The JSE surged on Wednesday as it tracked the upward trend in Asian equity indices earlier on.

Gains on the local bourse were on the back advances in both the resources and industrials indices. This surge was despite disappointing local economic data in the form of the Standard Bank PMI reading for April which fell to 35.1 from a prior recording of 44.5.

The gains in Asia were limited to the Hang Seng and the Shanghai Composite Index which rose 1.13% and 0.61% respectively. The Japanese Nikkei remained closed for a holiday. Stocks in Europe tracked mostly lower on the day, but the local all-share index was unperturbed. Strong gains were recorded for the Nasdaq when US markets opened while the S&P 500 and Dow Jones rose marginally.

On the currency market, the rand traded softer against the greenback as it slipped to a session low of R18.77/$. At 17.00 CAT, the rand was trading 1.33% lower at R18.76/$.

GT247, South Africa's Top Online Stockbroker, as voted by Intellidex, will continue to operate their powerful MT5 trading platform during the COVID-19 lockdown period. The trading team has assembled their workstations at home and are operational remotely. Clients may experience slight delays in support queries but trading online will resume as normal. Please use our FAQ self-help portal or email supportdesk@gt247.com if you require assistance.

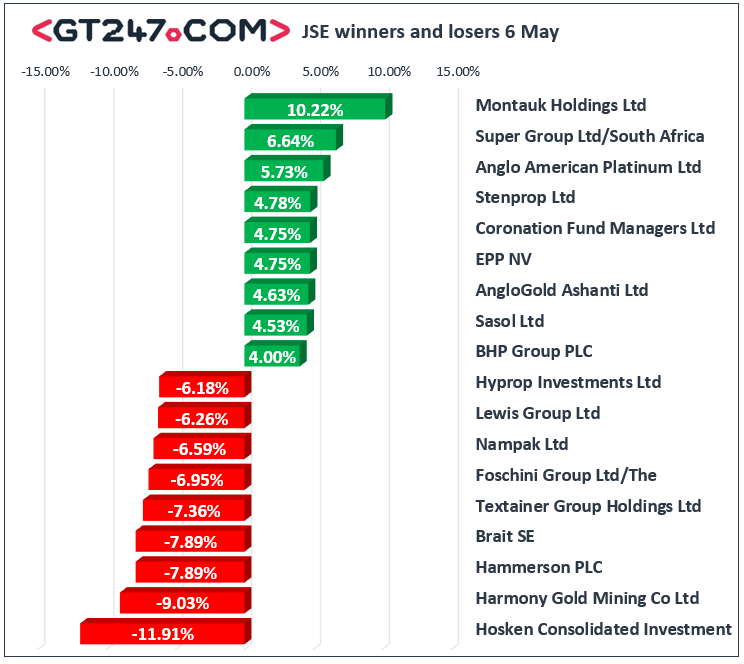

Montauk Holdings [JSE:MNK] closed amongst the day’s biggest movers after it surged 10.22% to close at R29.76. Super Group [JSE:SPG] gained 6.64% as it closed at R6.64% higher at R15.41, while Coronation Fund Managers [JSE:CML] added 4.75% to close at R37.90. Anglo American Platinum [JSE:AMS] led the gains on the resources index after it gained 5.73% to close at R1017.85, while Impala Platinum [JSE:IMP] climbed 2.37% to close at R105.43. Diversified mining giant Anglo American PLC [JSE:AGL] added 2% to close at R321.09, while tech giant Naspers [JSE:NPN] closed 2.04% higher at R2924.46. Richemont [JSE:CFR] managed to post gains of 2.23% as it closed at R102.93, while British American Tobacco [JSE:BTI] closed at R695.73 after gaining 1.9%.

Harmony Gold [JSE:HAR] came under pressure following the release of its 9 month operational update as it slipped 9.03% to close at R64.50. Hammerson PLC [JSE:HMN] also traded considerable pressure as it lost 7.89% to close at R12.50, while Hyprop Investments [JSE:HYP] lost 6.18% to close at R17.30. Retailers retreated on the back of the weaker rand which saw losses being recorded for The Foschini Group [JSE:TFG] which lost 6.95% to close at R66.98, while Truworths [JSE:TRU] lost 3.67% to close at R27.82. Losses were also recorded for Sappi [JSE:SAP] which lost 3.33% to close at R21.50, and for Brait [JSE:BAT] which closed at R3.50 after falling 7.89%.

The JSE All-Share index eventually closed 1.32% higher while the JSE Top-40 index gained 1.64%. The Financials index lost 1.43%, however the Resources and Industrials indices managed to recorded gains of 3.22% and 1.31% respectively.

Brent crude retreated following consecutive sessions of strong gains as it was recorded trading 4.42% lower at $29.60/barrel just after the JSE close.

At 17.00 CAT, Palladium was 0.53% softer at $1803.77/Oz, Gold had shed 0.96% to trade at $1689.56/Oz, and Platinum had lost 1.26% to trade at $758.43/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.