, presenting an exchange control difficulty for the South African Reserve Bank.

In the US; the Dow Jones and S&P500 eased 0.16% and 0.13% respectively after the close of the JSE.

Republican Senators said late Monday that they would vote for the Republican-led tax overhaul Tuesday. The bill is now expected to pass the Senate even without the votes of Arizona senators Jeff Flake, who remains uncommitted, and John McCain, who will miss the vote as he recovers from chemotherapy treatment.